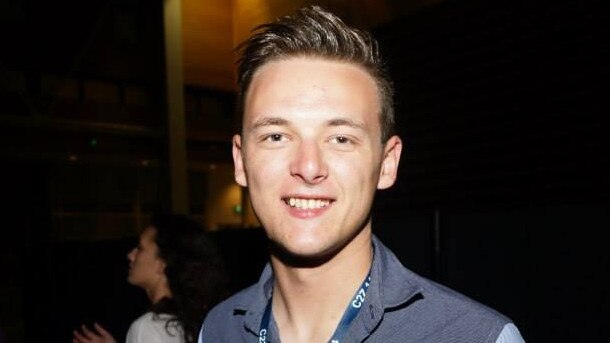

Melbourne fraudsters 2022: Peter Ravenscroft, Andrew Sackl, Carolyn Kruger, Dwayne Antojado

Beware of Melbourne’s devious penny-pinching scoundrels who will pull elaborate swifties just to line their own pockets.

Melbourne City

Don't miss out on the headlines from Melbourne City. Followed categories will be added to My News.

Melbourne’s courts are busting to the seams with swindlers, scammers, scoundrels and shonks some of which lied, stole and cheated to glean a cash advantage.

Here are some of the most devious to go through the courts this year.

SLIPPERY CAR DEAL CONMAN

Greensborough dole bludger Curtlie Keeshan claimed to have made millions selling a self driving car idea to Volkswagen to ruse family friends out of hard earned cash.

Keeshan was sentenced in the County Court in May to a two-year community correction order after pleading guilty to obtain property by deception.

Keeshan rorted $150,000 from family friends in separate swindles between November 2016 and March 2017.

The fraudster gleaned $100,000 from his first victim after claiming he sold “intellectual property to Volkswagen” for “$3 or $4 million”.

Keeshan told the victim he couldn’t access his bogus cash windfall because it was held up in a “trust”.

Keeshan spruiked a pie in the sky scheme to purchase cars in Perth and flip them for a profit.

The dodgy dealer claimed he could “make money” due to a “downturn” in Perth’s post mining boom car market.

Keeshan’s retired victim, who was looking for ways to earn extra money, invested $100,000 into the scheme.

Keeshan bought and sold a couple of cars but the venture went pear-shaped quickly.

Keeshan spent most of the cash on “living expenses”, the court was told.

The serial scoundrel repeated his Volkswagen ruse to rope another family friend into the scheme for $50,000.

Keeshan also told his victim he had “investors from around the world to the value of $6 million” but these funds were held up in the trust and business.

The victim lumped up the cash after Keeshan told her she would make 20 per cent on her “investment”.

The court heard Keeshan, a passionate car enthusiast, was on the dole living with his mum at the time of the offending.

Keeshan was convicted and ordered to repay the cash.

GAMBLING DEGENERATE’S CASH SCAM

Degenerate gambling junkie Adam Crowe stole more than $1.5 million from two employers to bet large at the Casino, Sportsbet and Bet365.

Crowe fronted the County Court in April after pleading guilty to multiple fraud offences and attempting to pervert the course of justice.

Crowe rorted $711,968 from former employer Melbourne River Cruises via 163 transactions between September 2014 and February 2017.

The fraudster pleaded guilty to that offending at a County Court plea hearing heard in October 2020.

Crowe told the court he ceased gambling once his offending was discovered, deleted his betting apps and claimed to have joined Gamblers Anonymous sessions.

Crowe’s submissions may have resulted in a reduced sentence.

However, it emerged Crowe never ceased gambling and actually placed a bet on the day of his plea hearing.

The shock revelation came after the Herald Sun published a story covering Crowe’s Melbourne River Cruises fraud, the court was told.

Crowe’s most recent employer onQ Plumbing was shocked to learn of their former bookkeeper’s skulduggery via the media.

The court heard Crowe quit onQ just days before his plea hearing, telling the company he had a “personal family issue” and had to “leave to go interstate”.

onQ General Manager Gerard Misquitta did some digging and found “discrepancies” with the Craigieburn company’s accounting records.

Crowe funnelled $791,586 from onQ’s coffers to his personal bank accounts between December 2017 and September 2020.

Analysis of Crowe’s bank accounts revealed the degenerate transferred $399,654 to Bet365 and Sportsbet between October 2017 and October 2020.

Crowe also withdrew $122,440 cash.

The court was told, during the 2020 plea hearing, Crowe gambled most of his stolen Melbourne River Cruise cash at Crown, at the TAB and various other betting apps.

Crowe bet during work then wandered to the Casino after his shift.

