Super lot selling: How to turn a $2 million home into a $10 million windfall

THERE was a bit of luck involved, but a group of nine Sydney neighbours have demonstrated how they sold their homes for up to five times more than they’re worth.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

CONSOLIDATING to sell: It’s when good neighbours become instant millionaires.

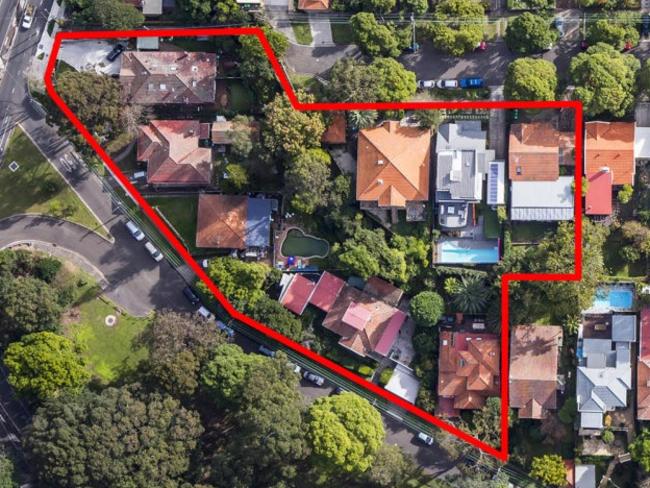

A group of nine homeowners in a quiet suburban street on Sydney’s north shore have pocketed an average of $7.3 million each after joining forces to sell up.

Thanks to the rezoning of a large portion of St Leonards, where the Holdsworth Ave and Canberra Ave properties are located, the family homes on large, leafy blocks quickly caught the eyes of developers.

The joint sale, which saw one homeowner trade a $2 million family home for a $10 million windfall, will see the undisclosed Hong Kong developer who bought the parcel build up to 250 apartments in the place of houses.

Selling agent JLL said the multi-million dollar sale was the first of its kind in the area, but eager residents either side of the soon-to-be high-rise apartments blocks were anticipating their own multimillion-dollar paydays.

“While there has been a lot of talk around residents consolidating to sell, this is one of the first real examples of such a large unconditional transaction,” the agency’s head of metro sales and investments Sam Brewer said.

“We see a large proportion of next year’s pipeline been made of similar mum and dad house consolidations as St Leonards.”

Looking down the tree-lined streets, it’s clear Mr Brewer’s statement is not just an optimistic prediction.

On Holdsworth Ave, aside from those that have just sold, most houses bear a “for sale” sign out front.

It’s the same on Canberra Ave and surrounding streets. The placards are picketed outside what look to have been quaint family homes for a long, long time.

Homeowners who have handed over their residences in the sale of the super lot declined to discuss the sale with news.com.au. One neighbour, who has been living in the area for more than 10 years, said it would be sad to see the area change.

“It’s a beautiful part of Sydney,” the resident said, pointing out the convenience of the properties’ proximity to the railway station, nearby hospital, and views. “It’s clear why it’s an attractive place to live and to build on, but these units are going to be just as expensive as the houses.

“What I do find disquieting is that people who grew up in Sydney, have been living in Sydney, won’t be able to afford to buy in areas like this.”

The median house price in St Leonards is $2.6 million.

While most homeowners in the area rezoned for high-rise development by council in December last year have grouped together to sell hoping to follow in the fortunes of the super-lot sellers, residents say the only reason some haven’t is because they may have fallen into disagreements with prospective group members, or could be waiting for a better time to strike.

Lower clearance rates in recent weeks have ignited commentary that Sydney’s explosive market may be slowing, but property experts have said prices in sales like the St Leonards super lot show there is still plenty of demand for inner-city sites.

“We’ve been through a very buoyant period, and still we’ve got strong inquiry rates and we’re selling just as many apartments now as we were 12 months ago,” CBRE director David Milton told The Australian.

“There’s more stock on the market, and that’s prompting people to take longer to make a decision, but at the end of the day they are still coming back to the make the purchase.”

Along with the St Leonards properties, other Sydney areas like Castle Hill have neighbours grouping together to sell their homes for more than they’d be worth individually.

Originally published as Super lot selling: How to turn a $2 million home into a $10 million windfall