Australian Federal Budget 2020: Stimulus to pull nation from COVID recession

More than 11 million Australians will be handed thousands of dollars in tax cuts and millions of businesses asked to buy up big and hire more employees in bid to drag Australia out of its COVID recession. WAS THE BUDGET RIGHT FOR YOU?

- Budget 5-minute guide: What’s in it for you

- Winners and losers: Did you come out in front?

- Analysis: A true budget for every Australian

More than 11 million Australians will be handed thousands of dollars in tax cuts and millions of businesses asked to buy up big and hire more employees in a bid to drag Australia out of its COVID recession.

The most important federal budget since WWII will see the government take a bill to parliament today to put $2000 in tax relief in the bank accounts of seven million Australians.

Extraordinary tax incentives for businesses will place the private sector – and more than one million NSW businesses – at the centre of our economic recovery with a suite of measures, including unlimited instant asset write off and radical loss carry back, to drive hiring and spending.

The cash-splash budget will blow the budget deficit out to $213.7bn this year, all in the aim of resuscitating the moribund pandemic-hit economy.

Combined, the government estimates the measures to cut income tax and encourage business investment will generate 100,000 jobs by 2021-22.

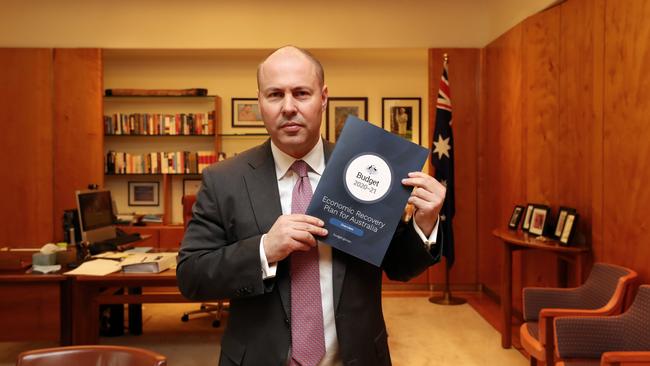

“Australians will have more of their own money to spend on what matters to them, generating billions of dollars of economic activity” Treasurer Josh Frydenberg said.

“We have a plan to rebuild our economy and to create jobs … we will do this by growing the economy, not increasing taxes.”

Crucially, the budget is based on the assumption Australia has access to a vaccine by the end of 2021, that almost all state borders are reopened by 2020 and there is no further Victorian-style second wave.

For this reason, its success rests on rosy forecasts: it expects the economy to grow by 4.5 per cent next calendar year and unemployment to fall 6 per cent by June 2022.

The cost of saving the economy doesn’t come cheap – after hitting $213.7bn this year the budget deficit will still be $66.9bn by 2023-24.

In other eye-watering forecasts gross debt will grow to $872bn – 45 per cent of GDP, while net debt will hit $703bn or 36 per cent of GDP this year.

But Treasurer Frydenberg asks for perspective – he points out Australia’s net debt as a share of the economy is half that of the UK, a third that of the US and a quarter the size of Japan’s today.

Opposition leader Anthony Albanese criticised the Budget on Wednesday morning, saying there is “no comprehensive plan” and “nothing in terms of reform.”

“They’ve set up a whole lot of pots in this budget that are up to ministerial dissection and we are concerned about that,” he said.

The budget is underpinned by an overarching strategy of high spending with a defined end point – once recovery has taken hold and unemployment is on a path back below 6 per cent, Australia will move to a “second phase” of stabilising debt.

“We will then rebuild our fiscal buffers so that we can be prepared for the next economic shock,” Mr Frydenberg said.

Bringing forward stage two of the tax cuts hands seven million Australians tax relief of $2000 or more compared to 2017-18, with low and middle income singles to get relief of up to $2745 and families $5490.

The benefits of the tax changes are skewed to those on lower incomes, with those on $40,000 paying 21 per cent less tax and those on $80,000 paying 11 per cent less.

For the job-generating private sector an expanded instant asset write off will allow 99 per cent of businesses to write off the full value of any asset purchases, with no limit on the amount that can be spent. Businesses with a turnover of $5bn will be able to immediately deduct the full cost of eligible depreciable assets from 7.30pm last night.

In another “game changer” initiative companies with a turnover up to $5bn will be able to offset tax losses against previous profits on which tax has been paid.

The government expects this will boost cash flow for businesses desperately in need — it means losses incurred to June 2022 can be offset against profits made in or after the 2018-19 tax year.

Small businesses tax concessions will also be expanded so more businesses can access them.

At the individual level, 5.1 million Australians on lower incomes will benefit from two separate $250 economic support payments at a cost of $2.6bn from December.

They will go to age pensioners, disability support pensioners, eligible veterans, concession cardholders and other social security recipients.

Mr Frydenberg lays out a $1.5bn vision for manufacturing which puts Australia-made at the heart of our future, locking in a globally competitive and resilient manufacturing sector.

A massive infrastructure program will support 100,000 jobs on worksites across the country, boosting the 10 year pipeline to $110bn.

Crucially, the state based allocations come with a massive use it or lose it caveat – if any state drags its feet with spending the cash, another state gets the money.

Mr Frydenberg repeatedly stated the budget was “all about jobs”.

“We owe it to the next generation to ensure a strong economy so that their lives are filled with the same opportunities and possibilities we have enjoyed,” he said.

“There is no economic recovery without a jobs recovery. There is no budget recovery without a jobs recovery.”

On Wednesday morning, while spruiking the Budget live on Channel 9, Mr Frydenberg was heckled by a protester wearing a white jumpsuit and carrying a sign which read, “tell the truth.”

“This place is never lacking action. I can tell you that,” the Treasurer responded.

The protester was escorted away from the TV set on the front lawn of Parliament House.

Originally published as Australian Federal Budget 2020: Stimulus to pull nation from COVID recession