Crowe, a father of five, also picked up a dangerous cocaine habit after his marriage hit the skids.

Crowe will be sentenced at a later date.

THE ‘WOLF OF WALL STREET’ SHONK

Colourful bankrupt Melbourne businessman Andrew Sackl who has left a trail of broken clients has been slammed for his shonky antics.

Sackl, who sources say is referred to as a ‘Wolf of Wall Street’ character, left multiple companies in the gutter before going bust in November, 2020.

Sackl left several international job seeker hopefuls high and dry through his collapsed employment companies Punk Jobs and Dynasty Global.

The slippery operator used his charm to rope in eight non-citizens “open to exploitation” and willing to pay big bucks to secure job sponsorship and 457 visas between November 2012 and May 2013.

Sackl, and others, met hapless marks at upmarket cafes and restaurants including former plush bar Silk Road to pose up and pitch ultimately hopeless visa dreams for exorbitant fees.

Many of Sackl’s desperate clients got caught up in his shonky promises via cheap Gumtree adverts.

Sackl, who sources claimed lived an opulent lifestyle with his wife, also wooed clients at his Prahran office.

An associate of Sackl quoted a Chinese national $45,000 to obtain employment and a visa.

The Chinese national coughed up almost $12,000 but Sackl falsified the 457 visa application which was ultimately refused.

Sackl, whose businesses provided legitimate employment services, dudded other internationals who all handed over cash for fruitless services.

Many of Sackl’s marks, some of which claimed the shonk presented as “attractive” and “smartly dressed”, demanded refunds after it became apparent the visa application process was going nowhere.

However, Sackl stonewalled clients and even demanded more money for fees.

In reality, Sackl, who graduated Wesley College with a 96.4 ATAR, falsified visa applications and diddled work sponsorship forms.

Multiple businesses including a bakery, a pizza joint and a bar were falsely put up as willing to sponsor non citizens for work on decent salaries.

A legitimate migrant agent quit Dynasty Global in November 2012 after she suspected a Prahran bar proposed as a work sponsor was part-owned by Sackl.

Sackl appeared at the County Court in June after the Australian Border Force received a tip-off about a suspected “migration scam”.

Sackl, aka James Sackl, pleaded guilty to 13 charges including deliver false or misleading information relating to a non-citizen.

Judge Justin Hannebery, who said the offending “wasn’t a complicated fraud”, convicted Sackl with a three-year community correction order.

TECH DAD BLEW STOLEN CASH AT NANDO’S

Former State Revenue Office computer nerd Marc Thompson rorted unclaimed money reserves to pay off credit card debt and take his family to Nando’s and Groove Train.

Thompson was sentenced in the County Court in February to a minimum seven-month jail term after pleading guilty to multiple rolled-up fraud charges.

Thompson diddled State Revenue Office computer systems to siphon $212,315 via multiple bogus unclaimed money transactions between July 2017 and January 2020.

The Vermont dad’s racket came unstuck after an State Revenue Office overnight transaction bounced back due to an irregularity.

An internal investigation uncovered “suspicious claims” and Thompson’s persistent skulduggery in January 2020.

Senior State Revenue Office staff were poised to question Thompson but he sensed his goose was cooked, skipped the building and never returned.

Senior staff attempted to call Thompson several times but he never answered the phone.

The matter was referred to police who raided Thompson’s Vermont home on February 27, 2020.

Investigators seized multiple devices including a PC, a laptop, an iPhone and Thompson’s work computer and State Revenue Office ID card.

Thompson, a father and husband who had worked at the State Revenue Office for 20 years, gave a “no comment interview” when questioned by police.

The court heard Thompson made a futile attempt to “cover his tracks” after his racket was exposed.

Thompson, who earned a whopping $155,000 per year, gave evidence he was bankrupt from 2014 to 2017 due to credit card debt and money “mismanagement”.

Thompson was jailed for a maximum 15 months.

EX POMMY PLODDER’S LIES

Serial impostor Peter Ravenscroft lied his way into well-paid government gigs with “staggeringly transparent fabrications”, a court was told.

Ravenscroft was sentenced in the County Court in June to a two-year community correction order after pleading guilty to perjury and multiple obtain financial advantage by deception charges.

Ravenscroft fibbed about his experience and education and fabricated references to land work at the Department of Treasury and Finance, Frankston Council and the Victorian Ombudsman.

The court heard Ravenscroft — aka ‘Peter Murphy’ — scored a senior investigations officer role at the Department of Treasury and Finance in June 2012.

Ravenscroft, a former English policeman, landed the gig after claiming to be a UK National Crime Squad detective inspector.

