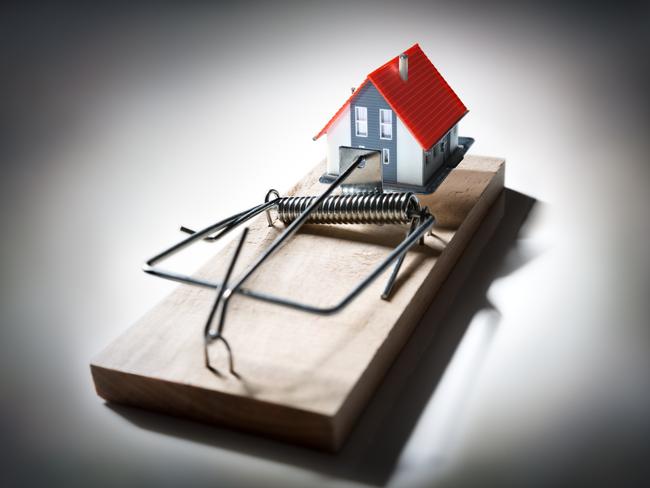

Plan to boost mortgage lending ‘will benefit banks, not consumers’

A federal government plan to make it easier to borrow money will remove a bank’s responsibility to the customer, say consumer groups who slammed the idea as a ‘shortsighted fix for a flailing economy’.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

- Download our app and stay up to date anywhere, any time

- What you get as a subscriber to The Daily Telegraph

Consumer groups have slammed a federal government proposal to make it easier to borrow money, as it expands help for first-home buyers in next month’s budget.

Bank stocks soared yesterday after the Morrison government announced it would axe laws requiring lenders to work out whether would-be borrowers could afford to repay their mortgages.

Instead there would be a greater emphasis on self-responsibility, and borrowers would be able to access credit without handing over as much information as they do now.

The government hopes the move will speed up the credit approval process, but consumer groups criticised the plan, claiming it removes the bank’s responsibility to customers.

MORE NEWS

$250 pizza a slice of the high life

History: Australia’s first millionaire

NYE fireworks to go off with a bang

In a group statement, CHOICE, Consumer Action Law Centre, Financial Counselling Australia and Financial Rights Legal Centre said the reforms would open up “new opportunities for banks to aggressively sell debt”.

Financial Rights Legal Centre chief executive Karen Cox said: “Unsustainable debt hurts real people and is a shortsighted fix for a flailing economy.”

“Watering down credit protections will leave individuals and families at severe risk of being pushed into credit arrangements that will hurt in the long term.”

But Treasurer Josh Frydenberg insisted consumer protections will “stay in place”.

“The flow of credit will be absolutely critical to our economic recovery,” Mr Frydenberg said. “But our current regulatory framework … is not fit for purpose.”

The changes to lending laws come as the government prepares to expand programs to help first-home buyers get into the property market.

The Saturday Telegraph has confirmed the October 6 Budget will include changes to the First Home Loan Deposit Scheme which helps applicants purchase a home with a deposit of as low as 5 per cent. The scheme is available each year on a first-come, first-served basis to 10,000 applicants, but is expected to be expanded next month.

The changes come as the government unveiled the final budget position at the end of the 2019-20 financial year, with the deficit hitting $85.3 billion.

Originally published as Plan to boost mortgage lending ‘will benefit banks, not consumers’