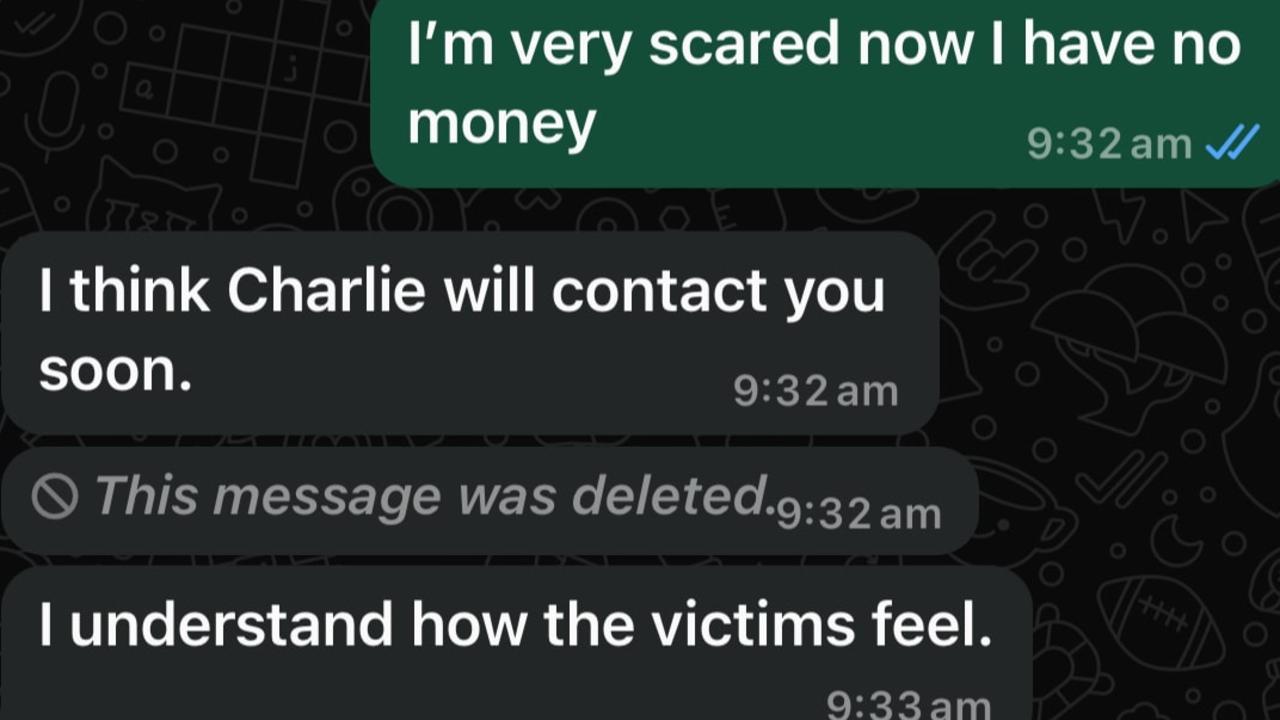

Aussies ripped off by banks warned compensation has ‘tax consequences’

Australians entitled to compensation after the banking royal commission may face more problems with the ATO.

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

Aggrieved bank and finance sector customers that stand to get compensation after the Royal Banking Commission are being warned to beware of the Australian Taxation Office.

With an estimated $6 billion owed to customers, experts are warning the payments could lead to an unexpected tax bill.

H&R Block has seen a surge in clientele seeking tax advice for financial compensation in the past three years.

Mark Chapman, the company’s director of communications, told News Corp Australia the compensation claims being paid out by financial institutions are a “minefield”.

“It is very complicated,” he said.

“Depending on the type, different types of tax treatments apply.”

MORE NEWS

How to multiply your tax refund

Barefoot: How to pick a great accountant at tax time

Australia ‘sent down the path to conflict’

Why your health fund is overcharging you

Someone claiming compensation for an investment, for example, would be in a different tax position to someone claiming for interest.

In terms of adviser fees, it depends on whether they claimed a deduction in the first place.

Mr Chapman’s advice is don’t try figuring it out alone.

“If you get one of these payouts you really need to get professional advice to find out what the tax will be,” Mr Chapman said.

He said even after being taxed, compensation recipients come out winners.

“It’s always worthwhile getting compensation, even if you pay tax,” he said.

“Very often it puts them back into the position they should have been in if things went to plan”.

The Australian Taxation Office website advises compensation recipients to “consider the tax consequences”.

“You need to consider the tax consequences if you have personally received compensation from a financial institution because you received advice from them that was found to be inappropriate; paid for advice that you did not receive.”

The website explains a compensation payment can include some or all of compensation for loss on an investment; a refund or reimbursement of fees; or a return on interest.

“The compensation may relate to multiple investments, with different amounts of compensation granted against each one. You must consider the tax consequences of each compensation amount separately,” the ATO warns.

Treasurer Josh Frydenberg this week promised to roll out a third of the government’s commitments outlined as a result of the Hayne royal commission by the end of the year.

Legislation for all 76 recommendations will be introduced by the end of 2020.

WHAT YOU CAN GET COMPENSATION FOR:

*A loss amount if the value of your investments is lower than it would have been if you had received correct advice on either investments you’ve sold or existing investments

*A payout may include an amount that is a refund or reimbursement of adviser fees. The tax on this depends on if you claimed a deduction for the adviser fees in your tax returns. If a deduction was claimed, the amount you got as a refund or reimbursement will form part of your assessable income in the year you receive it.

WHAT TO DO FIRST IF YOU GET COMPENSATION:

*Contact your tax agent and notify them about the amount received

*Don’t try to figure it out alone

*Make sure you keep all tax return information for previous years so a tax agent can go back to your return and work out what you’re owed and what you have to pay

WHEN YOU MAY NEED TO CONTACT THE ATO:

*You held investments on a revenue account

*You held investments on a trust

*The compensation related to a superannuation account or self-managed super fund