Trump’s tax returns show why loopholes must be axed

The US President has paid far less tax than any of his predecessors. Here’s how it compares and what needs to change.

Analysis: New revelations of Trump’s tax returns make it clear that there is one set of rules for the majority of working people and a range of loopholes for individuals and corporations with money and influence.

On Sunday, the New York Times reported President Trump paid $750 in income tax in his first year in office, the lowest of any president since Jimmy Carter.

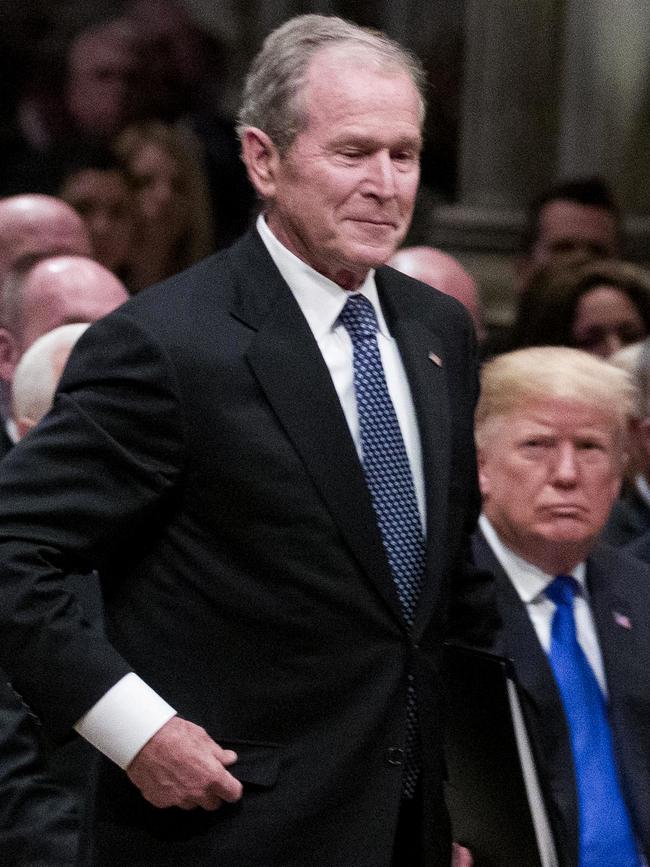

Mr Trump’s predecessor Barack Obama in contrast paid nearly $1.8m in his first year of office, largely on royalties from the sale of his books, while George W Bush paid $250,221 mainly on his presidential salary and investment income.

While the United States has become an extreme example, this is a global phenomenon. Australia is no exception.

Growing levels of inequality and the ability of wealthy individuals and corporations to make the most of the rules and use loopholes are not sustainable. Faith in democracy itself and the institutions which support it are being undermined and at risk.

Now more than ever – with the current crisis – we need to shut down loopholes to fully fund our public health, education and economic recovery.

How is it that workers at Trump hotels or golf courses pay their full share of income tax on the desperately low incomes they make, while Trump – the owner – with the help of creative accountants and lawyers pays virtually nothing?

We all benefit from public spending; Trump far more than most. Trump’s tax avoidance doesn’t indicate how smart he is, as he has boasted, it indicates that he and others have a wide range of tax loopholes that they can and do use.

Tax avoidance by Trump and other wealthy individuals and corporations requires cuts in essential public services or forces the rest of society to pay more.

More bluntly put, tax avoidance represents uncontrollable greed from those at the top and theft from those at the bottom of society.

Taxes should make society fairer, not more unequal.

Most people work hard to earn a living and pay their expenses; most household finances are simple and straightforward.

However, for many at the top end of town there are different methods of accounting and nothing is straightforward.

How is it that Trump’s ethics filings as President show that in 2018 he made at least $US434.9 million, but the tax filings show a loss of $US47.4 million.

How is that in Trump’s ethics filings, the Mar-a-Lago Resort has one value but for local property tax – which directly funds local public schools and other services – that value is much less than half?

In order to restore faith in democracy and raise the revenue we all need for public health, education and economic recovery, we must close tax loopholes so that we all play by the same set of rules and contribute to a brighter fairer future.

– Jason Ward is the Principal Analyst at the Centre for International Corporate Tax Accountability and Research

Read related topics:Donald Trump