Talking Point: Why land tax is crushing Tasmanians’ aspirations

With land tax spikes of up to 273 per cent, it’s time to reconsider the model – especially when the state government was warned about staggering anticipated increases, writes Brian Wightman.

Tasmania

Don't miss out on the headlines from Tasmania. Followed categories will be added to My News.

THERE has never been a more important time for Tasmanians to be aspirational. From education to home ownership and small business survival, we must strive to encourage investment in the most important elements of our future.

Being aspirational has a different connotation for many Tasmanians when compared with mainland Australia.

Perhaps it is relative value for money or the want to do better to prove others wrong or the desire to strive to improve the life chances for our children.

Whatever it is and wherever it comes from, it is important.

In recent times, Tasmania has found an economic sweet spot.

Positive population growth for the first time in a decade led to our state reaching the top of the pops on CommSec State of the States ratings and we remain there at the end of October.

Supporting improved economic conditions, an investment culture continues in Tasmania in shacks and rental properties where families have shared ownership for generations.

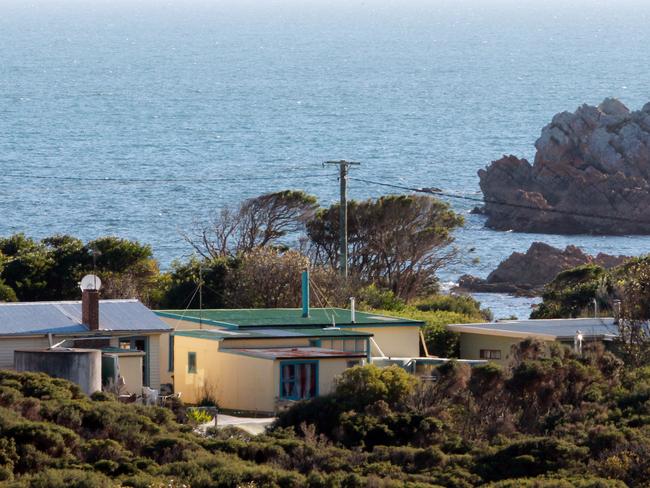

Shack culture across Tasmania defines communities.

The desire to relax and unwind through interacting with family and friends is a rite of passage for many, with financial and social investment in the regions benefiting from this way of life.

And although many of these properties have been updated and renovated, this has often happened over several years as capital and significant elbow grease became available.

From a real estate perspective, Coles Bay is not Byron Bay, Bridport is not Bondi Beach, and Swansea is not the Sunshine Coast.

And, with value for money squarely residing in Tasmania, there remains opportunity for hard workers to enter the market.

However, shack and investment property owners across Tasmania continue to pay land tax based upon a cyclical revaluation by the Valuer-General that occurs every six years.

The State Revenue Office website states: “Land tax is an annual tax payable by the owner of land as at 1 July each year. Properties that are taxable include vacant land, commercial properties, rental properties and shacks.

“Land tax is not payable on a property which is the owner’s principal place of residence or the land classified as primary production land.”

Due to the extended period between revaluations and the subsequent setting of land tax, an adjustment factor is employed to smooth out bumps which appear on bills as significant price hikes.

The Property Council of Australia has held major concerns about this issue since 2019 and raised these with the Tasmanian government on several occasions.

In February last year, we met with the Treasurer to discuss the looming economic and political problem because of revaluations and the apportioning of land tax.

It had come to our attention that, most unfortunately, the Valuer General had employed the adjustment factor to increase land valuations across Tasmania.

This was a year before the coronavirus reached Tasmania, complicating matters even further.

The Property Council then followed with correspondence during April and June 2020 regarding the need to suspend any revaluation project currently under way or planned in the foreseeable future across the local government sector.

As we predicted, in Hobart for example, the factor rose from 1.25 to 1.5 as of July 1 2020.

The Tasmanian Division considers this illogical, and a significant risk to business and property owners.

For a typical Tasmanian shack community like Orford, land tax has risen by a staggering 273 per cent since the 2016-2017 financial year.

We strongly believe that the recently gazetted Land Tax Adjustment Factors must be reset to 1.0 across all local government jurisdictions until revaluations can be updated with relevant and current data.

Obviously there has been a material change to the ability of property owners to pay, and to the concessions required of property owners, since the Valuer General’s determination of February 28.

It is convenient for the Treasurer and Premier and Finance Minister to make the point that property prices have risen due to improved economic times.

However, we are experiencing a recession to an extent not witnessed since World War II. Furthermore, and as he is well aware, value is locked in properties that have often been in families for generations who, with no intention to sell, are left with huge increases to land tax bills as a result of remaining aspirational.

The Tasmanian Division of the Property Council of Australia made the government aware of the challenges of revaluation and staggering anticipated increases in land tax some 21 months ago.

It is disappointing they did not heed our concerns.

Brian Wightman is the Property Council of Australia’s Tasmanian executive director.

Originally published as Talking Point: Why land tax is crushing Tasmanians’ aspirations