NT Treasury report into impacts of mining royalty shake-up released

Tax reform promises to lure miners to the NT, but critics warn Territorians will lose millions in royalties over the next 20 years.

News

Don't miss out on the headlines from News. Followed categories will be added to My News.

Drastic mining royalty reform could generate $1.5bn a year for the NT economy, but critics warn that the Territory could lose out on millions under proposed changes.

A Treasury-commissioned report released on Wednesday estimated that if mining royalty changes were enacted today, it would boost the Territory’s gross product by $1.5bn per year over the next 20 years.

The ACIL Allen report argued that the “economic case for royalty reform is strong”, recommending that the Territory switch from its current profit-based scheme to a four-tiered value-based “ad valorem” royalty model.

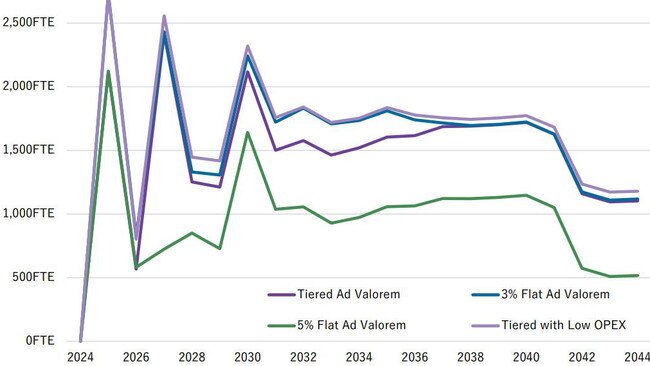

The report said the new scheme would create an average of 1538 new jobs a year over the next two-decades, with mining employment spikes in 2025, 2027 and 2030 before plateauing until 2041.

However the mining profits could come at a cost to the NT budget, with the government predicted to miss out on $93m in royalties.

The ACIL report argued that the shift would “stimulate new mining developments”, however even assuming five projects got the green light, the royalties deficit would still be $47 million per year for 20 years.

Any royalties loss would hit the Territory twice as hard, as the Commonwealth matches every dollar of royalties generated from mining on Aboriginal land with a payment to the Aboriginal Benefits Account.

Mining Minister Mark Monaghan acknowledged the new model charged “lower royalty rates”, however confirmed that existing mines would be exempted from the changes.

“The Northern Territory Government has already committed to grandfathering existing mines under the current royalty scheme,” he said.

“There will be no reduction in royalties (from current mines) paid to the Northern Territory or the contribution to the Aboriginal Benefit Account.”

Mr Monaghan said the new model was “simple, competitive, and delivers investment certainty”.

In a letter obtained by the NT News, the Territory Revenue Commissioner Sarah Rummery did not rule out existing mines eventually moving to the cheaper rate.

“The Department of Treasury and Finance will periodically review circumstances to identify when transition to the ad valorem scheme will be revenue neutral,” she said.

Environment Centre NT mining policy officer Naish Gawen said the proposed royalty cuts were nothing but a “multinational mining company wishlist” which would ultimately hurt Territorians.

“The government is shooting itself in the foot by proposing a royalty scheme that actually lowers the amount that mining companies have to pay to the Territory,” Mr Gawen said.

“The new royalty scheme should ensure that Territorians get a fairer share of the revenue generated by the royalties that belong to them – this reform does the exact opposite of that.”

Mr Gawen said the potential $93m per year in lost royalty revenues was larger than the NT’s entire annual budget for preschool education, agriculture, or tourism.

He said the Territory was also giving a mineral discount compared to other states, with lead, rare earths, silver and zinc all levied at a higher rate in Western Australia, South Australia and Queensland.

More Coverage

Originally published as NT Treasury report into impacts of mining royalty shake-up released