ASX drops at open as banks hit with credit rating downgrade

The Australian share market has plunged more than 2 per cent at its open today, with the big four banks hit as a major credit agency downgraded their rating.

World

Don't miss out on the headlines from World. Followed categories will be added to My News.

The Australian share market has plunged at the open on heavy losses for the big banks after an APRA suggestion to suspend their dividends and a downgrade to their credit ratings.

The S&P/ASX200 benchmark index fell 108.3 points, or 2.06 per cent, to 5,144.0 points in the first 15 minutes of trade on Wednesday as only the consumer staples sector remained in the black.

The All Ordinaries index shed 104.2 points, or 1.97 per cent, to 5,197.1.

Commonwealth Bank, Westpac, ANZ and NAB were down by between 3.5 per cent and 5.09 per cent as they moved to reassure investors they were well capitalised after the prudential watchdog said they should “seriously consider” suspending their dividends until there was more certainty about the impact of the coronavirus pandemic.

Fitch also downgraded the banks to A+ from AA- to reflect the agency’s expectations of a significant economic shock in 1H20 due to measures taken halt the spread of the coronavirus.

Yesterday, Much like local equities, US stocks built early gains following tentative signs coronavirus outbreaks in some of the biggest hot spots are easing.

However, the major overseas indices slipped as oil prices plunged late in the session.

West Texas Intermediate crude futures settled $US2.45, or 9.4 per cent, lower on Tuesday at $US23.63 a barrel, accelerating their losses late in the day, ahead of weekly US crude oil inventory reports.

Brent crude futures settled at $US31.87 a barrel, losing $US1.18, or 3.6 per cent.

IG Markets analyst Kyle Rodda said lion’s share of Wall Street’s losses came from the heavily weighted US tech sector, which accounted for half of the market’s fall.

On local shores, Westpac is expecting a modest increase of 1.5 per cent in February home loan approvals, ahead of a steep drop through March and April, as the sector moves into a virus-related shutdown.

The Australian dollar was buying 61.44 US cents at 1015 AEST, down from 61.84 US cents at the close of markets on Tuesday.

WALL STREET RALLY FADES DESPITE GAINS IN EUROPE, ASIA

Wall Street’s early signs of life turned out to be a false dawn as strong gains faded away late in the day despite hopes investors were starting to see a light at the end of the COVID-19 tunnel.

The S&P 500 was up by as much as 3.5 per cent in midday trading as analysts speculated the market was starting to factor in good news about a long-term bounceback once life “returns to normal”.

But the rally disappeared late in the day as sharp swings continued to be the flavour of a market that has been smashed by the uncertainty surrounding life under COVID-19

The S&P 500 dipped 0.2 per cent after erasing a surge of 3.5 per cent earlier in the day. The market’s gains faded as the price of US crude oil abruptly flipped from a gain to a steep loss of more than 9 per cent.

It dampened what had been a brighter day for global markets. European and Asian markets rallied earlier, following up on Monday’s 7 per cent surge for the S&P 500 on encouraging signs that the coronavirus pandemic may be close to levelling off in some of the hardest-hit areas of the world.

Earlier, market watchers assessed the gains elsewhere in the world as a sign that investors were finally starting to see an end to the gloom.

“It’s hard to reject the view that things are improving,” said Paul O’Connor, head of multiasset at Janus Henderson. “Markets have been celebrating this in the last couple of days.”

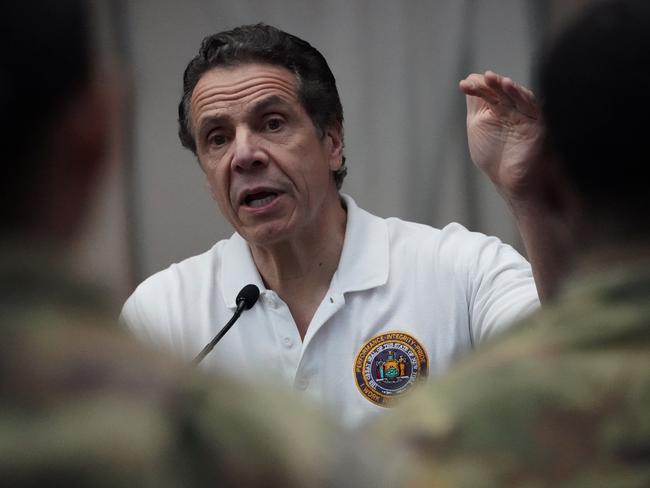

This assessment came despite New York Governor Andrew Cuomo reporting his state’s highest single-day death toll of well over 700 took New York’s total number of death to more than 5,000.

In New York City alone, the death toll has surpassed the number of people killed in 9/11.

But New York’s breathtaking death and hospitalisation rates have started to stabilise, according to figures released by Governor Cuomo.

“You see that plateauing - that’s because of what we are doing. If we don’t do what we are doing, that is a much different curve,” he said. “So social distancing is working.”

While market watchers still believe a recession is unavoidable given the lockdowns crippling economies around the world, Wall Street and other exchanges seem to be starting to factor in the likely big bouncebacks that will follow when doors finally open for business.

Wall Street was also waiting with optimism for the Treasury Department to call for at least another $A330 billion to help supplement a new program designed to help small businesses secure loans from banks.

There has been a massive demand for assistance through the program.

The formal request could come as early as Tuesday, according to an official familiar with the plans, who asked for anonymity to disclose details of the announcement.

Senator Mitch McConnell of Kentucky, the Republican majority leader, said: “It is quickly becoming clear that Congress will need to provide more funding or this crucial program may run dry. That cannot happen. Nearly 10 million Americans filed for unemployment in just the last two weeks. This is already a record-shattering tragedy, and every day counts.”

Retailers, travel companies and energy firms were the leading stocks, all rising as investors foresaw people returning to work, flying to meetings and drivings to stores instead of just online.

In China, the first country to lock down wide swaths of its economy to slow the spread of the virus, authorities reported no new deaths over the past 24 hours - although the West remains highly sceptical of any “official’ numbers coming out of Cina.

But investors have much more faith in the transparency of signals that the number of daily infections and deaths may be close to peaking or plateauing in Spain, Italy and New York.

But economists expect a report this week to show another 5 million Americans lined up for unemployment benefits last week in addition to the 10 million who applied in the previous fortnight.

Japan’s government on Tuesday formally announced a $A1.65 trillion package for the world’s third-largest economy.

In Europe, leading indices were up in Germany (DAX up 2.5 per cent), France (CAC 40 rose 1.6 per cent) and London (the FTSE 100 added 1.9 per cent).

In Asia, Japan’s Nikkei 225 rose 2 per cent, South Korea’s Kospi gained 1.8 per cent and the Hang Seng in Hong Kong was up 2.1 per cent.