Peter Dutton’s ‘highly unusual’ GFC share-trading in Labor’s sights

The opposition leader’s personal trades during the global financial crisis have raised eyebrows after he bought lucrative bank shares at rock-bottom prices.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

EXCLUSIVE

Peter Dutton’s share-trading during crucial junctures of the global financial crisis is in Labor’s sights, prompting demands that he reveal whether he knew “sensitive information” before buying up shares in the big banks.

As the Prime Minister prepares to call an election, a forensic analysis of Mr Dutton’s declarations to parliament reveals he notified parliament of a share-buying blitz involving the big banks the day before Labor announced a bailout in 2009.

But Mr Dutton has slammed the claims as muckraking accusing Labor’s “dirt unit” of trawling his financial records to create controversy.

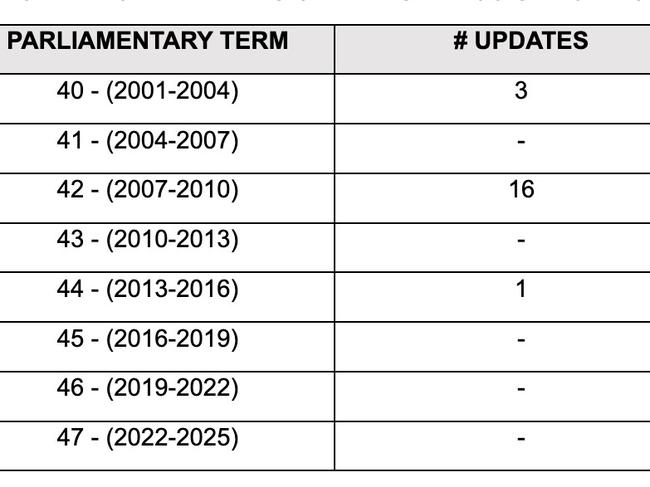

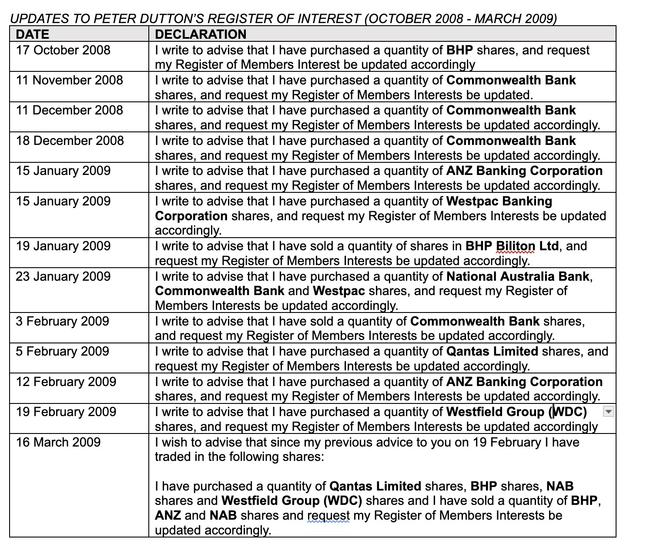

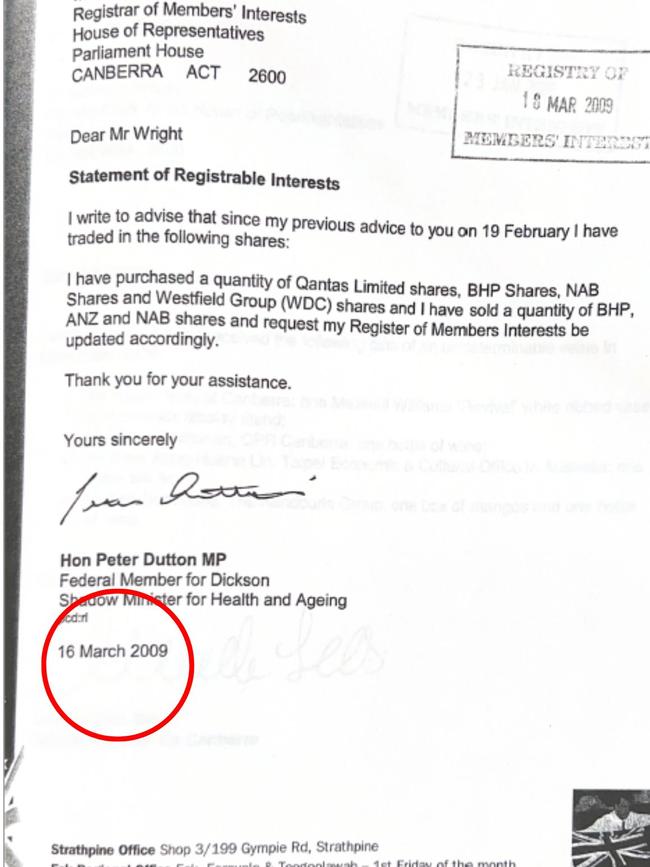

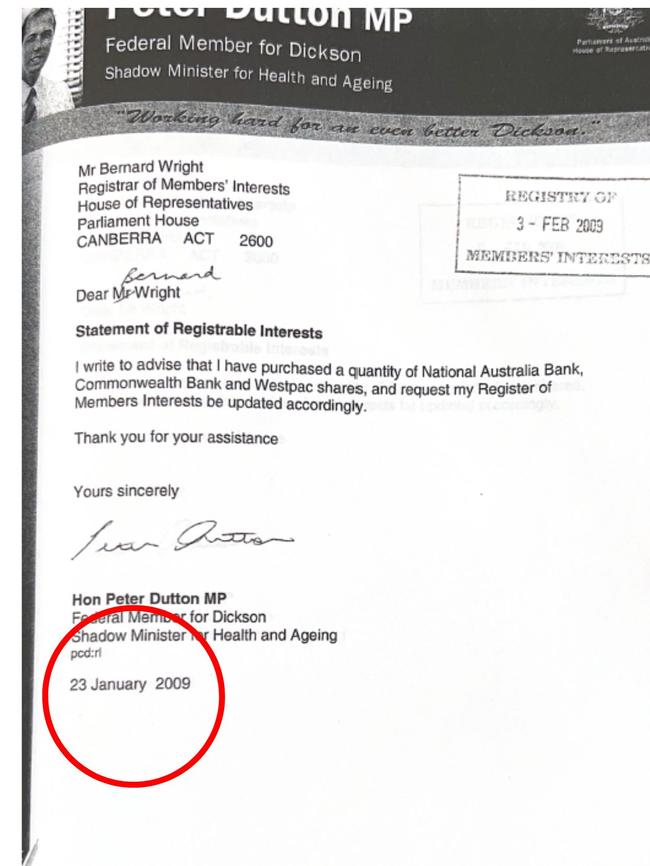

