Mick Gatto associate Fedele D’Amico claims tip deal rip-off

EXCLUSIVE: AN associate of Mick Gatto claims he has been ripped off in a multi-million-dollar deal to buy a tip with an accused money launderer.

Law & Order

Don't miss out on the headlines from Law & Order. Followed categories will be added to My News.

AN associate of Mick Gatto claims he has been ripped off in a multi-million-dollar deal to buy a tip with an accused money launderer.

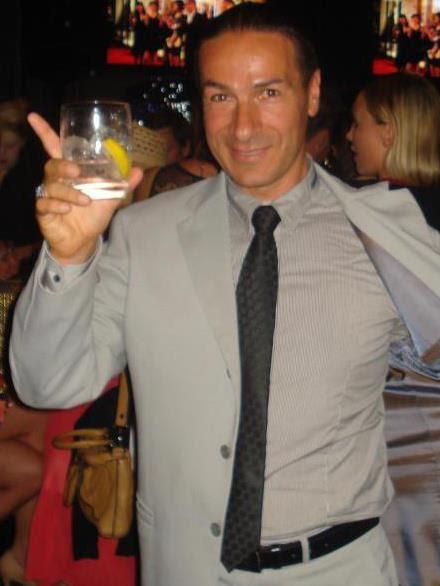

Accused drug syndicate kingpin and failed businessman Fedele “Freddy the Bear” D’Amico, 50, has lodged a writ in the Supreme Court claiming four associates, including loan shark Tom Karas, have refused to hand over his share of the $5.5 million Bulla tip and quarry business.

In February, Mr D’Amico says he and Frank Furia, his brother-in-law and Mick Gatto’s nephew, met with Mr Karas and Vaslios “Bill” Saris, at Brunetti’s cafe in Carlton.

At that meeting Mr D’Amico claims he was told that he would not be receiving his 20 per cent share of the tip.

Mr D’Amico claims he struck a deal with Mr Karas, Mr Saris, Apostolis “Paul” Tsotsovis and Constaninos “Con” Kalaboukas last year to buy Bulla Quarry Development, which owns the land, and the BTQ Group, which operates the tip, a recycling facility and a mineral quarry.

The deal is allegedly detailed in emails and was struck in discussions at the tip site, the Lincoln Hotel in Essendon, and the Latrobe St office of Mr Karas’s State Securities.

MORE:

PAUL HAIGH: VICTORIA’S WORST SERIAL KILLER WANTS TAROT CARDS IN JAIL TO READ FUTURE

DEAD MOUSE IN SPONGEBOB BISCUIT PACKET FROM REJECT SHOP

Purana Taskforce detectives accused Mr Karas of laundering money for drug boss Horty Mokbel. He also has close business ties with the self-styled biochemist at the centre of the Essendon supplements saga, Shane Charter.

In 2015 he was bankrupted after being hit with a $64 million tax bill, including $43 million in interest and penalties accrued while fighting claims his wealth was built on the proceeds of crime.

According to Mr D’Amico’s statement of claim it was agreed Mr Saris would pay a $500,000 deposit for the $5.5 million purchase; Messrs Saris, Tsotsovis, Kalaboukas and Karas would then each contribute $800,000, which, along with a $1.8 million loan, would be used to pay the purchase price of all the issued shares in the companies.

Mr D’Amico claims each of the partners were to receive 20 per cent of the shares.

Under the alleged deal Mr D’Amico claims he was to conduct a due diligence of the companies, be appointed chief operations officer and advance a loan of $800,000 to the companies for three years at a 10 per cent interest rate, and, if required, purchase them.

He claims he engaged accountants at his own expense to audit the books, was trained on the tip’s operations, applied for finance, helped with the sale and negotiated with the Environment Protection Authority and prospective customers.

Mr D’Amico alleges when the sale proceeded early this year Mr Tsotsovis was appointed a director of the companies and arranged the transfer of shares.

Despite his demands, Mr D’Amico claims he did not receive his cut. He says he remains willing and able to carry out his end of the deal and has asked the court to acknowledge his entitlement and order his four alleged partners to transfer to him 20 per cent of the shares.