NAB, Westpac, CBA, ANZ and other banks confirm sixth successive rate hike

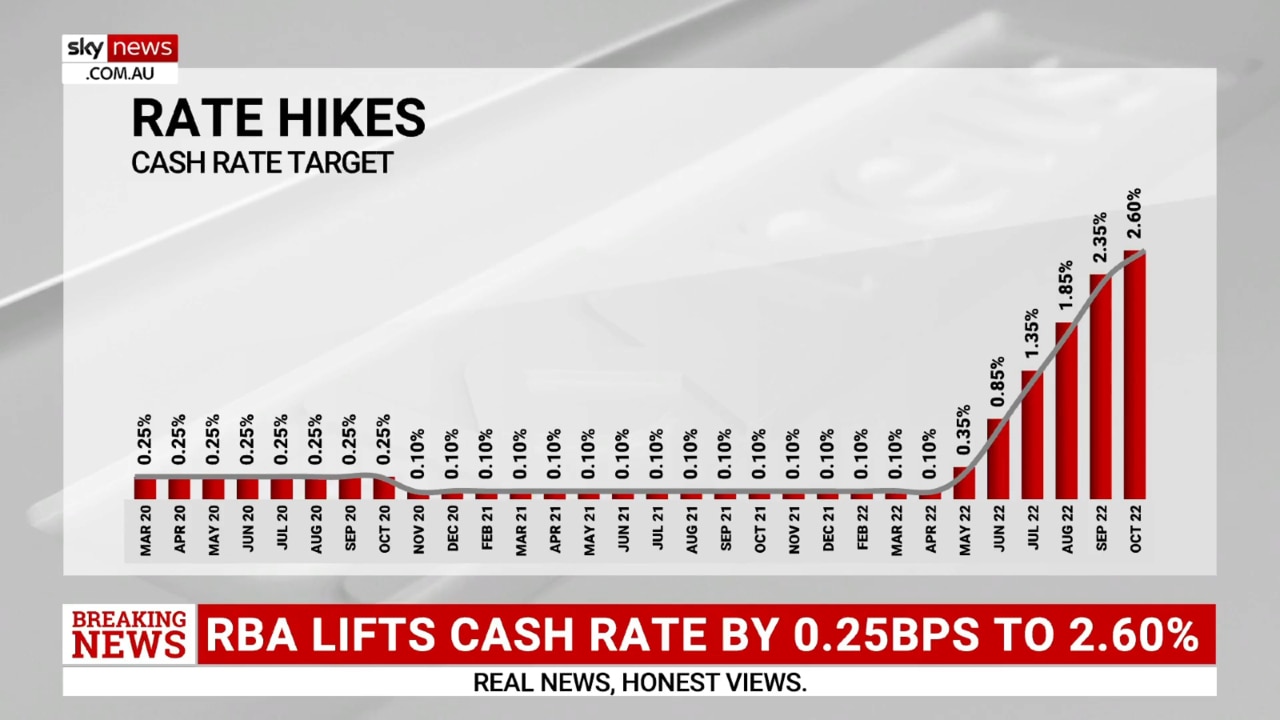

Homeowners have been slugged with a sixth successive hike that has brought interest rates to 2.60 per cent – a nine-year high that intensifies recession fears and causes more mortgage pain.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

All of Australia’s four biggest banks have committed to passing on the latest rate rise to customers after the Reserve Bank of Australia (RBA) announced its sixth successive hike.

The ‘big four’ – NAB, Westpac, Commonwealth Bank of Australia (CBA) and ANZ – have confirmed the new 0.25 per cent rate rise will come into effect for variable rate home loans in the next few weeks.

Other banks, like Macquarie, ubank and Suncorp, have also passed on the increase to customers. But, it’s not all bad news – most of them have agreed to lift the new rate for savings accounts as well.

After a meeting on Tuesday, the RBA Board decided to increase the nation’s cash rate by 25 basis points to 2.60 per cent – the highest recorded in nine-year.

It also increased the interest rate on Exchange Settlement balances by 25 basis points to 2.50 per cent.

The bump in interest rates is likely to sting borrowers. For example, a monthly repayment on a $500,000 mortgage is set to increase by $76.45, and a $1 million mortgage will cost an extra $152.90 per month.

Most economists are predicting further rate rises this year despite one in four Aussie homeowners already struggling to make their payments.

Before Tuesday’s hike, rate rises had already added $8000 to the annual cost of a $500,000 mortgage.

The increase was less than the 50 basis point increase predicted by most economists and three of the big four banks.

The official cash rate had increased from 0.1 per cent to 2.35 per cent in September since the RBA started its monetary tightening cycle in May. The shift takes the cash rate to 2.6 per cent – the highest level since 2013.

It will be a hard hit in the back pocket for Aussies already struggling to pay an extra 25 cents a litre on fuel with the end of the fuel excise.

Rates have not risen with such speed since 1994 when the cash rate soared from 4.75 to 7.5 per cent in just five months.

