Stockland-Supalai rises as housing developer giant in Ipswich, Moreton, Logan, Redland after ACCC green light

A property giant is emerging after its latest takeover was approved, paving the way for the conglomerate to become the largest housing developer in southeast Queensland.

Regional News

Don't miss out on the headlines from Regional News. Followed categories will be added to My News.

The state’s housing crisis has taken a new turn after the country’s consumer watchdog greenlighted a massive $1.3 billion takeover bid to allow an international conglomerate to buy out embattled property developer Lendlease.

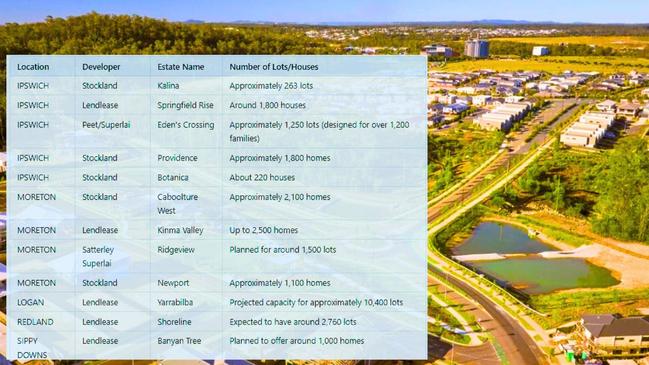

The Australian Competition and Consumer Commission said it will not oppose Stockland-Supalai buying 12 Lendlease masterplanned communities across the country, including four in Queensland, despite raising major concerns in July about competitive practices for projects in Ipswich and Moreton.

Stockland, an ASX-listed diversified property group, and Supalai, a Thai-listed property developer, formed a joint venture for the takeover.

The Lendlease-owned communities of Yarrabilba in Logan; Springfield Rise in Ipswich; Kinma Valley in Moreton; and Shoreline in Redland will remain as takeover targets.

ACCC approval was dependent on Stockland selling off its Forest Reach masterplanned community in the Illawarra to address competition concerns in that region.

The approval paved the way for greater investment security at 11 housing estates in Moreton, Ipswich, Logan, and Redland.

The green light came after a five-month investigation which looked at concerns that the deal, signed last year, would jeopardise competition at estates, including Ipswich and Moreton Bay, and increase housing prices.

Concerns had stemmed from Stockland being the largest developer in Ipswich, controlling masterplanned communities in the area including Kalina, Providence, and the forthcoming Botanica.

The July ACCC report said the takeover could add to Stockland’s market power if it included Lendlease’s Springfield Rise estate, currently the most established estate in Ipswich.

“With Lendlease removed as an independent competitor, Stockland may have more incentive to raise prices, which would adversely affect consumers,” the report said.

The Statement of Issues also outlined similar concerns for the Moreton Bay region with Lendlease’s 2500-lot Kinma Valley project, the largest in the region, and Stockland’s future Caboolture West project of 2100 lots set to be a close competitor.

Concerns were raised that the deal would allow Stockland to use its market position to influence Supalai’s decisions in the Springfield Rise Community Partnership and allow Stockland and Supalai to set pricing, supply, and quality of housing.

Despite initial apprehensions, the ACCC indicated that the acquisition was not expected to adversely affect competition in other regions where Lendlease has projects, including Redlands and Logan, where there were “alternative competitors” to the two developers.

Both Lendlease and Stockland refused to comment on upcoming planning arrangements for the southeast Queensland estates after the deal proceeds.

The takeover was expected to be completed in the second quarter of 2025, with Stockland estates in Queensland eventually becoming home to more than 200,000 people.

The Stockland portfolio would then include Kalina, Springfield Rise, Eden’s Crossing, Providence and Botanica in Ipswich along with Caboolture West, Kinma Valley, Ridgeview and Newport in Moreton Bay and Yarrabilba in Logan and Shoreline in Redland.

Lendlease chief executive Tony Lombardo has said the company, which has posted dismal annual profit figures for the past three years, would be moving away from single-dwelling houses to high-rise projects to cash in on Baby Boomers downsizing.

News of the ACCC approval coincided with a call from the Property Council of Australia report released on Tuesday, which found the state had missed out on 33,000 new homes and thousands of jobs over the past eight years due to “uncompetitive” tax policies.

The study, Time for a Fair Go, conducted by Queensland Economic Advocacy Solutions, criticised the state’s tax regime for international capital and indicated that property and developer taxes aimed at curbing overseas investment had hindered housing delivery.

Property Council of Australia Queensland executive director Jess Caire said the state taxes had driven away the global capital component for large-scale housing projects and called for an independent tax review to find fairer policies to support developers and boost housing stock.

“These apartment-killer taxes were sold to Queenslanders as a solution to a perceived influx of overseas buyers looking to crowd them out of housing, but in reality, they’ve put the handbrake on housing delivery altogether,” Ms Caire said.

“These ill-considered taxes have only worsened Queensland’s housing issues by driving away the global capital that backs Australian-based developers who deliver new homes at scale and bring community-building projects to life,” she said.

The Property Council report showed an 83.9 per cent drop in international investment since the taxes were introduced in 2016, resulting in a loss of $17.8 billion in housing investment and between 21,129 and 37,972 jobs.

The Real Estate Institute of Queensland echoed concerns about unfair taxes for developers.

More Coverage

Originally published as Stockland-Supalai rises as housing developer giant in Ipswich, Moreton, Logan, Redland after ACCC green light