The impostor also claimed he completed diplomas at “Guildford University” which the court heard does not exist.

Ravenscroft, who earned $67,631 during his treasury tenure, quit in January 2013 to take a job as Frankston Council compliance and safety manager.

Ravenscroft repeated his National Gang Squad and Guildford Uni lies and added bogus qualifications including University of Leeds fellow, Master Builders Victoria and Australian Institute of Management diplomas and various forged Surrey Police and Sussex Police merits and certificates.

Ravenscroft, who raked in $456,038 while working for the council between January 2013 and November 2015, then landed a Victorian Ombudsman Strategic Investigations assistant director role.

Ravenscroft beefed up his resume to score the gig but also failed to inform the Ombudsman he had been under investigation at the council.

Ravenscroft, who earned $196,857 at the Ombudsman from January 2016 to February 2017,

was arrested and interviewed in December, 2020.

Ravenscroft told police he studied via correspondence but couldn’t explain why there was no record of him attending multiple universities.

Ravenscroft also claimed a juiced-up tertiary gong landed on his resume by mistake because he and his wife shared the same “resume template”.

Investigators also obtained a statement from Ravenscroft’s former Sussex Police colleague Anthony Pike who said the applications to the treasury, council and Ombudsman included “staggeringly transparent fabrications”.

Ravenscroft, of Emerald, was convicted and ordered to perform 180 hours of unpaid community work.

CROOKED BOOKKEEPER’S $3.8 MILLION RORT

Scoundrel bookkeeper Carolyn Kruger stole almost $3.8 million from a family run Mordialloc water filter company.

Kruger was sentenced in the County Court in April to a minimum four-year jail term after pleading guilty to multiple rolled-up theft charges.

Kruger fleeced more than $3,780,670 from her former employer Triangle Waterquip between January 2008 and February 2015.

The shonky bookkeeper diddled account records and funnelled her ill-gotten dough to her personal bank accounts and business accounts.

Kruger, of Bonbeach, was employed as a part-time bookkeeper at the Mordialloc company.

Her racket came unstuck after a Triangle Waterquip employee discovered “discrepancies” in February 2015.

The employee questioned Kruger but she told them to “not worry”.

Kruger later admitted thieving $3000 to meet an “urgent commitment”, the court heard.

Further investigation revealed the full extent of Kruger’s skulduggery.

Kruger was hauled in for a meeting with senior staff where she admitted stealing $80,000.

Triangle Waterquip fired Kruger on the spot.

Kruger later signed a deed where she agreed to sell properties to repay the cash.

The victim company also told Kruger if her “unauthorised transfers” totalled more than $1 million then it would dob her into the cops.

Family members who ran Triangle Waterquip told the court they were “adversely affected” by Kruger’s offending.

Kruger, who has repaid more than $580,000 after selling her home and business, was charged in March 2017.

Kruger was jailed for a maximum five years and four months.

SERIAL SWINDLER CRAVED ‘HIGH-END’ LIFESTYLE

Serial conman Dwayne Antojado committed a $100,000 Medibank rort to fund a “high-end” lifestyle of flashy clothes, clubs and cocaine.

Antojado was sentenced in the County Court in March to time served – 609 days – after pleading guilty to obtain property by deception.

Antojado rorted $120,901 from Medibank coffers after the scoundrel used 109 false identities to open accounts between October 2018 and December 2019.

The conman, who paid the minimum premiums for the accounts, lodged multiple bogus claims for non-existent health care services via Medibank subsidiary AHM.

Antojado exploited AHM’s online claiming system which did not require receipts, the court was told.

Antojado then funnelled the dough into various bank accounts held under his name.

The racket unravelled after police arrested Antojado for unrelated offending in June 2019.

Investigators, who discovered evidence Antojado had opened the AHM accounts, sought a search warrant to examine the scoundrel’s bank accounts.

Antojado’s run on the outside came to a screeching halt when police arrested and charged the fraudster in December 2019.

Antojado kicked off his Medibank rort after getting the idea from a “helpful” AHM representative.

The court heard Antojado discovered how easy it would be to commit the scam after being led through the claim process by the representative.

The defence submitted Antojado was “drawn” to Melbourne’s clubbing scene where cocaine and MDMA were his “drugs of choice”.

“It appeared to be social choices … which led to that particular drug selection,” the defence submitted.

“Ice was such that he wouldn’t try it (the drug) due to the stigma but cocaine was a more high-end drug in his eye … not because of its effects but more about how it allowed him to fit in … (it was) the genesis of the offending.”