Single parent home loan: major issue with Federal Budget’s Family Home Guarantee

The government’s new solo parent homebuying scheme won’t help many families get the house they want, despite all the fanfare.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

The Federal Government’s two per cent home deposit scheme for single parents isn’t enough for those on a median income to buy a house in either of the nation’s two biggest capitals.

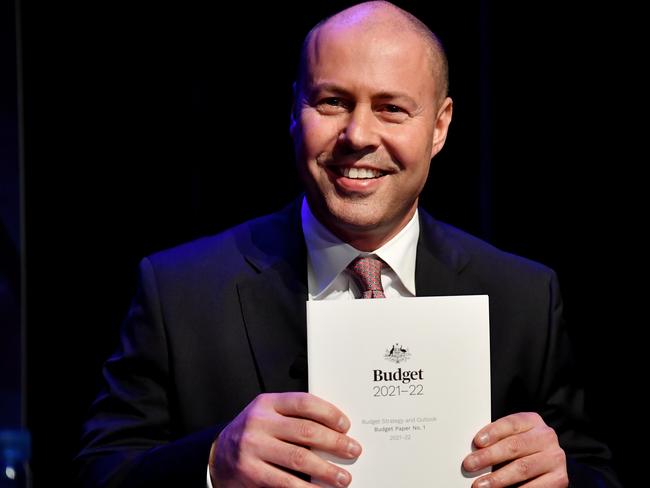

The Family Home Guarantee outlined in Tuesday’s Federal Budget allows solo mums and dads to buy a home with as little as a two per cent deposit and the government guaranteeing the remaining 18 per cent of the required 20 per cent deposit.

The scheme will be open to 10,000 parents over the fours years starting July 1.

However data revealed in the wake of the Morrison Government’s announcement have revealed the scheme won’t help single parent families to realise their dreams of owning a house anywhere in either Sydney or Melbourne.

Figures from the Melbourne Institute show a typical single parent with one child under 15 has $54,000 a year left after tax, or $57,000 if they have two children.

Mortgage Choice estimates these figures would service a maximum $370,000-$375,000 mortgage.

According to the latest realestate.com.au median house price figures, this leaves just 1008 suburbs or towns in the entire country where that budget would get them into a house.

At the state level this gives them access to 340 Queensland postcodes, 161 in NSW, 152 in WA, 146 in South Australia, 131 in Victoria and just 65 in Tasmania.

There are no suburbs with a median house price at or below $383,000, which includes the 2 per cent deposit as well as the $375,000 maximum loan, in Sydney or Melbourne.

Social housing provider Housing First chief executive Haleh Homaei said the measures didn’t go far enough to help families on smaller budgets.

“This initiative itself is great and I think for a small cohort of people that we deal with, including single parent families, it will be a welcome opportunity to homeownership, but I don’t know how many people will benefit,” Ms Homaei said.

“An unintended consequence of this scheme is it could drive single parents to suburbs outside CBDs and areas with employment, so it adds to the cost of living in other ways, such as transport, people being time poor, (and) pick up and drop off from school.”

Realestate.com.au economist Paul Ryan said the scheme could save families more in the long run by getting them out of rentals and into their own home sooner — but the 10,000 cap on places over four years would impact the scheme’s overall effectiveness in tackling housing affordability.

Mr Ryan warned that with applicants effectively still paying their deposit as they paid their mortgage they would “pay more on a weekly or a fortnightly basis”.

The breakneck pace of rising dwelling prices in early 2021 is slowing according to CoreLogic. However that figure of $370,000 to $375,000 sits well below the median house prices of all capital cities. As of May 3, Sydney’s median house price was $1.147m, Melbourne’s was $870,000, Brisbane’s was $622,000, Adelaide’s was $492,000, CoreLogic said.

Perth’s median was $537,000, Hobart’s was $601,000, Darwin’s was $466,000 and Canberra’s average house value was $833,000.

All prices well beyond the reach of the average single parent family.

Core Logic Head of Research Eliza Owen said the The Family Home Guarantee “seems well targeted” but like the Barefoot Investor Scott Pape, she said it could lead those who take it up, into a debt trap.

“Low deposits mean more debt. More debt means more interest needs to be paid over the life of the loan,” Ms Owne said.

She said people who access the scheme could pay around $145,000 in interest over the life of the loan.

“However the long term gains in real asset values that come from accessing ownership earlier with a lower deposit, could be s factor helping to outweigh the additional interest paid,” she said.