‘Effectively worthless’: EV bubble bursts

The proverbial ‘arse’ has fallen out of the EV market, and it’s those who have already bought who are the biggest losers.

On the Road

Don't miss out on the headlines from On the Road. Followed categories will be added to My News.

The electric vehicle bubble is bursting.

They were meant to be the environmental panacea – the guilt-free answer to travel.

And just think of all that money you’d save not having to buy increasingly expensive fuel (of which 49c in every litre is tax, by the way).

Cars have always been money pits. I’ve single-handedly put my mechanic’s son through private school.

But those who bought into the EV dream are fast discovering they’re the proud owners of even bigger money pits.

The arse has gone right out of the EV market.

Manufacturers are now heavily discounting new vehicles in an effort to get them off the showroom floor.

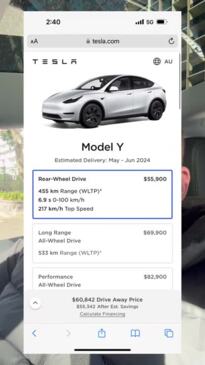

A brand new Tesla Model Y is now $11,400 cheaper. The Peugeot e2008 has been given a massive cut from $63,000 to $39,990. On the lower end of the market, a GWM Ora is down 20 per cent to $35,990.

This is partially indicative of more competition naturally putting downward pressure on the market, which is generally a good thing for consumers.

But it’s not much good for someone who bought an EV a year ago, now watching the resale value of their car plummet overnight.

The other cause is a softening market for electric vehicles. And is it any wonder when you take a look at the balance sheet?

Cars, like houses, are some of the biggest assets most people will ever own. And thus they are treated like investments – some vehicles hold their value better than others.

Falling retail prices will automatically cut resale value. But the biggest threat to the used EV market is the speed at which the technology is changing.

A standard car model is generally updated every few years with a new trim and some extra mod cons inside. The most important part of the car, though – the internal combustion engine – is by and large a comparable product.

You can happily drive a 20-year-old Camry without any worries.

With EVs, however, it’s the basic function of the cars that is changing at a rapid pace.

The average range of an EV in 2010, according to the International Energy Agency, was less than 130km. By 2021, it was about 350km.

You wouldn’t think twice about buying a 14-year-old fuel-powered car if it was in good nick. But who, in their right mind, would buy a used EV that has three times less capacity than one rolling off the production line today?

It renders the vehicle effectively worthless.

Battery technology, and thus travel range with it, is improving every year. And given range is the greatest concern of most people looking at an EV, it is also the biggest cause of depreciation in the used car market.

Electric cars are almost like a mobile phone – the technology changes so fast that by the time you’re ready for a new one you may as well chuck out the old one.

Unless you have enough money to not care about the loss, why would you take the risk?

Insurance premiums for EVs in the UK are now double those of fuel cars because they are so expensive to repair.

The sheer weight of electric cars, thanks to their batteries, means tyres and brakes wear down much faster – pumping more pollution into the atmosphere than a normal car.

Not to mention the fact that we still haven’t worked out how to recycle the heavy metal-laden batteries that power these vehicles.

So much for saving the planet.

Toyota chairman Akio Toyoda said in January that EVs would only ever make up 30 per cent of the global car market.

“I think this is something that customers and the market will decide, not regulatory values or political power,” Mr Toyoda said.

He chairs one of the biggest car manufacturers in the world. If he thought EVs were the future, he’d be building them at a rate of knots.

Prior to the 2022 federal election, the opposition – now the Albanese government – predicted that EVs would make up 89 per cent of new car sales by 2030.

Now the federal transport department believes they’ll only make up 27 per cent.

And that’s because they’re not all they were cracked up to be.

Originally published as ‘Effectively worthless’: EV bubble bursts