‘Punch in the face’: Business owners slam payroll tax

The threshold to avoid paying payroll tax in NSW has not risen for almost five years, despite the increasing cost of wages. It’s now on track to collect $15 billion a year.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

The Minns Government has been accused of squeezing billions of dollars out of struggling businesses, by failing to adjust an ‘insidious’ tax which no longer reflects Sydney’s difficult operating conditions.

Treasury Daniel Mookhey is being urged to lift the payroll tax threshold of $1.2 million, a figure which has not increased since the early days of the COVID-19 pandemic.

Budget records say the tax, described by one business owner as a ‘punch in the face’, collected $8.5 billion for state coffers in 2019-2020 and is on track to reach a whopping $15.4 billion a year by 2027-2028.

As of July 2020, businesses with a modest annual wage bill of above $1.2 million have been slugged payroll tax for their employee salaries. For every cent paid to workers above that threshold, the government adds a tax of 5.45%.

In the five years since, the cost of wages alone has grown by roughly 20 percent, with Australia boasting one of the highest minimum wages in the world. According to the Australian Bureau of Statistics, average earnings in the ‘food and hospitality’ sector have risen more than $300 a week between 2020 and 2024.

A key example of the sharp wage increase is with baristas. In 2020, cafe owners have told The Daily Telegraph a barista in the CBD would cost roughly $24 or $25 an hour. It’s now approaching $40, with some venues willing to pay upwards of $45.

Anthony Pitt, who employs more than 350 people with his clothing company Academy Brand, described the tax as a ‘debacle’ and a ‘hindrance.’

‘It’s never been harder to be a successful business person in this country. Payroll tax is punishment for growth. It should be renamed Penalty Tax’ Mr Pitt told The Daily Telegraph.

‘It is not instinct with caring with people trying to make a quid and employing Australians, which we are really proud of. (But) rather than a pat on the back I get a punch in the face. That’s how I feel. For too long taxes like this have killed businesses Mr Pitt said.

Lauren Sommer, the owner of Moi Moi Fine Jewellery in the Queen Victoria Building, conceded payroll tax was an ongoing ‘consideration’ and a ‘challenge’ for businesses who wanted to expand their operations.

‘It’s demoralising. We started as a family operation but all businesses want to grow but it’s hard to do that when you get penalised for actually having some growth’ she said.

Restaurateur Luke Mangan added: ‘since COVID-19 our costs have increased significantly while the threshold has not budged. It is an insidious tax. You are taxing business for employing people’

Opposition Treasury spokesperson Damien Tudehope said Labor had become ‘addicted to taxing small business’ and was suffering a ‘revenue problem’ after lifting the cap on public sector wages.

Mr Tudehope noted the Coalition had increased the threshold multiple times during its term in power as ‘a lever… to ensure the tax burden on businesses is not such that we are sending them broke.’

Treasurer Mookhey was approached for comment. A spokesperson for the NSW government noted ‘Payroll tax threshold and rates in NSW are comparable to other states.’

‘Create jobs’: restaurateur backs Dutton’s small business tax cut

One of Australia’s leading restaurateurs has backed the Coalition’s small business tax deduction, claiming the economic benefits will ‘create jobs’ in the hospitality sector.

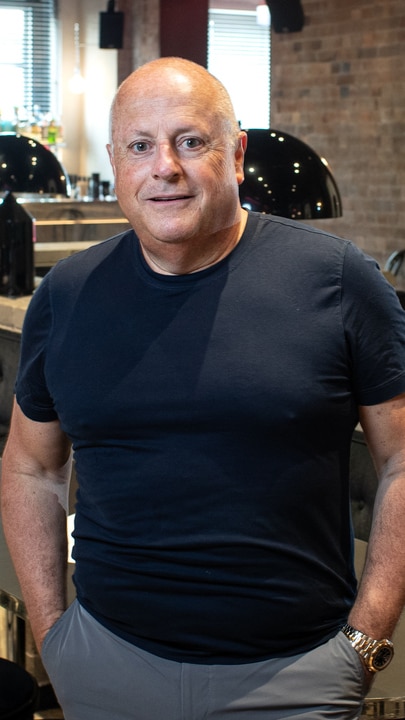

Chris Lucas, who runs multiple venues, including Chin Chin in Surry Hills, believed it was ‘the first time that we know of… that a government or an opposition has announced a genuine cut in tax for our industry.’

Opposition Leader Peter Dutton has pledged to introduce a deduction of $20,000 for meal and entertainment expenses. Small businesses with a turnover of under $10 million would be eligible.

The Daily Telegraph has reported the policy would also cover taking clients to sporting events or to the movies.

The Albanese Government has used Treasury to claim the policy will cost at least $1.6 billion. Treasurer Jim Chalmers has described the move as a ‘farce’ which will ‘make workers and families worse off to pay for tax breaks for long lunches.’

However, Mr Lucas disagreed: ‘when you cut taxes, small businesses get to potentially consider reinvesting, growing, hiring… and that in itself starts to generate tax’ Mr Lucas said.

The owner of LUCAS Restaurants, employing almost 3,000 staff, warned the hospitality industry was facing ‘a perfect storm’ of ‘rising costs at every level’ and ‘heavy regulation.’

‘Every level of government is bringing in their own view of what the rules and regulations should be. And that just drives costs up… it has a multiplying effect’ Mr Lucas said.

More Coverage

Originally published as ‘Punch in the face’: Business owners slam payroll tax