Federal Budget 2018: Treasurer Scott Morrison’s cutting edge tax reform ushers in surplus

SCOTT Morrison has promised to finally bring the federal Budget back into surplus for the first time in a decade while unveiling a radical seven-year plan to hand out $140 billion in tax cuts, starting with up to $1060 in cash bonuses for five million families.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

TREASURER Scott Morrison has unveiled a radical plan to reform Australia’s income tax scales by abolishing the entire 37 cent tax bracket to put more money in the pockets of millions of workers.

But the catch is Australians will have to wait seven years to get the full benefits of lower taxes, with the proposal not kicking in until 2024-25, at least two elections away.

To head off attacks his tax package will never be delivered Mr Morrison plans to enshrine it in legislation this week — raising parallels with the infamous “L.A.W.” tax cuts by former Labor prime minister Paul Keating 25 years ago.

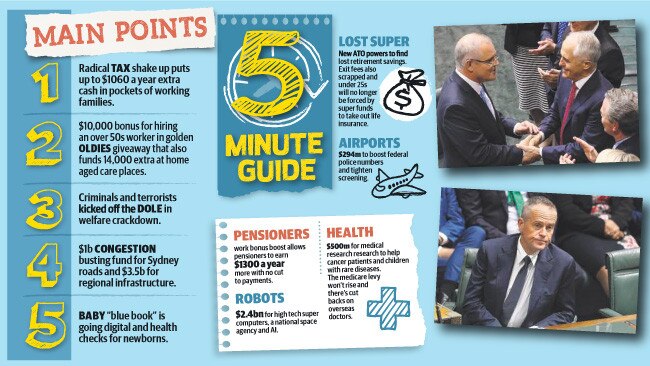

► The Federal Budget explained in five minutes

► Inside the 2018 Federal Budget lock up with Miranda Live

► Sharri Markson: Budget’s a blow to Shorten’s end game

► ScoMo brings tax relief for five million families

The government’s comprehensive attack on bracket creep was Mr Morrison’s surprise rabbit out of the hat in his third Budget which promised a delayed start to reducing Australia’s massive government debt problem.

For the first time since the Howard-Costello era, the federal Budget is forecast to return to the black by a slim $2.2 billion in 2019-20 — a year earlier than expected — with the surplus building to $11 billion in 2020-21 and $16.6 billion the following year.

There will still be tax relief of up to $530 for more than 10 million lower and middle income earners next year but it will be delivered via the mechanism of an income tax offset.

“This is not a spending or a giveaway. We are simply enabling Australians to keep more of what they have earned,” the Treasurer said.

► ROLLING COVERAGE: Follow all the Budget reaction

► 2018 Federal Budget: Morrison promises household ‘relief’ with $10 tax cut

► Companies to be paid $10,000 to hire older Aussies

► Tim Blair: What was ScoMo really saying?

The Budget was also heavy with measures aimed at helping older Australians live longer, healthier and wealthier lives in their own homes.

There is a $10,000 wage subsidy to encourage employers to hire elderly workers and an expanded Pensions Loans Scheme to help retirees improve living standards.

► Treasurer Scott Morrison to announce a small surplus for 2019

► Victoria to get majority of new national infrastructure spending

► Federal Budget 2018: Everything you need to know

► Traffic ‘pinch points’ focus of $1bn congestion-busting fund

The government announced a crackdown on the black economy with new laws banning all cash payments of over $10,000.

And in a long-awaited move, about 18,000 criminals and terror suspects with outstanding arrest warrants will be banned from receiving taxpayer-funded welfare support payments.

The twin tax reform and debt goals have been set on the back of a $35 billion revenue windfall the Turnbull government is expecting over the next four years, of which $26 billion comes from extra tax. The government is spending $15 billion on tax cuts and banking $20 billion to the bottom line.

In total, five million households and 10 million Australians will get money back next year when they do their tax returns for the 2018-19 financial year, through tax offsets.

The reason for starting tax cuts next year, instead of in 2018, is the Government has prioritised returning the Budget to surplus.

Tax thresholds will be adjusted from July 1, 2018 when the third highest tax bracket of $87,000 will increase to $90,000 to stop 210,000 Australians from creeping into the next tax bracket where they would pay 37 per cent. Further adjustments will be made in later years.

But it’s in 2024 when Mr Morrison’s most radical changes kick in when Australia reverts to just three key brackets and only those on more than $200,000 pay 45 per cent.

Mr Morrison said next year’s tax cuts targeted at lower and middle income earners would pay for half a dozen tanks of petrol, two to three months of a train fare, a power bill for a quarter, car registration or new tyres on your car.

“(Tax relief) starts with those who need it most and then works through the system,” he said.

“This will be the best Budget outcome since the Howard government’s last Budget a decade ago.” For a dual income family, this could mean a tax cut of $1060 which they’ll get mid next year — after the federal election is held.

Five million families will benefit from the tax cuts which Mr Morrison has pledged will not be “clawed back by other taxes” — part of the reason why he scrapped increases to the Medicare levy. The cuts will cost $140 billion over the next 10 years.

Describing the Budget as a “turning point on debt” Mr Morrison said the government will now not need to lift the $600 billion debt ceiling, with debt peaking at 18.6 per cent of GDP — or just under $600 billion — this year and then expected to fall by $30 billion over the forward estimates. In 10 years time, the net debt will drop to just 3.8 per cent of GDP while gross debt will be $126 billion less than forecast just six months ago.

The deficit will be $18.2 billion for the 2017-18 financial year and is forecast to fall to $14.5 billion next year, before returning to surplus. The Treasurer said spending growth was the lowest of any government in 50 years — it was 1.6 per cent in real terms compared to 3.3 per cent under the Howard government and 4 per cent under Labor.

“As a government we have put constraints on how much we spend and how much we tax, to grow our economy and responsibility repair the budget,” he said. “It has been a long road back from where we started in 2013. We are close to our destination.”

Aside from tax reform, the federal Budget centred on empowering older Australians, with $2.2 billion in new healthcare and employment funding, taking the government’s total aged-care package to $5 billion. There is also an increase of 14,000 new home care places over the next four years, so that people are not forced to move into an aged care facility. Money has also been provided for mental health support services to combat loneliness and depression for those in residential aged care facilities.

The Budget also contains money for upgrading airport security at 64 regional airports and increasing police and border force officers at domestic and international airports.

The Budget includes new measures enabling the ATO to return lost superannuation to workers while exit fees will be scrapped on superannuation companies. Young workers will also no longer have to pay for life insurance through their super fund.

In a significant development for the cruise-ship industry, $300,000 has been put towards a study to identify sites for new cruise terminals, with Sydney’s Overseas Passenger Terminal at capacity.

The study will examine Botany Bay, despite major cruise companies pushing for shared use of Garden Island.

There will be several moves to try to collect taxes from digital businesses based overseas that are run in Australia.

► Federal Budget: your 5-minute guide

► Federal Budget 2018: All the winners ... and losers

Offshore-based hotel accommodation websites will now have a GST exemption scrapped to level the playing field in a move that will bring in an estimated $15 million over the next four years.

Mr Morrison said he will release a discussion paper on ways to tax other digital businesses in Australia, “to bring the digital global economy into the tax net”.

He also revealed an Urban Congestion Fund would be set up, with $1 billion in funding, to help improve traffic flow in the congested cities of Sydney and Melbourne. The fund followed an injection of $75 billion into new infrastructure projects across the country.

Originally published as Federal Budget 2018: Treasurer Scott Morrison’s cutting edge tax reform ushers in surplus