It’s best not to inherit this family financial problem

INHERITANCE is a touchy subject for parents and their adult children, but it’s also one you need to discuss. David and Libby Koch share their advice on how to go about it.

Saver HQ

Don't miss out on the headlines from Saver HQ. Followed categories will be added to My News.

BE honest. In this era of tiny (or no) payrises, who’s feeling a bit of financial strain at the moment and who dreams of a big inheritance to not only solve those financial problems but also fund a better lifestyle?

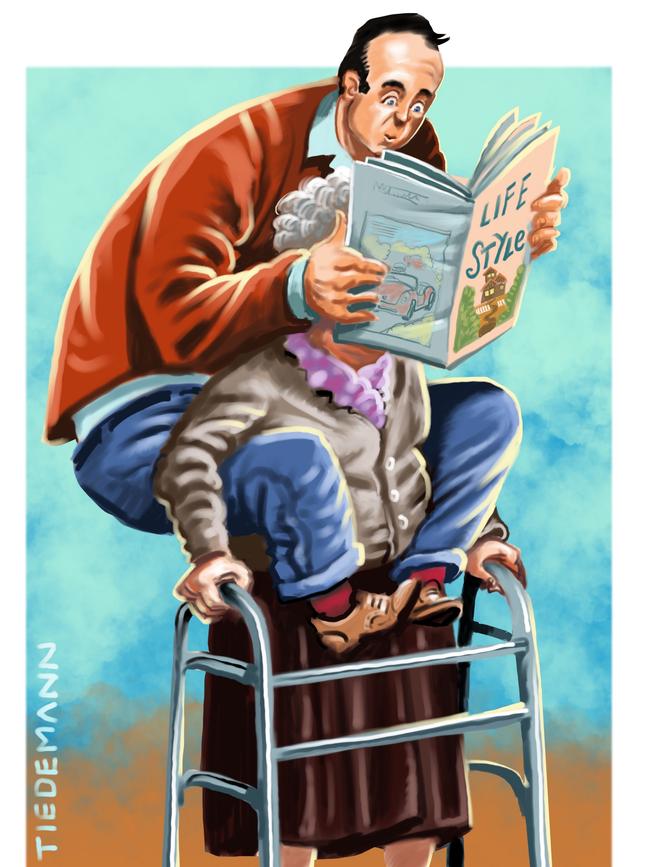

For a growing number of adult children, waiting for the will is as tense as trying to win Lotto. With softening property prices, high debt levels, the prospect of rising interest rates and the desire to maintain a good lifestyle that inheritance from elderly parents is being seen as a financial get-out-of-jail card.

As was reported recently, at the extreme, the temptation for some is too much and there is a horrifying increase in abuse of the elderly by adult children literally conning parents out of their wealth to fast track the inheritance.

MORE: A big problem faced by senior Australians

MORE: What to do if the property bubble bursts

We’re currently going through one of the greatest intergenerational wealth transfers in our history as Baby Boomers die and pass on their substantial property assets.

It’s turning into a tussle between the generations.

Baby Boomers fearing they’ll run out of money as they live longer.

Adult children eyeing off their inheritance and begrudging parents spending it.

It can tear families apart if not handled properly. The worst outcome is if an elderly parent suddenly has a serious health problem and family is unprepared.

So what can each side do?

The answer is a family summit on estate planning.

ADULT CHILDREN

A good starting point is to work from the basis that you have no legal or moral right to your parent’s money. It’s not yours and they can do what they want with it.

While parents may have benefited from rising property values, remember they won’t get the full benefit of compulsory superannuation as you will.

Having said that, we understand your position and also that some parents use the prospect of your future inheritance as an emotional and financial weapon to have power (and give an opinion) over the way you live your life.

Yes, that is not only annoying but also unfair.

Even among those baby-boomers and their adult children who pride themselves on their ability to talk to each other, the subject of inheritance is often taboo.

Most families can be divided into two camps. One where the subject is not even raised and the other where parents go to extremes of putting stickers on everything in the house to ensure it goes to the right child. But discussing the contents of the will is almost universally frowned upon.

Secret wills are usually made by two types of people. Those who have had previous family hassles and those who don’t want to acknowledge their death.

Starting the conversation can be the most difficult part.

Don’t phone your parents out of the blue and fire off a list of questions about their money. Sit down with them, show respect and tell them you have some questions you would like to ask them about their finances. Explain you simply want to check everything is in order and whether they need any assistance looking after their money.

No parent wants to face the problems of old age and no parent wants to feel as though their children are putting them out to pasture. Try to personalise the conversation.

For example, explain how you’ve been getting the right documents in order to make sure your family is OK if something happened to you and you’re wondering what they have in place.

Everyone can recall a story of a friend or relative where the dominant financial partner dies, leaving the surviving spouse with no idea of their financial situation. Make sure that doesn’t happen to your mother or father.

Emphasise to your parents that your inquiries are not being made by a gold digging child, but by a family concerned about caring for their parents in the best possible way if a disaster occurs.

It can be an uncomfortable situation, but the secret is to find out as much about your parent’s financial affairs before a crisis occurs. That terrible middle of the night phone call carrying news of a catastrophe can be a nightmare if preparations have not been made earlier. For example;

● Do your parents have legal documents and do you know where they are located?

● Where are the bank accounts and who do your parents rely on for advice?

● What are their other investments and are they held jointly or separately?

PARENTS

We know your biggest fear is running out of money in old age, facing the prospect of big medical bills and having to rely on your children for support. They are very realistic concerns and we know it’s your money and you are absolutely entitled to spend it any way you want.

But the best way to deal with these concerns is to be open about it and discuss it with loved ones. Because there is only one inevitable outcome … you are going to die. So planning for the financial consequences of that inevitability is just the smart thing to do.

One way to stave off any of these issues is to develop a financial plan as soon as possible that includes what your wishes are as you age and if you become incapacitated. It is really important to do that while you’re of sound mind before you actually need it.

You should also have a team in place that knows your plan and can be trusted to play their roles in following it. Keeping multiple people — whether they’re your adult children, other relatives and friends or financial professionals — apprised of your plans allows for a system of checks and balances.

If you fear you’re already in a problematic situation involving abuse from children, don’t be silent. Try talking with a trusted person in your life or seek outside support and if you’re concerned for your safety, or certainly if you’re in imminent danger, contact the authorities.

But … the vast majority of adult children are good people. They are concerned about your welfare while at the same time worrying about their own partner and family.

Don’t use your estate as a weapon to control them or pass judgment on their lifestyle decisions. Guide but don’t judge.

Be sympathetic to the financial strains on adult children and balance that up with your situation and ability to help. There can be a lot of different options available:

● Providing a documented low interest loan secured by assets of the child which could be deducted from their inheritance on your death or forgiven.

● Offering to be a limited guarantor for a loan taken out by a child.

● Advancing them part of a planned inheritance … making sure you’re not left short.

● Rather than giving them a lump of money to be spent at their discretion, pay for a specific cost … it might be school fees for grandchildren, a car, rent, home loan repayments etc.

● Pay for things you can enjoy together like family holidays.

There are plenty of ways you can ease the financial burden on adult children without giving them early access to an inheritance.

But the most important issue is … talk about it together.

Originally published as It’s best not to inherit this family financial problem