Metallica Minerals releases feasibility study for Cape Flattery silica project

Queensland-based Metallica Minerals Limited is forging ahead with its Cape Flattery silica sand project, which could generate $2.91bn in cash revenue over a 25-year lifespan.

Cairns

Don't miss out on the headlines from Cairns. Followed categories will be added to My News.

Queensland-based Metallica Minerals Limited is forging ahead with its Cape Flattery silica sand project, which could generate $2.91bn in cash revenue over a 25-year lifespan.

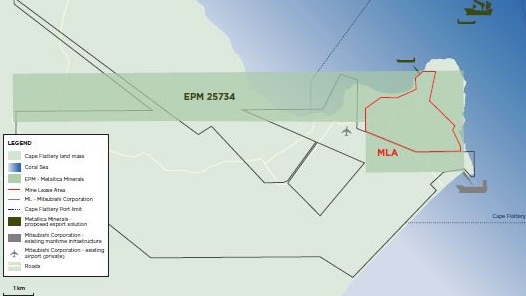

The ASX-listed company has released its definitive feasibility study (DFS) for the project north of Hope Vale and 440km from Cairns.

Metallica Minerals executive chairman Theo Psaros said the project would produce high quality silica sand for use in the manufacture of solar PV glass and other applications.

He said it could achieve consistently attractive profit margins given strong current and forecast market dynamics in the Asia-Pacific region.

“Combined with our location in Far North Queensland and support from the Queensland Government’s Critical Minerals Strategy, Metallica is well positioned to become a leading provider of high purity silica sand to the booming Asia-Pacific market,” Mr Psaros said.

“With the DFS now complete, we look forward to advancing the Environmental Impact Statement, progressing negotiations with traditional landowners, and looking at other initiatives to enhance the value of the project,” he said.

The initial capital cost is estimated to be $165m including a 10 per cent contingency fund of $13.6m.

There is an ore reserve of 47 million tonnes (Mt) and 99.19 per cent silica would be processed at 1.5Mt per annum.

Mr Psaros said a purpose-built jetty was planned to be constructed, subject to development approval, to allow barge loading and shipping operations.

The infrastructure would be within the port limit of Cape Flattery.

Mr Psaros said the project would deliver employment, apprenticeship training and new business opportunities to the townships of Hope Vale and Cooktown, particularly local Indigenous communities.

The move comes as ASX-listed Iltani Resources raised $5m in an initial public offering with drilling beginning this month to determine if a mine at Herberton could be economically viable.

Iltani managing director Donald Garner said the company was focusing on a silver-lead-zinc-indium-antimony project.

“We will drill to understand the mineralisation and then work out if it is economically viable to mine, with tests, designs and studies on the information we have at that point, to better understand what sort of mine it would be,” he said.

“It’s been a long process to get this point, now the real hard work begins and hopefully we can deliver a great return for shareholders.”

At Mt Carbine, about 130km northwest of Cairns, EQ Resources has been approved to operate an open-cut tungsten mine.

Tungsten is used in smartphones, solar panels, wind turbines and EV batteries.

EQ Resources chief executive Kevin MacNeill said open-cut mining would increase the mine’s grade quality five-fold.

Production of the critical mineral would jump from about 350 tonnes of concentrate a year to 900 tonnes, the company expects.

More Coverage

Originally published as Metallica Minerals releases feasibility study for Cape Flattery silica project