LOWE EXPLAINS SMALLER RISE

RBA Governor Philip Lowe said in a statement that the surprise decision to lift the rate by only a quarter of percentage point rather than the half predicted by many experts was a reflection of the large number of increases over the last six months.

“The cash rate has been increased substantially in a short period of time. Reflecting this, the Board decided to increase the cash rate by 25 basis points this month as it assesses the outlook for inflation and economic growth in Australia,” he said.

“The Board is committed to returning inflation to the 2–3 per cent range over time. Today’s (Tuesday’s) increase in interest rates will help achieve this goal and further increases are likely to be required over the period ahead.”

Inflation in Australia hit 6.8 per cent last month — down from 7 per cent in July but still more than double the RBA’s target.

Mr Lowe predicted a further increase in inflation before it dropped to the desired level next year and said that would dictate the size of rate rises in the coming months.

“The Board expects to increase interest rates further over the period ahead. It is closely monitoring the global economy, household spending and wage and price-setting behaviour,” he said.

“The size and timing of future interest rate increases will continue to be determined by the incoming data and the Board’s assessment of the outlook for inflation.”

Mr Lowe said the RBA was pushing for a return to low inflation while keeping the economy on “an even keel” with stable prices and full employment. However, he noted: “The path to achieving this balance is a narrow one and it is clouded in uncertainty.”

He said the deterioration of the global economy and how Australia responds to tighter financial conditions were two of the major sources of uncertainty.

“Higher inflation and higher interest rates are putting pressure on household budgets, with the full effects of higher interest rates yet to be felt in mortgage payments. Consumer confidence has also fallen and housing prices are declining after the earlier large increases,” he said.

MARKETS REACT

The market responded immediately to the announcement with share prices jumping by 80 points to leave the index price up 3.6 per cent by mid afternoon trade.

Craig James, chief economist at CommSec, said the 25 per cent rate rise was “a very smart call” by the RBA because it kept the official rate at its targeted level.

“Now the RBA has got to the level it wants to be there is little point in making a big change,” he said.

“I expect the RBA to sit back now and assess the landscape, making only smaller rises of 25 basis points where necessary in the future.”

With a quarter of Australians struggling to pay their mortgages, Mr James said the strong economy was in their favour.

“The important factor is that the job market is in such strong shape. If someone is having difficulties paying their mortgage they have options to look around and get another job that pays more,” he said.

He added the rate rise would also act as an incentive to savers to deposit more money which would also help slow the economy and help reduce inflation.

STILL NOT EASY: CHALMERS

Treasurer Jim Chalmers said that even though the rate rise was “a bit less” than many people expected, that would not “make it that much easier for Australians to find room in their household budgets to meet the increasing cost of servicing the mortgage.”

“They (the RBA) have made it clear that they think there is more work to be done by tightening interest rates. That remains to be seen whether that is the case or not,” he said.

“Our own Treasury forecast expects it to get worse not better and will moderate it during the course of next year.”

AMP chief economist Shane Oliver said the deteriorating global economy had clearly played into the RBA’s thinking: “They made the mistake of tightening in 2008 as the world was falling apart so I think the current global backdrop has played a part in their thinking.”

He labelled it a “sensible move” to restrict the rate rise to 0.25 rather 0.50 percentage points: “We have had five hikes in a row before this, four of them super-sized, and to keep going would almost certainly tip us into recession.”

Mr Oliver said the smaller increase was “clearly a sign that we are closer to the peak” of the rate rises but that it did not alter the fact that people were having to pay more for their mortgages.

“If you have a $600,000 mortgage you are about $800 a month worse off than you were in April when the rate hikes started,” he said.

GLOBAL INFLATION IMPACT

Global inflation beyond the RBA’s control is pushing its hand. The Organisation for Economic Co-operation and Development’s latest outlook said Russia’s war in Ukraine was “dragging down growth and putting additional upward pressure on inflation worldwide.”

Increased prices for food and fuel internationally is having a knock on effect on prices in Australia. Australia’s inflation rate hit 6.8 per cent last month – down from 7 per cent in July but still more than double the RBA’s target of between 2 and 3 per cent.

Graham Cooke, head of consumer research at Finder, said: “With one in four (26%) Aussie homeowners already struggling to pay their mortgage in September, this could be the rate rise that pushes some borrowers to the limit.“

As a result, house prices are continuing to fall with CoreLogic reporting a 1.8 per cent drop in Sydney home values in September.

CoreLogic’s research director Tim Lawless said: “If interest rates continue to rise as rapidly as they have since May, we could see the rate of decline in housing values accelerate once again.”

RECESSION FEARS

A United Nations agency warned on Monday that central banks including the RBA risked pushing the global economy into recession followed by prolonged stagnation if they kept raising interest rates.

“Excessive monetary tightening could usher in a period of stagnation and economic instability” for some countries, the UN Conference on Trade and Development (UNCTAD) said in a statement.

“Any belief that they (central banks) will be able to bring down prices by relying on higher interest rates without generating a recession is, the report suggests, an imprudent gamble.”

Originally published as NAB, Westpac, CBA, ANZ and other banks confirm sixth successive rate hike