Sale of a dilapidated shack without power or water for $1.18 million is ‘the new norm’ in Sydney

An abandoned house in one of Sydney’s most notorious suburbs has sold for a staggering price after a fierce bidding war.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

It doesn’t have power or water connected, the yard resembles a rubbish-filled jungle, and vandals have covered most walls with graffiti, yet this dilapidated house in a notorious Sydney suburb fetched a staggering price at auction at the weekend.

Eleven registered bidders battled it out to secure 80 Mount Druitt Road in Mount Druitt, with the victor forking out $1.18 million for the eyesore.

Selling agent Greg Okladnikov from Starr Partners shared a clip of the final moments of the jaw-dropping auction to TikTok, sparking a flood of shocked commentary.

“So, you have to be a millionaire to live in Mount Druitt now?” one man wrote, summing up sentiment. “That’s insane.”

MORE: RBA’s cut is hiking prices in these Aus areas

A decade after SBS sparked controversy with its fly-on-the-wall documentary Struggle Street, chronicling the lives of underprivileged residents of the crime-riddled suburb, it seems fortunes have shifted.

And they have too across a whole host of Sydney pockets where the thought of million-dollar real estate was once unthinkable.

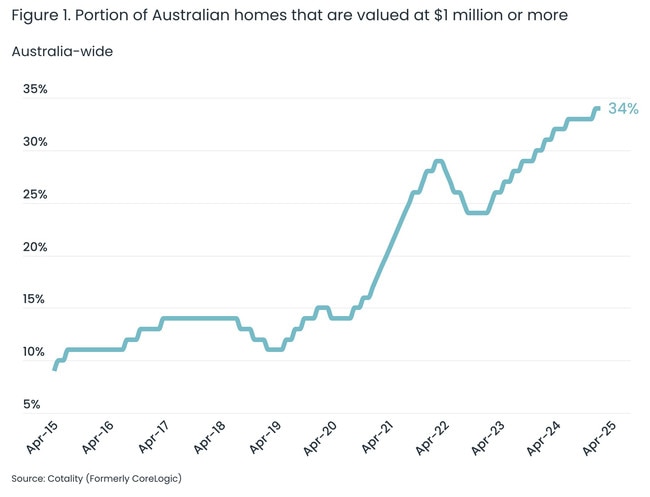

“For housing, $1 million is increasingly standard,” Eliza Owen, head of research at Cotality, said. “More than a third of homes nationally are now valued at $1 million or higher, with that amount of money buying less in the market than ever before.”

Sydney has the highest portion of homes valued at more than $1 million, with almost two-thirds of all properties above that threshold.

MORE: Named: Aus’ shock new $3m suburbs exposed

“Even for those with a budget of $1 million, the kind of property available in Sydney is generally smaller and further afield than a decade ago,” Ms Owen said.

“Only houses with five or more bedrooms had a median value more than $1 million in Greater Sydney a decade ago.

“Now the median house value for all bedroom types is more than $1 million, ranging from a median of $1.3 million for a three-bedroom house to $2 million for a house with five or more bedrooms.”

In Mount Druitt, the median house is currently sitting at $960,000, but just a decade ago, it was roughly half that.

Mr Okladnikov has worked across Western Sydney for 28 years and watched the region evolve dramatically over the years.

“It used to get a rap, and it still sometimes does, but it turns out a lot of people want to live here, otherwise nothing would sell. It’s changed so much.

“That’s true of anywhere, though. I remember when I was at uni, no-one wanted to go to Surry Hills or Redfern, let alone buy there. The same for Chippendale, and even Paddington, which was very rough and working class.

“Mount Druitt is seeing a lot of renewal. There are a number of duplexes and new homes being built. There’s a lot of development activity.”

This particular property was hot from the moment it hit the market, Mr Okladnikov explained, with half of those bidding having inquired within the first few days.

“Sometimes you get properties that become a local curiosity or a bit of a landmark, and that was the case here,” he said.

