Victorian housing markets where it’s cheaper to buy than rent revealed

From Melton to Carlton, here are the 60 Melbourne suburbs where you can pay a mortgage for less than you’d pay in rent per month. Find out the hotspots where you can capitalise.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Paying off a mortgage is cheaper than renting in more than 60 Melbourne suburbs, new research reveals.

And with interest rates continuing to plunge, more postcodes could soon be joining them, according to a report from home lender Aussie.

It found once tenants jumped the hurdle of saving a deposit, they would actually spend less covering the costs associated with a three-year fixed rate mortgage on a median-priced house than paying typical rent in three Melbourne suburbs.

RELATED: The hottest Melbourne suburbs to buy into post-pandemic

Hadfield sparky’s ‘massive punt’ pays mortgage in two years

Melbourne’s next million-dollar suburbs revealed

They were Hastings ($257 cheaper monthly), Melton ($106) and Melton South ($33).

This was also the case in 64 unit markets across the city, with the biggest savings on offer in Carlton ($675 cheaper monthly), Travancore ($564) and Flemington ($453 cheaper).

The report — which used CoreLogic data — also painted buying as a financial no-brainer in regional Victoria, where servicing a mortgage under this same scenario was cheaper than renting in a whopping 63 per cent of house markets and 91 per cent of unit markets.

For houses, the gap was widest in Red Cliffs near Mildura ($668 cheaper monthly), followed by Portland ($664), Terang ($657) and Ararat ($610).

And for units, typical monthly mortgage repayments were $548 more affordable than rental costs in Portland, $472 less in Traralgon and $468 cheaper in Mildura.

Aussie chief executive James Symond said this “truckload of suburbs where it’s cheaper to buy than rent” was the product of record-low interest rates — which had fallen even further since the report was compiled, with the Reserve Bank cutting the cash rate to 0.1 per cent on Tuesday.

He said these “unheard-of” rates — coupled with COVID-19 conditions that had caused property prices to cool and allowed Melburnians who had remained employed to save in the absence of holidays and eating out — made now an ideal time to get a foot on the property ladder.

Once they did, the benefits of owning over renting included earning equity and capital growth, and not having to answer to a landlord.

“You can be the master of your own destiny,” he said.

“Plus, (owning a home) is the Great Australian Dream, there’s an emotional impact.”

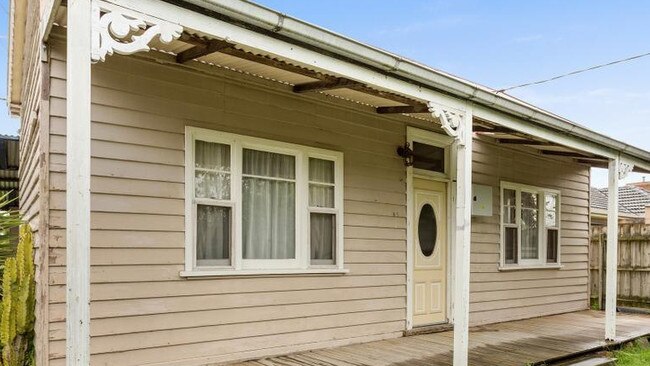

First-home buyer Aaliyah Ingram is delighted she’ll soon be trading her Point Cook rental for a house in Melton she recently snapped up for less than $400,000.

“Instead of having to rent, I’ll soon have a home I can call mine,” she said.

“If I want to paint the walls, I can just grab a paintbrush.”

The 18-year-old said she chose Melton for its affordability, accessibility to public transport and shops, and its “quiet” suburban vibe.

Barry Plant Melton partner Ned Nikolic said after years as an investor hot spot, his suburb had become a haven for first-home buyers and families thanks to its affordability and relative closeness to the CBD.

Mr Nikolic said there was “no better time than now” for buyers to snare a piece of Melton, with improving infrastructure and growing job opportunities in Melbourne’s west on track to turn the suburb into “a little satellite city”.

Prices had also been gaining momentum for years, he added: “When I started 15 years ago, houses were $150,000. Now the median price is about $400,000.”

The Aussie and CoreLogic research also found the gap between typical mortgage repayments and rental costs had narrowed for houses in greater Melbourne since 2017, from $1927 per month to $1308 per month.

Analysis in the report assumes mortgage repayments are being paid on a 10 per cent deposit over a 30-year loan period, and bases rental costs on the median rental valuation.

MORE: Even ‘passive buyers’ pursuing rare Toorak mansion

Buy one of Brighton beachfront’s most modern luxuries

Bag Melbourne’s own Hobbit home in Olinda

WHERE IT’S CHEAPER TO BUY THAN RENT

Greater Melbourne

Houses

Hastings: monthly repayments* $257 cheaper than monthly rent

Melton: $106 cheaper

Melton South: $33 cheaper

Units

Carlton: monthly repayments* $675 cheaper than monthly rent

Travancore: $564 cheaper

Flemington: $453 cheaper

Melbourne CBD: $337 cheaper

Notting Hill: $310 cheaper

Hastings: $218 cheaper

Craigieburn: $210 cheaper

Dandenong: $203 cheaper

Melton: $197 cheaper

Bacchus Marsh: $183 cheaper

Regional Victoria

Houses

Red Cliffs: monthly repayments* $668 cheaper than monthly rent

Portland: $664 cheaper

Terang: $657 cheaper

Ararat: $610 cheaper

Hamilton: $603 cheaper

Mooroopna: $596 cheaper

Kerang: $594 cheaper

Stawell: $588 cheaper

Orbost: $577 cheaper

Morwell: $554 cheaper

Units

Portland: monthly repayments* $548 cheaper than monthly rent

Traralgon: $472 cheaper

Mildura: $468 cheaper

Lakes Entrance: $444 cheaper

West Wodonga: $435 cheaper

Mooroopna: $424 cheaper

Horsham: $421 cheaper

Wodonga: $414 cheaper

Shepparton: $407 cheaper

Cobram: $401 cheaper

Source: Aussie and CoreLogic

*for a three-year fixed rate