Banking regulator warns super funds they have five working days to give struggling Australians their cash

Superannuation funds must not drag their heels when handing over retirement savings to cash-strapped Australians. This is how to get your money quickly.

Coronavirus

Don't miss out on the headlines from Coronavirus. Followed categories will be added to My News.

Super funds have been put on notice not to drag their heels when it comes to handing over money to cash-strapped Australians accessing their retirement savings early.

From Monday Australians in financial hardship because of the COVID-19 pandemic will be able to start accessing their super early which includes withdrawing $10,000 tax-free before June 30.

The banking regulator, the Australian Prudential and Regulation Authority, issued guidelines today and said once an applicant has been given the green light to access their money the cash should be handed over within five business days.

Only in exceptional circumstances where red flags have been identified with the application can process take longer.

The APRA guidelines also state the onus relies on applicants to give their correct banking details for the money to be transferred into their account and funds won’t have time to conduct their usual fraud checks.

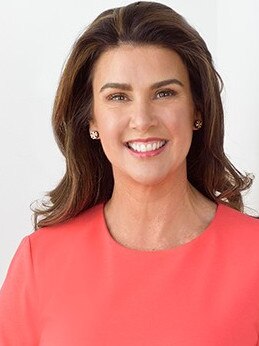

Assistant Minister for Superannuation, Financial Services and Financial Technology Jane Hume said the APRA guidance gave Australians confidence they would get their money quickly.

“Given the importance of cash flow for many people at this critical time the Morrison Government expects super funds to be paying members their money as quickly as possible and within five business days,” she said.

“We understand this is a very challenging time for all Australians,”

To be eligible for early access to super applicants must meet one or more of the following requirements – they are unemployed, eligible to receive a JobSeeker payment, Youth Allowance for job seekers, parenting payment (which includes the single and partnered payments) or Special Benefit or Farm Household Allowance.

Other criteria includes they were made redundant after January 1 this year or had working hours cut by 20 per cent of more.

For sole traders their business must have been suspended or there was a reduction in their turnover by 20 per cent or more.

The Australian Institute of Superannuation Trustees’ chief executive officer Eva Scheerlinck

funds would do everything possible to hand over money to applicants quickly.

“Given the different demographics of the members of each fund, some funds may receive more requests than others,” she said.

“Given there is still plenty of time until the 1 July cut-off date for the first round of early release applications, it may be worth having a conversation with your fund about the impact of the new measures.”

Ms Scheerlinck warned accessing super early should only be done as a last resort.

“A 25-year-old taking $10,000 out of their super could be as much as $120,000 worse off at retirement,” she said.

Eligible Australians can access $10,000 before June 30 and another $10,000 from July 1 through until September 24.

Early registrations of interest can be made via my.gov.au and formal applications will open next week from Monday, April 20.