“A few of the top bidders said they had driven or walked past it over the years and wanted to snap it up if it ever went for sale. The people who really wanted it had been thinking about it for years.”

The house had also served locals as a convenience store in the distant past but has sat empty for at least the past 15 years.

And it shows.

While it’s not much to look at, the property has plenty of potential given it sits on a level 758 square metre block with a generous 18.2-metre frontage.

“We had people looking at it from all sorts of residential development angles – dual occupancy, maybe small townhouse development.”

One model that was being considered by a buyer was a duplex, each with a granny flat in the backyard, effectively turning one dwelling into four.

Mr Okladnikov, who sold the home with colleague Mark Vella from Starr Partners Blacktown, showed through plenty of buyers with builders in tow.

“People were bidding with what I call considered interest. They’d done their numbers. They’d gone through the process over that month prior. And they had done their homework and felt that what they were bidding was the price they were happy to pay.”

On the negative comments on TikTok, Mr Okladnikov said he’s used to criticism about the high prices some properties fetch.

But on this occasion, he was surprised by the high volume of remarks about this being a sign Mount Druitt locals are being locked out of the market.

“Occasionally I respond to some of those comments and ask: ‘What do you mean by a local?’ And most people don’t actually know how to answer.

“Yes, some people couldn’t afford that property, that’s fair, but there were 11 people registered in a transparent auction and when it crept above $1.1 million, there were still four people bidding.

“Yes, in terms of affordability, it’s not easy. I’m not saying it’s easy, but every property that comes on the market here generally sells. So, again, people make comments like, ‘who can afford to buy anything?’ but people are buying.”

Ms Owen said the sharp rise in homes valued at more than $1 million – it was 9.7 per cent in 2015 while now it’s 34.4 per cent – is a reflection of Australia’s growing wealth and prosperity.

“After all, housing markets wouldn’t have a million-dollar price tag if at least some Australians couldn’t come up with that level of finance,” she said.

“As values continue to rise, the chance that homeowners hit millionaire status increases, opening up new opportunities for further investment, or accessing that wealth through the sale of a property.”

It’s not just Sydney with a high proportion of million-dollar-plus properties.

In Brisbane, 40 per cent of homes are valued at $1 million or more, while that figure was a tint 2.8 per cent in 2015. In Melbourne, 30 per cent of properties are in the million-plus club, compared to 12.4 per cent a decade ago.

Meanwhile, in Adelaide, 27.8 per cent of homes are worth more than seven figures, while in Perth, it’s one quarter.

There are considerable downsides to of such an “extraordinary” price point, Ms Owen said.

“The rate of home ownership has gradually declined over time, particularly among younger, low-income households where income cannot keep pace with growth.

“The average age of first home buyers has increased, and increasingly, wealthy households are stuck renting for longer, which increases competition for low income, renting households.”

Housing debt has also blown out as homeowners battle to keep pace with rising values.

Mortgage balances relative to income was 135 per cent at the end of last year, according to the Reserve Bank of Australia. That’s up from 122 per cent a decade before.

“With values expected to continue rising on the back of rate falls in 2025, the wealth divide between homeowners and non-homeowners is also likely to expand,” Ms Owen said.

Governments are investing billions to stimulate housing supply in order to ease pressure on home prices, but progress has been slow.

The National Housing Supply and Affordability Council released its State of the Housing System report this week, showing building activity projections remain flat.

Australia is forecast to build 983,000 new homes between now and 2029, which is some 262,000 dwellings short of Anthony Albanese’s goal to build 1.2 million new properties by then.

“The sad fact is that many Australians feel that homeownership is out of reach,” Property Council chief executive Mike Zorbas said.

“We have seen the federal and state governments co-ordinate their efforts on boosting supply, but more must be done.”

More Coverage

Originally published as Sale of a dilapidated shack without power or water for $1.18 million is ‘the new norm’ in Sydney