Real estate agent reveals group causing house prices to soar

A new report has confirmed a very grim reality about housing in Australia. Now, a property agent has revealed who is to blame.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Housing in Australia is more unaffordable than ever, and according to one Sydney real estate agent, a key group is to blame.

According to Proptrack’s affordability report, released today, housing affordability is at a record low in 2024. Rising interest rates and home prices have made homeownership more unattainable, with prices increasing 6.6 per cent over the past year.

The report also found it takes an average of five years to save for a house deposit, and of all the homes sold over the past year, a median-income renting household could only afford to buy 11 per cent of them.

Sydney real estate agent Amir Jahan said prices keep rising because of “emotional” first-time home buyers with rich parents who are prepared to overpay to keep their adult children happy.

Mr Jahan said it isn’t uncommon for him to sell a home to a young couple willing to pay more than market value for the home they want.

“They are emotional buyers. Young people who have help from rich parents will say, ‘I love this property,’ and their parents will help them get it,” he told news.com.au.

Young people backed by Boomer money will do things like pay $1.5 million for a home that would have otherwise sold for $1.3 million, dragging prices up.

Mr Jahan said when properties sold for over market value, it always came down to “buyers emotionally falling in love with the property.”

Those buyers are usually from generational wealth and in a position to spend more.

The 28-year-old agent said this has a kick-on effect and he often dealt with “unreasonable and uneducated sellers.”

He will give a seller feedback on market value and what similar properties have sold for in the same suburb or even the same street, and they’ll still demand a higher price.

He said sellers will come up with a figure out of thin air — like $1.5 million — and let their property sit on the market until someone fell in love with it.

Mr Jahan explained that he typically saw three types of buyers: bargain buyers who looked at properties they couldn’t afford and offer low-ball offers; logical buyers who understood the market and made reasonable offers; and the emotional buyers who spent based on what they loved.

He said emotional buyers “100 per cent” push the market up because they are prepared to pay more, and most people are now used to inflated prices.

“It has become normal. Four years ago, in Parramatta, when we told people a two-bedroom unit was selling for $500,000, people would freak out; now we tell them that same apartment is $650,000, and they are surprised it isn’t more.”

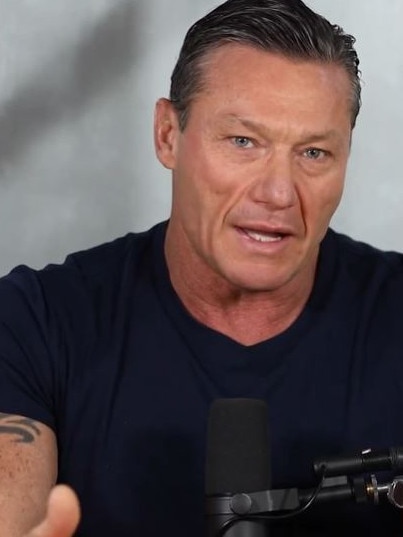

Real estate agent Mat Steinwede paints a similar picture. He said the hottest part of the market right now is entry-priced.

“The lower end of the market is as hot as it can be,” he told news.com.au.

Mr Steinwede said young people are now entering the market because everyone sees “reasonable value”.

The seasoned agent advised hopeful buyers to ender the market as soon as they could afford it. He said they shouldn’t wait, hoping prices will go down, because you “might miss it” entirely if rising prices continued.

Mr Steinwede agrees the bank of mum and dad is the new normal for young people getting into the market — a method that helped his 25-year-old son Jaxson buy a place.

“I’ve just helped him buy his first home. He wouldn’t have been able to do it alone, not with how much you need for a deposit plus stamp duty. It has become too difficult,” he told news.com.au.

Mr Steinwede is sharing the home loan with Jaxson, who is responsible for half of the repayments. The agent said he understood that with soaring house prices, saving for a first home can be “demotivating”.

He said his son would save $10,000 and find it hard to keep focused because saving for a deposit felt so out of reach.

Ultimately, Mr Steinwede decided to help his son buy a home because he knew how tough it was without help, which he was able to offer. He hopes his son will learn critical financial lessons.

“It is a good lesson for him. If you buy a car, it goes down in value, and you’re paying interest and repayments, but if you buy a property in 10 years, it might double,” he explained.

Mr Steinwede said Generation Z is used to getting everything instantly, but now that Jaxson is paying a mortgage, he is beginning to see how working towards something makes a big difference.

“Every time he makes a mortgage payment, it is the same as him putting $400 in the bank. He’ll waste his money otherwise,” he said.

“He’ll look back and be glad he did it.”

Originally published as Real estate agent reveals group causing house prices to soar