Australian Taxation Office returns $1.38 billion using new Protecting Your Superannuation Act

A woman has received $1.5m she’d simply forgotten about while a bushfire victim has got $600,000 to rebuild her life as the ATO uses a new law to reunite $1.38b with rightful owners.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

The Australian Taxation Office has paid more than $1.5 million into the bank account of an elderly woman who had simply forgotten about it — one of 841,000 superannuation accounts containing $1.38 billion the ATO has just reunited with rightful owners using a new law.

This includes 684,000 accounts worth $1.22 billion that have been transferred into active super accounts about 157,000 accounts containing $161 million that has been sent directly to bank accounts.

The recipients of the direct payments include a woman whose home was destroyed in a recent bushfire. She has been reunited with over $600,000 of unclaimed super. Because she is over 65, the money has gone straight into her bank account.

“She is now able to use this money to rebuild her life,” ATO assistant commissioner Graham Whyte said. “It’s very good news, isn’t it.”

Under the Treasury Laws Amendment (Protecting Your Superannuation Package) Act 2019, which passed federal parliament in February this year, super funds were required to transfer accounts of below $6000 to the ATO after 16 months of inactivity. The deadline for doing so was October 31, with 2.3 million accounts containing $2.16 billion transferred.

The ATO is continuing to work on reuniting nearly 800,000 of these accounts with their rightful owners.

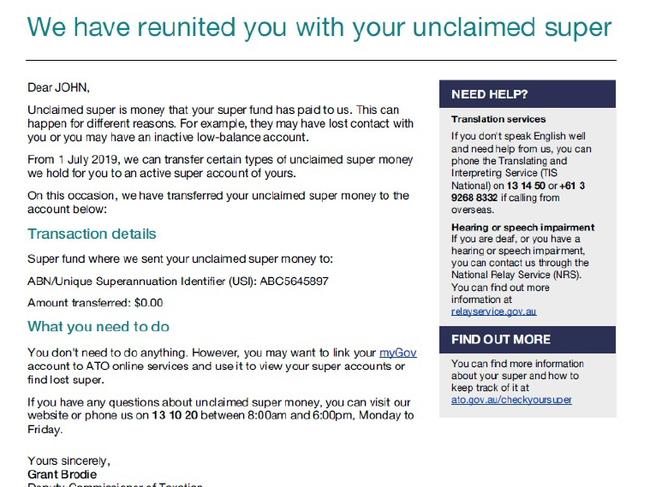

Those who do get a payment into their active super account or bank account will get a notification from the ATO.

“Anyone who thinks they may get a direct payment should make sure their bank account details are up to date by logging in to ATO online via MyGov,” Mr Whyte said.

“Even if you won’t be eligible for a direct payment, it’s important to do your future a favour by engaging with your super now.

“While it’s great that this new legislation means we can now proactively reunite Australians with their super, there are instances where we cannot reconnect you with your super.

“That’s why I recommend using ATO online to check that you aren’t missing out on any lost or unclaimed super that’s being held by us or your super fund ”, Mr Whyte said.

There is nearly $21 billion in lost and unclaimed super, ATO data released today reveals.

Have you received a windfall from the ATO recently? Email john.rolfe@news.com.au

Originally published as Australian Taxation Office returns $1.38 billion using new Protecting Your Superannuation Act