Between October 2008 and March 2009, Dutton updated his register of interest 13 times to indicate that he had either bought or sold shares.

News.com.au has confirmed he had not previously bought or sold any shares for the previous three years, according to his parliamentary records.

Timelines under the microscope

The Labor Party asserts that some of the share-trading buy-ups occurred shortly before the Rudd-Gillard Government announced big bailouts for the banks, spiking share prices.

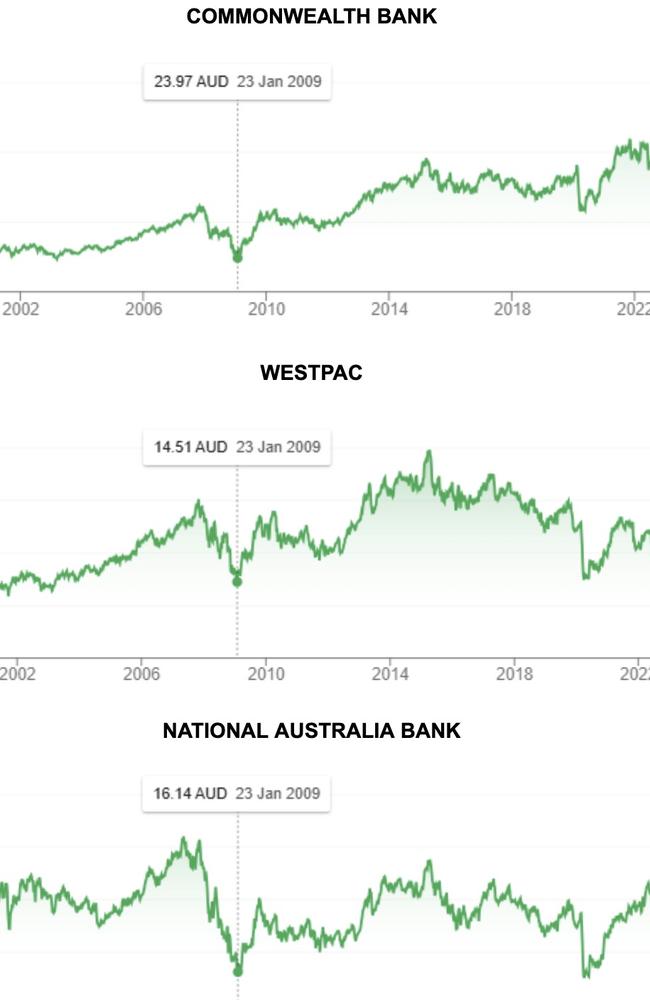

On January 23, 2009 Dutton declared that he had bought Commonwealth Bank, National Australia Bank and Westpac shares.

On that date, all three companies experienced record-low share prices.

On Saturday, January 24 2009, the Rudd Government announced the Australian Business Investment Partnership, a $4 billion in stimulus package to the commercial property market to be delivered in partnership with Australia’s major banks.

The ABIP never went ahead as it was opposed by the Coalition, but the announcement made waves at the time.

