Rising demand for older vehicles amidst overall price decline

After several years of soaring used car prices, the market is beginning to return to normal. But sadly, not all buyers are reaping the rewards.

Motoring News

Don't miss out on the headlines from Motoring News. Followed categories will be added to My News.

In a cruel twist, the cost of living crisis is making cheaper used cars more expensive.

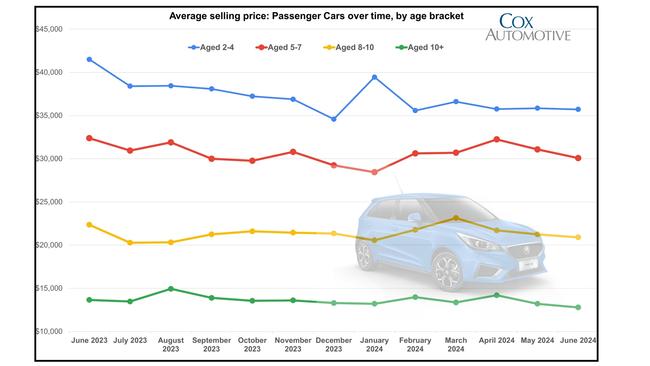

While the prices of late-model used cars are coming down due to improved supply of new cars, bargain hunters are pushing up the price of older hatchbacks and sedans.

The latest data from Moody’s Analytics, Cox Automotive Australia and Pickles show that older, more affordable used vehicles are experiencing an unexpected boost in demand.

Corporate Affairs Manager at Cox Automotive Australia, Mike Costello, said that as inflation and economic pressures tighten household budgets, consumers are increasingly opting for lower-cost vehicles.

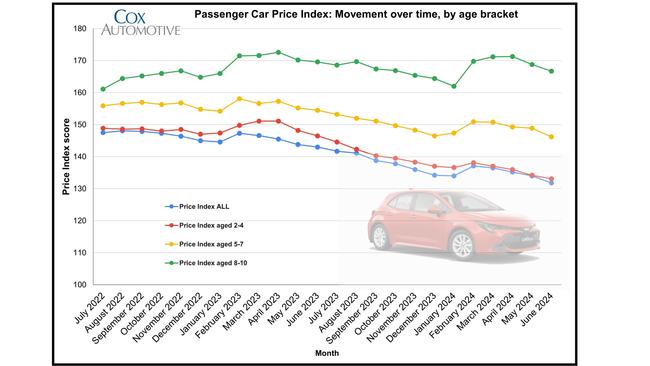

“We continue to see older used cars, for example those aged 8-10 years, maintain proportionately more elevated prices over their equivalent 2019 levels, when compared to younger used vehicles such as those aged 2-4 years,” he said.

Data from Cox Automotive supports this trend.

Costs for used passenger vehicles aged 8-10 years are up by 66.7 per cent since December 2019, significantly higher than the 33.1 per cent increase for vehicles aged 2-4 years.

Costello said traditional passenger vehicles such as hatchbacks and sedans were also holding their value better than SUVs and utes.

“Because the decline in new sales of these vehicles make them harder to find second-hand,” he explained.

While older vehicles are performing well, overall used car prices are experiencing a decline.

According to Moody’s Analytics, the Used-Vehicle Price Index is 6.7 per cent lower than a year earlier.

Prices are 18.6 per cent lower than their peak in May 2022 yet are still 44 per cent higher than the pre-pandemic level in June 2019.

The trend is largely attributed to a recent increase in the availability of used cars, spurred by improved global production of new vehicles.

The Asian automotive industry, particularly in China and Japan, has seen significant production growth of 11.6 per cent and 18.2 per cent, respectively, in 2023.

This increase is expected to channel more vehicles into Australia’s secondary market, thereby applying downward pressure on used car prices.

In addition to supply factors, high interest rates are also influencing the used car market.

Moody’s Analytics reports that high borrowing costs have eroded disposable incomes, leading to a decrease in demand for used vehicles.

Associate Economist at Moody’s Analytics Catarina Noro said the high prices and high borrowing costs had undermined consumer confidence.

“Households are becoming more cautious about making major purchases such as cars,” she said.

Noro expects the downward trend to continue.

Cox Automotive and Manheim Australia data reveals dealer inventories of used cars have grown by 10.5 per cent over the past year, with a corresponding 8.4 per cent increase in sales.

Despite the overall price decline, used car dealers are seeing a healthy increase in the volume of sales, driven partly by rising inventories and the increased availability of vehicles.

In June 2024, dealer used-car sales hit their highest level since November 2020.

Nearly half (47.6 per cent) of the dealer-used vehicle market consisted of SUV’s while traditional passenger cars made up 31.9 per cent, and light commercial vehicles accounted for 20.2 per cent.

Pickles’ Quarterly Automotive Report reveals a remarkable 246 per cent year-on-year increase in EV sales, setting a new quarterly record.

Pickles Chief Commercial Officer Fraser Ronald said these numbers highlighted the “resilience and adaptability” of Australian consumers.

“The surge in EV sales is particularly noteworthy, as it reflects the growing acceptance and demand for sustainable vehicles,” he said.

The Pickles’ report also highlights the increased choice of EV models in the used market, with the Tesla Model 3, Hyundai IONIQ 5, and Nissan Leaf among the top sellers.

But the used electric vehicle (EV) market is experiencing volatility.

Recent price cuts by Tesla and an influx of affordable new models from emerging Chinese brands such as MG have damaged the residual values of used Teslas.

Costello said the downturn was “unlikely to be permanent” and predicted that as the EV market matures and technology improves, resale values will stabilise.

Originally published as Rising demand for older vehicles amidst overall price decline