Taxing your Coca-Cola. Refreshing!

IF YOU’RE rich, then you might not think twice about a tax like this. But this ‘feel good’ tax proposal has a dark side.

Eat

Don't miss out on the headlines from Eat. Followed categories will be added to My News.

GET ready for a new tax on sugary drinks. The idea, which popped up after the UK announced a tax on Coke, Fanta, etc. this week, is one of those things Australia will love. But we should only do it on one condition.

The UK says its tax will help children “grow up fit and healthy.” It plans to spend all the money raised on sport for kids. Also, Jamie Oliver has come out in support of the tax. Who could oppose such a thing?!

Australia loves this sort of “sin tax”. We already happily tax fuel, booze and cigarettes at quite high levels.

If and when the idea comes to Australia, the sugar industry will raise a stink. But Queensland canegrowers are a much smaller part of Australia’s economy these days so they won’t have the sway they once did. And they export most of their product anyway, so a local tax won’t break them.

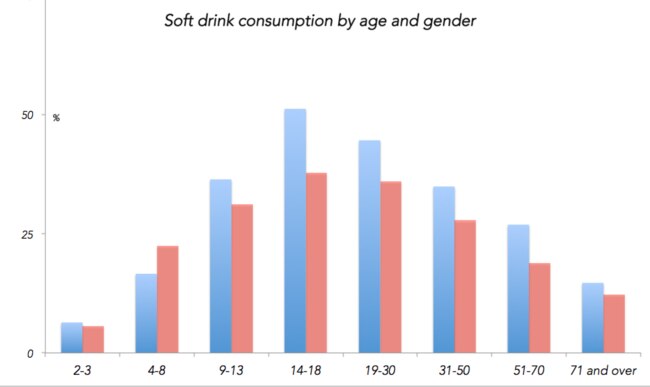

As for the voters? We probably wouldn’t raise a peep. Most people don’t drink them in an average day, with young men being the only exception. This graph shows that less than 30 per cent of people over the age of 30 sip fizzy drinks on a given day.

SOFT DRINK CONSUMPTION BY AGE AND GENDER:

The UK tax has loopholes you could drive a bus through. Soft drinks are taxed while fruit juice — which is often just as sugary — isn’t. Same with flavoured milk. Mexico’s soft drink tax is the same. It’s obviously not going to stop obesity on its own, but that doesn’t mean it’s a terrible idea.

The UK tax is 24 pence per litre for Coca-Cola, and a bit less for Fanta, which has less sugar. In our terms that’s 17c on a can of Coke, 27c on a 600mL bottle. Sounds about right — not enough to stop you if you really want one, but maybe enough to change your mind sometimes. That way the tax has a deterrent effect and raises some revenue.

A tax on soft-drinks, with money going to support healthy living, might just be a good idea. But it has a pernicious effect — making life more expensive. This matters — a lot.

The one condition for bringing in a sugar tax should be that it doesn’t make Australia more unequal.

Economists (for the record I am one!) often like to ignore household budgets. The assumption is people cut expenditure in one area to spend more in another.

But when people’s budgets are really stretched, shuffling expenditure gets very hard.

A tax on sugar would hit the poor most. And it’s not the only kind of tax economists think is clever. Economists in high places want higher taxes on wine, and cigarettes. They advocate for toll roads and congestion charging, and user-pays in a lot of other scenarios too.

Each of these things, by itself, could be a good idea. We don’t want to give away free subsidies, or let negative side-effects accumulate. It makes sense to make a market for a congested road, for example, so people with alternatives have a reason to use those alternatives. But as more and more of the economy becomes a good with an “efficient price,” what happens? Less and less is available cheap or free.

That’s fine if you’re wealthy. A few dollars here or there make no difference. But the creeping expansion of the market economy increases the relevance of income inequality. Being poor gets even harder.

Income inequality in Australia is wide, as this next graph shows. The average household makes four times as much as the bottom 10 per cent, and the top 10 per cent makes ten times as much.

If we want to uses taxes and charges to fix certain consequences of consumption (like obesity, lung cancer or traffic) — and I think we should — we also have to make sure the economy is fair.

Income inequality has been getting worse in recent decades, even as more and more aspects of society become user-pays. That just amplifies the effect of inequality.

I’d like to live in a society where people don’t get fat because sugary drinks are cheaper than water. But I also don’t want to live in a country where the gap between rich and poor is like America.

The alternative could leave us all with a very bitter taste.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine.

Follow Jason on Twitter @Jasemurphy

Originally published as Taxing your Coca-Cola. Refreshing!