Members Alliance liquidator ‘aided and abetted’ phoenixing, ASIC alleges

The Gold Coast liquidator of the collapsed Members Alliance building company is accused of engaging in illegal phoenixing.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Exclusive: The liquidator of controversial Gold Coast building company Members Alliance has been accused of helping the company commit illegal phoenixing after it collapsed owing millions.

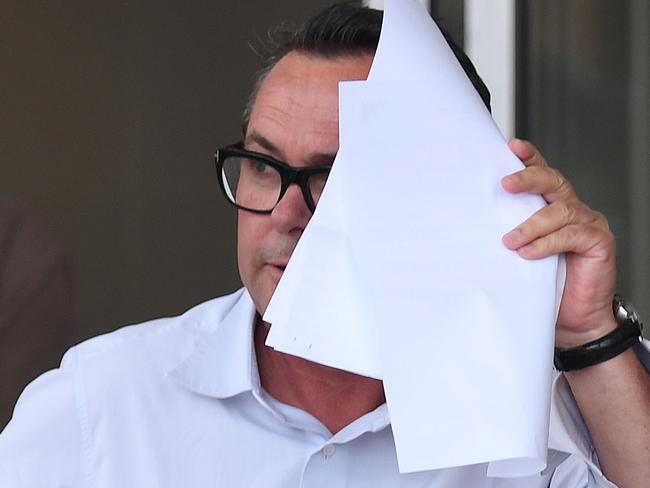

The Australian Securities and Investments Commission (ASIC) filed an application in the Federal Court earlier this month in a bid to launch an inquiry into Jason Walter Bettles.

Mr Bettles, of Worrells Solvency and Accounting on the Gold Coast, served as the liquidator for 18 of Member Alliance’s companies from July 22, 2016 to July 13, 2017.

The Members Alliance Group allegedly sold fraudulent house and land packages through cold-calling and collapsed in 2016 owing more than $40 million.

Directors Richard Marlborough, David Domingo and Colin Macvicar were charged last year with the fraud offence “dishonestly causing a financial detriment to persons investing in properties”, and were described by police as “company directors” of Members Alliance.

They will next appear in Brisbane Magistrates Court on December 9 for a mention of their cases.

Court documents viewed by News Corp reveal the allegations against Mr Bettles, including that he “aided and abetted” the controllers of Members Alliance in engaging in illegal phoenixing activity.

ASIC alleges that in July 2016, Mr Bettles was in meetings with Mr Marlborough, Members Alliance Group accountants and representatives of its lawyers when the strategy was devised.

According to the documents, the strategy was “executed in quick succession” and involved, among other things, a new group of companies called the Benchmark Group taking over the income stream of Members Alliance, which occurred about 25 July 2016.

This happened just days after 14 companies in the Members Alliance Group were placed into voluntary liquidation and a further four into voluntary administration.

Mr Marlborough’s son, Braiden, and the Marlborough family held a 95 per cent beneficial ownership in the new group.

One of the new group’s companies, Benchmark Private Wealth, employed 33 staff who had previously worked within the Members Alliance Group.

Braiden – who held senior roles in his father’s business – continued to live a lavish life after Members Alliance went under.

In 2017 at his wedding to Maighan Brown, the pair’s Shih tzu Bobby was driven by Mercedes into the ceremony in a remote-controlled SUV.

MORE NEWS:

Members Alliance founder’s new love

Members Alliance founder splits from wife

On bail in mansion, driving $640k Rolls Royce

Earlier this year, Marlborough Jr pleaded guilty to a charge of making “false or misleading statements” to Queensland’s Crime and Corruption Commission during its investigation into Members Alliance and was fined about $6000.

He has not been charged with any other offences.

His father also led an enviable lifestyle with a suite of luxury cars including a Rolls Royce Ghost, Bentley and Mercedes, and a mansion at the Hope Island Resort on the Gold Coast.

ASIC is seeking Mr Bettles’ liquidator registration be cancelled and that he be prohibited from reapplying for registration and acting as a liquidator for a period of time.

It’s alleged Mr Bettles was not only aware of the illegal phoenixing activity, but was “in a position to influence whether or not the illegal phoenix activity occurred”.

ASIC also claim he “prepared or, knew of, management deeds between various entities in the MA Group which redirected income streams, making those funds unavailable to creditors”.

A hearing date has been set for Mr Bettles in Brisbane on December 13.

Mr Bettles declined to comment on the allegations and referred News Corp to a statement made by Worrells.

In the statement, Worrells’ managing partner Raj Khatri said: “Given the passage of time, we’re naturally disappointed that this unexpected application has been made by the regulator.

“Jason continues to have the firm’s full support.”

“His practice and leadership within the firm remain unaffected and we’re ready and willing to assist him address ASIC’s concerns in the Federal Court setting.”

Originally published as Members Alliance liquidator ‘aided and abetted’ phoenixing, ASIC alleges