One man blamed for Australia’s biggest crisis

Horror predictions show Australia’s biggest problem is set to explode in 2025. One high profile Aussie has found himself being blamed for it all and he has hit back.

Leaders

Don't miss out on the headlines from Leaders. Followed categories will be added to My News.

Of all the problems facing Australia today, there’s one crisis that stands out as the most pressing — particularly if you’re at the younger end of the age spectrum.

Housing affordability has been a problem for decades now and, despite house prices slightly dropping over the past year in major cities and multiple governments trying to take action, there appears to be no relief in sight.

Houses prices have increased at roughly double the rate of wage growth for 25 years — meaning they have become out of reach for all but the well-off.

All the predictions suggest we will see the cash rate slashed on Tuesday, but interest rates are still high and the cost of living crisis and high rents are a massive hurdle for first time buyers to overcome. There are also concerns that if rates drop, house prices will begin to surge by more than 5 per cent his year alone in many cities.

Any way you look at it, it’s a dismal outlook for those trying to grab a slice of the great Australian dream — and the blame for the crisis was laid largely at the feet of one man this week.

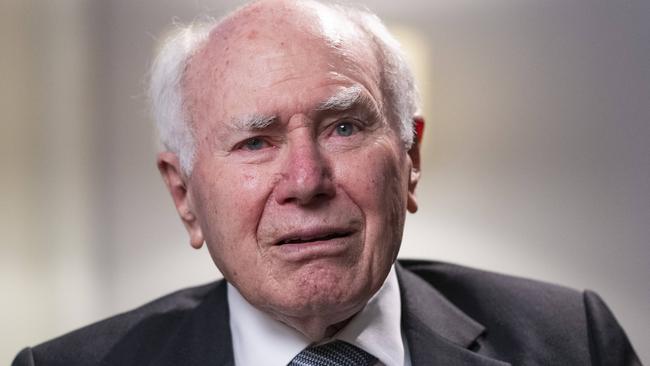

The ABC’s financial expert Alan Kohler took a deep dive into the crisis and, in his opinion, former Prime Minister John Howard is the main culprit.

“It’s my view John Howard did more than anyone to make housing unaffordable,” he said.

In 1999, Mr Howard cut Capital Gains Tax (CGT) by 50 per cent for individuals, after Labor had introduced the tax in 1985.

House prices surged and four years later, he was challenged in a radio interview about the property market overheating. His answer was telling.

“Anybody who owns a house is very happy that the value of that house has gone up, let’s be quite straight about that,” he said at the time. “I haven’t found anybody in seven and a half years shake their fist at me and say Howard I’m angry with you for letting the value of my house increase.

“So it is not a problem if you own a house, it is true that to get into the market in the first place it is harder if the prices continue going up.

“And one of the reasons why housing prices have gone up is that people can afford to borrow more because interest rates are lower. In a sense, we are the victims of our own success and our own prosperity.”

More than 20 years later, it appears we are still the victim of our own success but Mr Howard still stands by his word — telling news.com.au he still strongly believes in his approach was the right one.

“I completely reject the claim by the ABC that my policy of opposing a CGT on the family home was responsible for the housing crises,” he said.

“The principal asset most Australians have is the family home and I will continue to fight to keep the family home from Capital Gains Tax.”

Kohler meanwhile argued that policies like Mr Howard’s and the rejection of ideas like Bill Shorten’s — to restrict future negative gearing to new homes only and to cut the CGT concession from 50 per cent to 25 per cent — have created a nation where housing is seen as an investment opportunity rather than a roof over your head.

With huge levels of immigration, state governments like NSW and Victoria are desperately trying to meet an “aspirational target” set by the federal government and agreed by all parties to build 1.2 million new well‑located homes over five years from mid‑2024.

Kohler argued these targets will not be met because building those houses in new suburbs would cost too much in infrastructure — roads, public transport, water, power, schools and hospitals — which can’t be afforded after Covid.

“Therefore, the cost of population growth and more affordable housing will be borne by the existing residents of suburbs to be densified, in the form of crowded roads, trains, schools, hospitals, doctors etc,” he said.

“Or rather, that’s what would happen if the target was met, which it won’t be, so the NIMBYs probably needn’t worry.”

He argued that until Aussies who own a home accept there could major developments around them that could decease the value of their biggest asset, house prices will rise faster than incomes and the problem of affordability will continue to spiral.

Real estate agents’ major prediction

If the experts and real estate agents are anything to go by, the mountain facing first time home buyers is about to get a whole lot steeper.

Two-thirds of real estate agents predict house prices will rise in 2025, driven by improving affordability, rising incomes and the potential of cuts to interest rates, according to a new CoreLogic report.

The report released last week reveals 65 per cent of them expect house prices to rise, with 25 per cent predicting gains greater than 5 per cent. Queensland emerged as the standout market, buoyed by strong internal migration trends, with 70 per cent of respondents forecasting price growth for the Sunshine State in 2025.

In Melbourne, where data shows the median dwelling value of $774,000 has fallen -6.4 per cent below its 2022 peak of $801,000, agents anticipate a potential recovery, citing affordability and renewed demand.

Meanwhile, the Reserve Bank predicts real household disposable income in 2025 will increase by just under 2.4 per cent — which means house prices will rise at twice the rate of disposable income.

While it's uncomfortable reading for those saving for a deposit, those who have recently bought will be sighing with relief as interest rates are tipped to come down.

This week, Australia’s second largest lender, Westpac, became the latest of the big four banks to cut its interest rates just days prior to the Reserve Bank meeting to discuss Australia’s official cash rate.

According to Canstar rate tracking, Westpac has cut fixed rates for owner-occupiers by 0.40 percentage points, while investors will see a 0.35 percentage points reduction in their payments.

US faces rates uncertainty

What happens in the global economy is impacted by what happens to our friends over the Pacific in a big way, and this week the US was dealt a spanner in the works of its inflation battle.

US President Donald Trump on Wednesday blamed his predecessor Joe Biden for last month’s unexpected acceleration in consumer inflation, as he looked to deflect a moment of potential political peril early in his second term.

The consumer price index (CPI) edged up to 3.0 per cent in January from a year ago, the Labor Department said in a statement — slightly above economists’ estimates.

Stripping away volatile food and energy costs, so-called core inflation rose by 3.3 per cent over the past 12 months, which was also slightly above expectations.

“BIDEN INFLATION UP!” President Trump wrote on Truth Social shortly after the data was published, seeking to blame Mr Biden for the CPI figures, which included 12 days in which was President Trump was in office.

“It’s far worse than I think anybody anticipated, because unfortunately, the previous administration was not transparent in where the economy truly was,” White House Press Secretary Karoline Leavitt told reporters in Washington later Wednesday.

Inflation increased by 0.5 per cent in January from a month earlier, while core inflation rose by 0.4 per cent.

President Trump on Wednesday also called for interest rates to be lowered, adding they would “go hand-in-hand” with his plans to impose tariffs on major US trading partners — despite many economists arguing that both measures could boost inflation.

Originally published as One man blamed for Australia’s biggest crisis