Prime Minister Malcolm Turnbull promises Federal Budget will ease cost of living

TREASURER Scott Morrison is set to announce an early return to surplus at tomorrow’s budget with reports the bottom line could be back into the black by billions within two years.

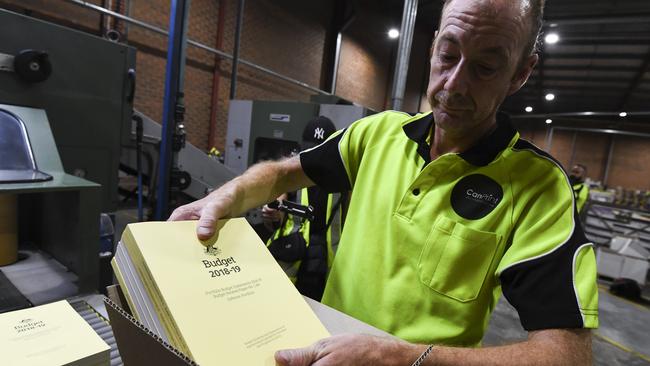

Federal Budget

Don't miss out on the headlines from Federal Budget. Followed categories will be added to My News.

TREASURER Scott Morrison is set to announce an early return to surplus at tomorrow’s budget with reports the bottom line could be back into the black by least $5 billion within two years.

Reports of the early return to surplus come as Prime Minister Malcolm Turnbull and Treasurer Scott Morrison preview their “responsible” budget, which will be handed down tomorrow at 7.30pm in Parliament House.

Despite the government announcing a $24 billion cash splash on infrastructure and flagging personal income tax cuts targeted at low and middle income earners, it’s expected higher than anticipated revenue will allow the Treasurer to announce an early return to surplus by 2019-20.

Sky News reports the surplus for 2019-20 will be at least $5 billion and could be as high as $7 billion.

Last year’s budget forecast a $2.6 billion deficit for 2019-20 and a return to surplus by 2020-21.

The mid-year budget update in December contained a hint that revenue collections had been higher. It showed a higher expected surplus for 2020-21 of $10.2 billion, up from the smaller $7.4 billion surplus forecast last May.

MORE: What to expect in the Budget

REVEALED: Why women will be the Budget’s big winners

Earlier Prime Minister promised the federal budget will help Australians with the rising cost of living while guaranteeing the funding of essential services.

Personal tax cuts for low and middle-income earners are expected to be a feature of Treasurer Morrison’s third budget tomorrow, although the cuts could be as little as $5 a week.

It’s expected the government will also announce the budget bottom line will return to surplus a year early in 2019-20.

“We are doing everything we can to ease the burden of cost of living pressures on Australian families,” Mr Turnbull told reporters in Sydney today.

“That is why we have got, you will see tomorrow, important measures relating to tax and you will see important measures relating to energy.”

RELATED: Why ScoMo should leave super alone

The prime minister was announcing Sydney’s portion of a $24 billion national road and rail infrastructure package that will also be a cornerstone of the budget.

The promise of personal income tax cuts has been flagged for months in what could be the final budget before the next federal election.

Mr Morrison conceded yesterday the tax cuts wouldn’t be “mammoth”.

He indicated they could be worth as little as $5 a week, similar to a Howard era cut criticised as being “a sandwich and a milkshake if you are lucky”, but that they would be “responsible” and affordable for the government.

“It’s been a long time since there has been some real relief in this area,” Mr Morrison told the Nine Network in his pre-budget interview yesterday.

“And, if they were to make that (sandwich and milkshake) observation then it would be very hard to say that the government is being irresponsible at the same time,” he said.

“You can’t have it both ways.”

Finance Minister Mathias Cormann confirmed low-and-middle-income earners would be prioritised for the tax cuts after The Australianreported tax cuts for higher income brackets would come into effect by 2024.

The publication reported tax relief would come through increasing the low-income tax offset.

At present workers with a taxable income less than $66,667 get this offset.

The maximum tax offset of $445 applies to incomes of $37,000 or less and this amount is reduced by 1.5 cents for each dollar over $37,000.

Minister Cormann has also defended the coalition’s decision to lock in a cap on the amount of tax revenue collected by the government.

The 23.9 per cent tax-to-gross domestic product limit will be written into the rules for the budget.

Senator Cormann said the “speed-limit” on the public tax burden, above which revenue is returned through tax cuts, would keep the economy strong.

But public policy think-tank The Australia Institute describes the cap as “entirely arbitrary”.

“There is no objective reason why the government should set this cap. The objective of fiscal policy should be whatever is appropriate for the state of the economy,” institute executive director Ben Oquist said.

Shadow assistant treasurer Andrew Leigh questioned what is looking like a big spending budget based on a company tax revenue windfall.

“You shouldn’t make permanent decisions based on temporary changes in revenue,” Dr Leigh told Sky News.

“This was one of the real problems of the Howard government, that they locked in unsustainable long-term budget decisions based on the first wave of the mining boom.”

Originally published as Prime Minister Malcolm Turnbull promises Federal Budget will ease cost of living