Young Australians feel they need six-figure salary for decent lifestyle

A big paycheck and impressive job title have become increasingly important to young Aussies. Here’s how experts think they can achieve these bold goals.

Careers

Don't miss out on the headlines from Careers. Followed categories will be added to My News.

Young Aussies say they need to earn at least $121,000 a year for a decent lifestyle.

The figure – identified by more than a quarter of Australian investors aged 18-24 years as the minimum required to “reach their desired standard of living” – is $25,500 more than the average full-time salary, exclusive research from online brokerage Stake reveals.

Seven per cent of young Aussies say they need to earn more than $250,000 a year.

The pay wishes are a far cry from the average Australian salary, which is now about $95,500 a year, or $1838 a week, according to latest ABS figures.

An impressive job title is also important to three-quarters of young people, the Stake research shows. In comparison, two-thirds of Aussies aged over 45 say an impressive title is not important at all.

‘Start as the CEO’

People and behaviour expert Mark Carter believes the research will further harm the reputation of young workers, who have unfairly been criticised as entitled.

But he says inflation is increasing the salary needs of all Australians and there may be legitimate reasons young people need more money.

“The joke going around is that young people want to start as the CEO and progress their career from there,” Carter says.

“But if you look at the flip side, younger generations often have HECS (student loan) debts that add to the already growing cost of living, plus the (potential) pressures of buying a house.

“Is it realistic (for a young worker to be on a $121,000 salary)? No, not necessarily.

“But, that said, they’re goals, or aspirations. Goals are achieved by not being realistic, to some degree.”

Be bold

With worker shortages at crisis point, Carter says young people may be able to negotiate higher salaries than would otherwise be the case. But he warns bosses will expect them to quickly prove their worth.

He suspects the need for an impressive job title is linked to the desire to bolster CVs, noting young Australians will have multiple roles over their lifetime.

“You’ve got to admire the confidence of young people,” Carter says.

“Could we (other generations) learn from them? Maybe.

“Maybe we could take some of their boldness and their tendency not to be shy to put themselves forward.”

Sacrifices

Carwyn Davies, 21, is weeks away from finishing an advertising degree.

With entry-level advertising positions typically paying $70,000 a year, Davies admits she’s worried about making ends meet and has all but abandoned dreams of moving out of the family home.

“I feel like I would need to make $160,000 just to move out and live a comfortable life but (based on realistic expectations), that (salary) will be chopped in half,” she says.

“I want to put money into buying a home or travelling overseas. I’ve got a HECS debt and … recreational things cost a lot of money as well – just going out with friends to simply have dinner (is something) I can’t afford.”

Davies says she has considered swapping her preferred career for a higher-paying industry but is determined to follow her passion.

“I’m willing to make that sacrifice (of a higher salary) and live at home for longer,” she says.

“But it would be so hard if my parents weren’t so accommodating and supportive.”

Other income streams

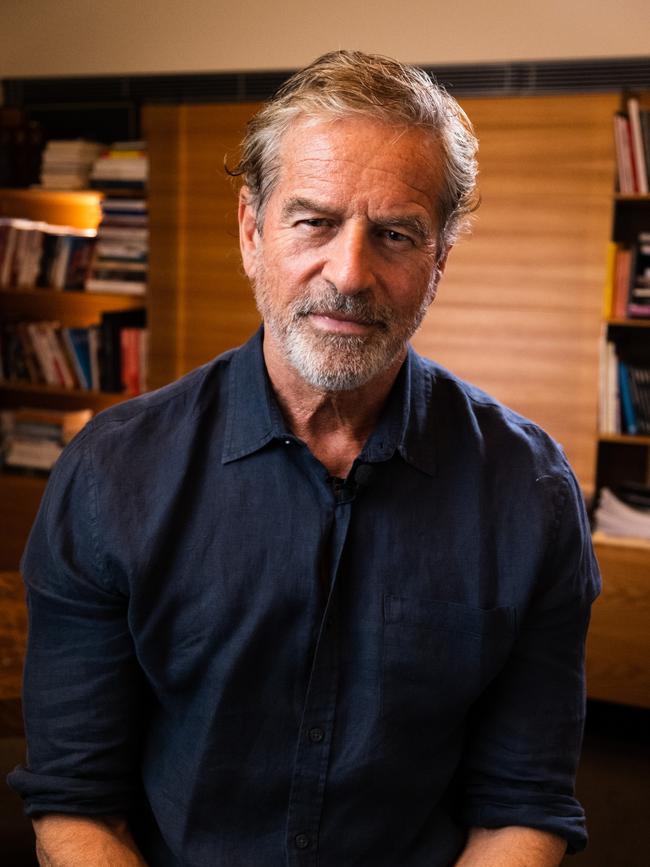

As inflation continues to outstrip wage growth, finance guru and Australian businessman Mark Bouris suggests young people look to investments to maximise their wealth.

“Young people are at an advantage when it comes to investing for the long term, thanks to compound interest,” he says.

“This essentially means that you earn interest on top of your gains and, over time, this has a massive impact on your potential future returns.”

When it comes to careers, Bouris says establishing a proven reputation as a dedicated worker will stand young people in good stead.

“You do this by being prolific, by chasing, executing and being a champion for good ideas within the business,” he says.

“That’s how I did it when I was coming up. Once this foundation is built, you will have greater flexibility to advocate for yourself and secure a pay rise.”

Set money goals

There is no one-size-fits-all salary to live a financially stress-free life, says William Buck principal wealth advisor Danielle Barron. She notes most Australians “live to their means”.

“It’s not necessarily the size of the salary that matters, it’s what you do with it,” she says.

“Those on higher salaries sometimes simply find more ways to spend and, in some cases, may end up financially worse off than those with less income.

“With your financial advisor, it’s very helpful to map out all your expenses and saving goals now and into the future, taking into account likely life changes such as home ownership and family.

“From there, you can determine the base income needed to fund your lifestyle.”

Show me the money

• The average weekly full-time adult wage is now $1898 – up 3.9 per cent (or $68 a week) since last year

• Public sector workers remain higher paid, on average, at $1999 per week, than those in the private sector ($1797)

• Ordinary weekly earnings are highest in Western Australia ($2039) and the ACT ($2028). The lowest are in South Australia ($1678) and Tasmania ($1619)

• Miners are the highest paid full-time workers, earning an average $2854 a week, followed by those in information, media and telecommunications ($2318). Accommodation and food services workers are the lowest paid, at $1347 a week.

Source: Australian Bureau of Statistics