Changing tax policy can be political suicide but it must be done, argues David Koch

Tax reform is political suicide, but it is shaping up to be a key deciding factor of this election, with Labor proposing a series of changes that the country needs, argues David Koch.

Federal Election

Don't miss out on the headlines from Federal Election. Followed categories will be added to My News.

Everyone agrees Australia needs tax reform. Over the years there has been a string of government inquiries recommending a range of options. But nothing happens.

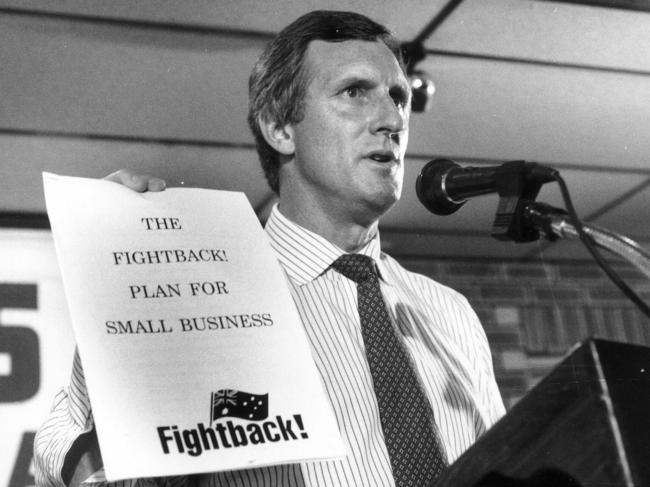

Why? Because tax reform is political suicide. Just ask John Hewson who lost an unlosable election in 1993 on his plans to introduce a GST … which was eventually introduced by the Howard Government in 2000.

Now Bill Shorten and the ALP is throwing the tax reform dice again: franking credits, negative gearing and capital gains tax.

MORE: What the tax changes will mean for you

EARLIER: Get behind the spin of Labor’s tax reforms

EARLIER: Stocks to watch as federal election draws near

All three were introduced for sound economic and financial reasons. But all three are now being rorted which is costing all of us taxpayers billions of dollars a year.

Don’t get me wrong, they shouldn’t be abolished. But the rules need to be tightened so they get back to their original purpose.

Take negative gearing as an example.

Negative gearing was introduced to assist investors to get over those early financial hurdles on their way to earning a positive return on which they’d pay tax. It was designed to encourage investors to supply rental properties for those who couldn’t afford to buy.

Negative gearing is where you borrow money to invest and the income from the investment is less than the expenses. For example, where rental income is less than loan interest and other expenses. Essentially this means you are making a cash loss which can be claimed against other taxable income to lower your overall tax rate and payments.

Over the years there has been a big trend of investors (on high marginal tax rates) constantly refinancing their investment properties to be permanently negatively geared and claim the tax concession. The property never becomes positively geared or makes a profit. It’s permanently a tax lurk, costing the country an estimated $4.5 billion a year.

Under the proposed ALP changes all existing negatively geared investments will be quarantined and continue under the existing rule.

But it will limit all future negative gearing to new housing and not existing property.

Under the proposed policy taxpayers will still be able to deduct net rental losses from salary and wage income, provided the losses come from ‘newly constructed’ housing.

Losses from negative gearing other investments (like shares) will not be allowed to be claimed against salary and wage income but can be claimed against other positively geared assets and carried forward.

Bottom line is existing investments won’t be affected - just new investments affected.

The rorts in negative gearing have to be stopped. The proposed Labor policy is one way, or you couple put a limit on the number of investments where negative gearing could be claimed

Limiting future property negative gearing to new housing will encourage new developments but logically see investors reassess existing properties which could reduce demand and accentuate the current property downturn.

Having said that, positively geared property can be a good investment in its own right.

Originally published as Changing tax policy can be political suicide but it must be done, argues David Koch