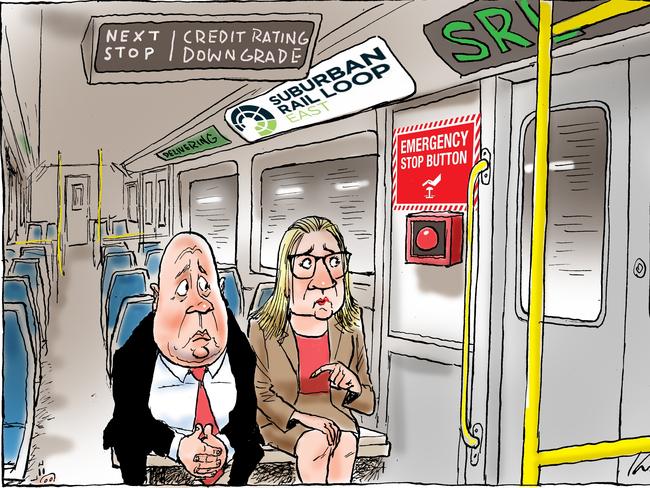

Shannon Deery: Dire debt warning amid tension between Jacinta Allan and Tim Pallas

At the rate Victoria is spending money we’ll rack up $200bn of debt by the 2026 election, which is perhaps why tensions between Jacinta Allan and Tim Pallas remain at an all-time high.

Opinion

Don't miss out on the headlines from Opinion. Followed categories will be added to My News.

Forget May’s budget forecasts, at the rate Victoria is spending money we’ll rack up $200bn of debt by the 2026 election.

That’s the dire warning contained in the latest quarterly budget update.

It was published quietly last week, just as Premier Jacinta Allan decided it was finally time to shape up to pro-Palestinian protest pests.

Peek behind the report’s bureaucratic spin and the reality that Victoria has already diverged well away from May’s forecasts is stark.

Which is perhaps why tensions between the Premier’s office and that of treasurer Tim Pallas’s remain at an all-time-high.

Government insiders say the working relationship between Allan and Pallas has broken down significantly of late.

On the one hand Pallas, who has long been planning his retirement according to government sources, is desperately trying to clean up the books.

His legacy – that which there will be for a Treasurer who has watched debt climb from about $22bn when he inherited the job to $140bn today – depends on it.

But his way of doing that, which is now coming down to big spending cuts and more taxes, is politically problematic.

And for a Premier with her eye on a fourth term, juggling myriad political problems, she doesn’t need her Treasurer adding to that mix.

Which is why she managed to overrule his decision to strip more than $1bn in health funding this year, committing an additional $1.5bn in funding instead.

It means political savvy and accounting creativity are needed to make Victoria’s budget position seem better than it is.

Most interesting in last week’s update was the revelation Victoria’s debt is growing at almost $25m a day more than what was predicted in May.

Then, forecasts tipped debt to grow from $135.8bn to $156.2bn by 2025-26 – a rate of $55.7m a day.

Ultimately we’re bracing for a total net debt of $187.8bn by 2027-28.

But do the maths and the budget update shows debt is actually growing at a rate of more than $80m a day.

If we stick to that trajectory – and the case to say we won’t has about much evidence to support a case to say we will – we’ll hit $200bn by the election.

At the same time taxation revenue climbed by $716m from the same period last year, and our operating deficit worsened by $600m to $1.9bn.

Liabilities outpaced asset growth while net debt surged by $7.4bn, reaching $140.7bn.

It paints a bleak picture.

Against that the government argues it is managing a sensible and disciplined fiscal strategy that will drive to debt reduction.

It is underpinned by driving new growth across the state.

And they continually point to forecasts by Deloitte Access Economics that our economy will grow faster than the national average over the next five years.

But they would say that.

This is a government who have become expert in smoke and mirrors budgeting.

The latest in the series is a continued over-reliance on accessing Treasurer’s Advances for core, planned, government work.

In the 10 years since Labor took office the Treasurer’s Advance kitty has grown from about $350m to $12bn – more than a tenth of total government expenditure.

The money is supposed to be used for urgent and unforeseen spending.

This year it was used to inject money into the state’s struggling court system, prop up health services funding and ensure sufficient cash was available to spend on major events.

Billions was also diverted to the government’s Big Build project and used to keep the Suburban Rail Loop continuing full steam ahead.

This over-reliance has raised eyebrows around Allan’s cabinet table because it reduces parliamentary scrutiny of decisions and major projects.

But don’t worry, Department of Treasury and Finance boss Chris Barrett told parliament on Monday this swish new accounting practice actually increases scrutiny.

Still, the numbers are the numbers, and our debt remains stubbornly high while confidence in doing business here teeters between low and none.

It’s a major problem for the government, and will set voters off to consider an alternative in the Opposition, who now lead the government on both primary vote share and preferred premier polling.

But they’ll have to work hard to keep the lead, and offer concrete answers as to how they propose to fix the state’s economic mess.

John Pesutto has promised policy announcements next year.

Until now much of the Opposition’s sell has been to rely on the fact that they are historically better economic managers.

The rest of its economic reform agenda has been so lightweight it would float away in a gentle breeze.

Even accounting for the fact government’s lose elections, Oppositions don’t win them, sitting back and waiting for Victorian Labor to lose 17 seats is risky business.

Latest polling has already shown a small uptick in Labor’s primary vote.

If after a year of cleaning the barnacles the government’s vote has bottomed out, they’ll now have two years to win voters back.

Shannon Deery is the Herald Sun state politics editor