With no will to slash services Jackie Trad’s second Budget will be the one to watch

POLITICAL pundits will have their eyes firmly trained on the Treasurer as she hands down her first Budget on Tuesday, but bigger surprises might still be to come, writesSarah Vogler.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

QUEENSLANDERS will be greeted with five new taxes and very few surprises on Tuesday when the state’s newly minted Treasurer Jackie Trad hands down her first Budget since wresting the role from Curtis Pitt last year.

Trad had her first minor test in the new role as she handed down her first mid-year economic review after less than a fortnight in the role.

Several other tests have followed as she switched from holding out the soup bowl to being in control of the ladle in Budget negotiations leading up to Tuesday.

But just how deft a hand Trad is at juggling the state’s tight financial situation will be writ large when her full Budget is revealed.

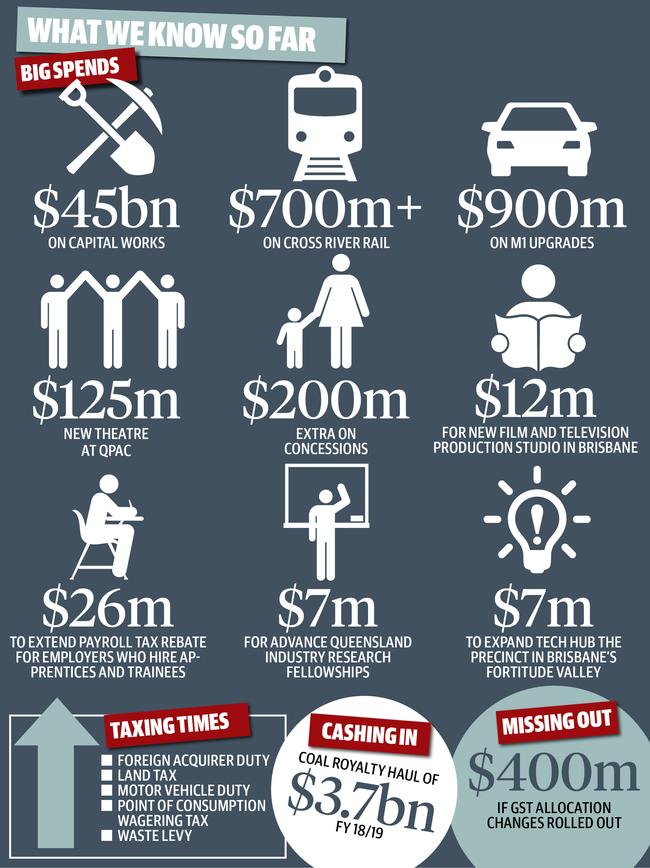

About $45 billion will be spent on capital works including roads, rail, schools and hospitals.

At least $700 million is expected to be handed to Trad’s pet Cross River Rail project as the State pushes forward with its pledge to fully fund the $5.4 billion project.

Almost $900 million will be spent on upgrades to the M1 between Varsity Lakes and Tugun and between Eight Mile Plains and Daisy Hill with half of that cash to be spent over the next four years.

The government has also announced it will contribute $125 million to a new 1500 to 1700 seat theatre at the Queensland Performing Arts Centre.

An extra $200 million will be spent on funding concessions.

Trad’s first post-Election Budget will also be focused on delivering on the $2.8 billion in election commitments Labor made during the November 2017 election campaign with its four new taxes and more than $1 billion in “re-prioritisations” designed to ensure they can be met without putting too much strain on the Budget bottom line.

Those taxes include an increase in the foreign acquirer duty from 3 per cent to 7 per cent to raise $99 million over three years.

Land tax will increase by 2.5 per cent on holdings of more than $10 million to raise $227 million and the motor vehicle duty will increase by $2 for every $100 over $100,000 in a bid to raise $90 million.

A new “point of consumption” wagering tax will raise a further $90 million over three years.

Those taxes and re-prioritisations are due to make the Government more than $570 million this coming financial year alone.

A new waste levy will also be added. It will start in the first quarter of next year and is expected to make about $200 million a year.

The new waste tax is a broken promise for Labor which initially said only the four next taxes it revealed on the eve of the November 25 election would be the only ones introduced in this coming Budget.

But with two more Budgets to come before the next election, the Government has time to get voters used to the idea.

Just whether voters will be happy with some of that waste tax being funnelled into Treasury’s coffers, however, remains to be seen.

Councils are not impressed and have already begun a campaign to ensure 100 per cent of the tax the Government has sold as necessary to build a new waste and recycling industry in Queensland is spent building that industry.

Trad has so far kept mum on the details of the levy, other than to reveal it will start at $70 a tonne from the start of next year and then increase by $5 a year for four years.

The resources industry is again expected to ride in like a white knight on a trusty steed with more royalties than initially predicted.

The Queensland Resources Council predicts the coal industry will hand the State Government a record royalty haul of $3.7 billion this financial year.

That is $530 million more than was forecast in the Mid-Year Fiscal and Economic Review and about $1 billion more than former Treasurer Curtis Pitt predicted in his final Budget last year.

Tinkering with the royalties formula to further capitalise on this, as was done by the LNP when it first won office in 2012, is not expected this coming financial year at least.

The Queensland public is also unlikely to see a bold plan to tackle debt contained within this Budget.

Labor is yet to announce anything new on the issue and the LNP also failed to outline any real debt plan before last year’s election with asset sales firmly off the table.

All the while the State’s debt continues to climb, heading towards $83 billion by 21/22.

Queensland’s debt per capita — currently at more than $14,000 — the second highest in the country.

The state’s interest bill is tracking at about $1.7 billion a year.

Analysis has shown Labor paid $5.6 billion in interest last term with a further $5.1 billion in interest repayments to be made this term.

That money could have paid for Cross River Rail almost twice over.

Just how Queensland will fill a looming GST hole also remains to be seen, as does the hit coming from Aurizon’s dispute with the Queensland Competition Authority over how much it can charge customers going forward.

Trad has estimated Queensland could miss out on $1.4 billion in GST if the Commonwealth forges ahead with plans to change the allocation to the states.

The State will already miss out on about $400 million this coming financial year.

With limited other levers available to fill that hole and no will within Labor to slash services or reduce the size of the public service, Trad’s second Budget will be the one to watch.

Originally published as With no will to slash services Jackie Trad’s second Budget will be the one to watch