Whisky war breaks out between business identities over leading Tasmanian distilleries

Whisky sour: A battle is heating up for control of the company that runs two of Australia’s leading whisky distilleries, with a few boardroom spills already observed.

Confidential

Don't miss out on the headlines from Confidential. Followed categories will be added to My News.

Whisky wars have broken out at the big end of town as rich listers tussle over control of the company that controls the nation’s top tipples, including the award-winning Lark and Nant distilleries.

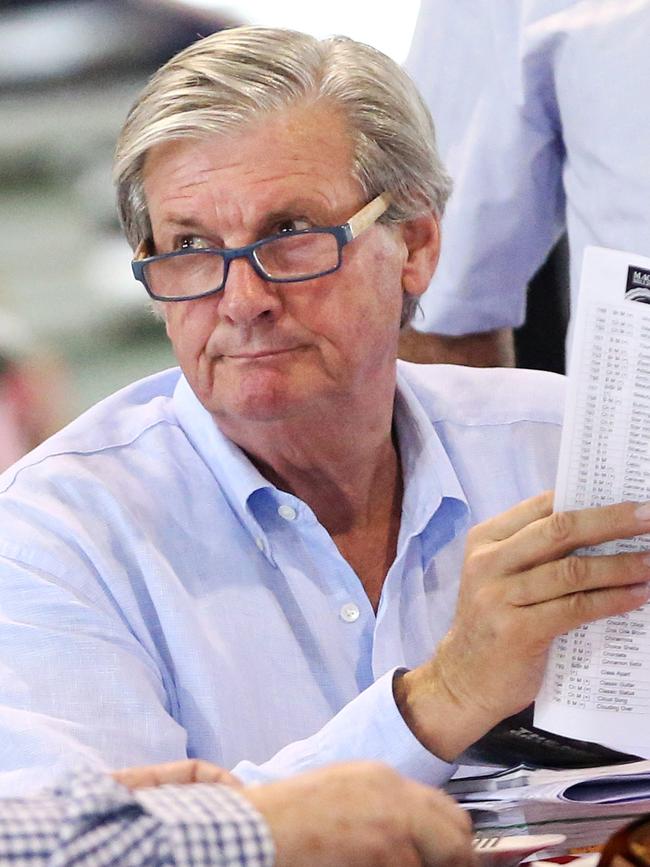

And Hobart businessman Bruce Neill — a major shareholder in infant formula company Bellamy’s who is said to be worth about $670 million — appears the winner.

The ASX listed Australian Whisky Holdings yesterday buckled to Neill’s demands for chair Terry Cuthbertson and directors Peter Herd, Gary Mares and Stuart Grant to all leave the board.

Mr Neill had forced a shareholder vote with his 9.4 per cent of the company yesterday valued at $6 million.

Neill’s choices for the board — former Treasury Wine Estates chief David Dearie and former Grill’d exec Geoff Bainbridge — were given the nod as directors.

Neither side in the stoush were returning calls yesterday.

Both Dearie and Bainbridge are not without controversy. Dearie saw his leadership at Treasury go down the gurgler six years ago after the company poured $35 million in excess stock down the drain.

Bainbridge left the $300 million business Grill’d after an ugly falling out with former best mate and business partner, Grill’d founder Simon Crowe.

Neill had wanted the legendary Bill Lark — who kicked off the Tassie whisky boom — to stay on the board, but he quit yesterday amid the turmoil.

The company’s chief financial officer and acting chief operations officer Brendan Waights

also quit yesterday.

MORE: BIG BANKS SURGE ON COALITION WIN

LOYAL WORKERS GET MORE ANNUAL LEAVE

McCRANN: PM FACES BIG REALITY CHECK

In March last year Australian Whisky Holdings brought the controversy plagued Nant distillery.

Under previous Nant owners, many investors stumped up money for whisky barrels which Australian Whisky, on buying the business, said did not exist.

Neill made a lot of money selling his wealth business Select Managed Funds which was ultimately snapped up by Chris Kelaher’s IOOF in 2009.