Following this announcement, Commonwealth Bank shares rose from $23.94 at the close of trading on January 23 to a high of $29.11 on the day Dutton declared that he had sold Commonwealth Bank shares – a 21.6 per cent rise in twelve days.

It’s not known if Mr Dutton bought the shares on January 23 or the day or prior but he did update his register multiple times during this period with individual share purchases. Under the rules, he must update the register within 30 days.

As a result, the Albanese Government wants the Liberal leader to reveal if he was briefed on the government’s plan through his role on the Coalition front bench at the time or via third parties.

While Mr Dutton was in opposition at the time, the Labor Government was regularly briefing the opposition leader Malcolm Turnbull on major stimulus packages, prompting Labor questions about what he knew when he bought the shares.

In the declarations, Mr Dutton does not detail the value or volume of shares bought and sold and is only required to reveal he bought shares within 30 days of purchase.

Labor says Peter Dutton has questions to answer

“Peter Dutton has questions to answer about his highly unusual share trading during the GFC,’’ Employment Minister Murray Watt said.

“Why did he make these trades at critical times the government was protecting Australian banks?

“Did he have access to sensitive information not available to the Australian public?

“Mr Dutton must reveal all records including the dates and times he made these share purchases and whether he received briefings or sensitive information on banking support.

“When the Australian people were going through incredible uncertainty and anxiety, Peter Dutton was playing the stock market.

“When the then Labor Government was working night and day to keep the Australian economy afloat and Australians in jobs, Peter Dutton was busy trading his share portfolio.”

Mr Dutton ultimately sold the shares in February, 2009, just weeks after buying them.

His declaration reveals that he sold Commonwealth Bank shares on February 3 2009.

This coincides with the Rudd Government’s announcement of the $42 billion Nation Building and Jobs Plan, the largest stimulus package of the crisis.

Peter Dutton slams Mr Albanese’s ‘dirt unit’

News.com.au approached Mr Dutton’s office on Thursday detailing all the share trade declarations and the questions that arose regarding their proximity to big government announcements.

Four days later, Mr Dutton’s office provided a two sentence response, accusing the Labor Party of muckraking.

“If the Albanese Government’s dirt unit spent more time being focused on fixing Labor’s cost of living crisis rather than obsessing about Peter Dutton, Australians might be better off,’’ a spokesman said.

“All updates to Mr Dutton’s register of interests were made at the appropriate time.”

At the time of the GFC, Mr Dutton had been Assistant Treasurer as recently as December 2007 and at the time of Lehman’s collapse was the Shadow Minister for Finance, Competition Policy and Deregulation.

Mr Dutton was appointed Shadow Minister for Health and Aging in September 2008 and remained a Shadow Cabinet member during the period that these trades occurred.

The declarations to parliament do not give specific times that these transactions occurred or the value of the shares traded.

Why January 23, 2009 was a big day

While the timeliness of Mr Dutton’s declaration to parliament is not in question, what Labor wants to know is whether or not Mr Dutton was aware when he bought the shares that the government planned to make billion-dollar investments that would increase the value of the shares.

For example, on January 23 2009 Dutton declared that he had bought Commonwealth Bank, National Australia Bank and Westpac shares.

That date was an extraordinary day as all three companies experienced record low share prices.

Then, on Saturday, January 24 2009, the Rudd Government announced the Australian Business Investment Partnership, a $4 billion in stimulus package to the commercial property market, to be delivered in partnership with Australia’s major banks.

Following this announcement, Commonwealth Bank shares rose from $23.94 at the close of trading on January 23 to a high of $29.11 on the day Dutton declared that he had sold Commonwealth Bank shares – a 21.6 per cent rise in twelve days.

Malcolm Turnbull was briefed on the stimulus package

In an interview with Alan Jones on February 6 2009, then-Opposition Leader Malcolm Turnbull claimed that the Opposition was given a Treasury briefing on the stimulus package at 12pm on February 3 2009, two and a half hours before Rudd announced it in the House of Representatives.

“Well we were given it at 12 noon, we got a fairly cursory briefing from the Treasury and then the Government were saying; ‘you must agree to it right now,’’ Mr Turnbull said.

Mr Turnbull also referred to the briefing in parliament. It is not known who attended the briefing and it is not suggested that Mr Dutton was present given he no longer held the finance portfolio.

“It is an insult to this parliament and to the Australian people to have the Prime Minister present the opposition with a $42 billion spending package that takes the budget for this very year from a $22 billion surplus into a $22 billion deficit in nine months,’’ he said.

“This program of so much spending, of such great scale, moment and importance was presented to us at 12 o’clock with a briefing where basic questions could not be answered by some of the officials present. Those officials said, ‘We will get back to you’ — and that is good; I have no doubt that they will.”

Mr Dutton ultimately sold most of the shares, although he held onto shares in ANZ, BHP and Qantas until December 2012.

Originally published as Peter Dutton’s ‘highly unusual’ GFC share-trading in Labor’s sights

Read related topics:Peter Dutton