Millennial investors learning fast: what they can teach you

A new breed of stockmarket investors has grown rapidly, and many of the lessons they can share are valuable for others.

SmartDaily

Don't miss out on the headlines from SmartDaily. Followed categories will be added to My News.

Young investors surged into the sharemarket last year and for many it’s been a fun ride as Aussie stocks climbed to fresh record highs in June.

But Millennials have already built some impressive investment knowledge, including experiencing 2020’s Covid crash, and can share lessons and advice that’s often as mature as a seasoned financial professional.

Investment platform eToro Australia’s managing director, Robert Francis, says young investor numbers boomed amid pandemic lockdowns, low interest rates, commission-free stock investing and Covid’s acceleration of digital technologies and business.

Francis says age is not a barrier when sharing investment knowledge.

“Anyone who takes the time to study, analyse and invest their own capital in the stock market, no matter their age or background, has the potential to share valuable factual investment lessons and unique experiences with others,” he says.

Here, three Millennial investors unveil important lessons they have already learned.

TOMMY ROGULJ, 33

Treat investing as a marathon rather than a sprint, Rogulj says.

“People who set a long-term investing horizon tend to have better outcomes than those who trade over shorter time frames,” he says.

“With many first-time investors hitting home runs with their stock picks in 2020, many now believe that this instant gratification translates over to investing. In reality the stock market appreciates at a much lower rate over the long-term relative to what we saw in 2020.”

Rogulj says dollar-cost averaging over the long term is an important investment strategy.

“It aims to reduce the impact of volatility on an investment,” he says.

“The strategy dictates that instead of making a lump-sum investment, you instead split the investment into several smaller parcels.”

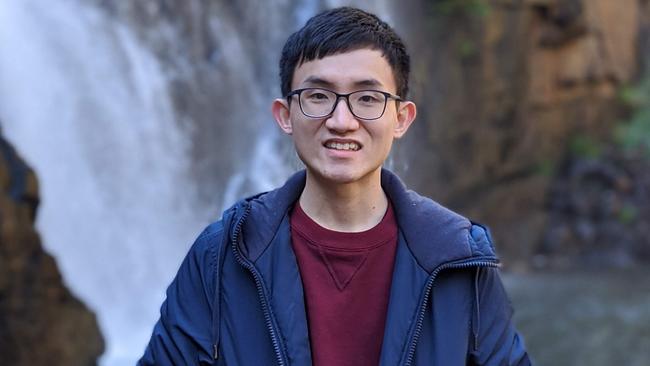

HAO-NING NG, 25

Investors should research stocks wisely and not put too much faith in others’ opinions, says Ng.

“Like many amateur investors, the internet was my only source of information for doing research,” he says.

“One of the rookie mistakes I fell prey to during that first year of investing was putting too much trust in those professional-looking analyses from the web.”

Ng says investors should avoid trying to make a quick buck with short-term trades, and should understand the stockmarket is volatile.

“Most of us who just started investing in recent years wouldn’t have experienced the major market crashes that happened in the past until last year when the global pandemic hit,” he says.

“Even then, the market crash we saw in 2020 was a rather short-lived one.

“Even though we have been told that the stock market always goes up in the long term, individual companies don’t.

“In fact, among the top 20 companies in the world in 1989, none of them remains on the list today. This tells you not to expect the stocks to keep going up forever.”

JOE MILAZZO, 34

Investing in your own financial education is vital, says Milazzo.

“I was caught out a number of times for not truly understanding the orders I was executing or the market I was investing in,” he says.

“By reading and learning more, the simple mistakes become rarer.”

Milazzo says learning not to check his stock portfolio every day has helped reduce stress.

“You should be confident enough in your investments to let them grow naturally,” he says.

“I used to watch my portfolio every day – this wasn’t healthy, as I wasn’t a day trader. I became more anxious and emotional with my investing.”

Investors should also determine why they are investing, to focus their strategy.

“At first I just wanted to invest to become rich, but I didn’t know what rich meant to me,” Milazzo says.

He suggests asking yourself what you want from investing.

“For some people, it’s an additional source of income, others it is to build generational wealth, and for some, it is to stand behind companies they feel are doing good in this world.”

More Coverage

Originally published as Millennial investors learning fast: what they can teach you