Latest ATO Statistics Report exposes gender divide in more areas than one

Data from the ATO has highlighted a significant issue impacting more than half of the country’s population, which could determine who has a better retirement.

Careers

Don't miss out on the headlines from Careers. Followed categories will be added to My News.

New data has revealed the alarming disadvantage just over half of all Australians have when it comes to their retirement savings.

Tuesday’s release of the Australian Taxation Office’s (ATO) Statistics Report for the 2019 to 2020 financial year offered Australian workers insight into the country’s top paying jobs, highest-earning suburbs and popularity of private health insurance.

According to the report, the average Australian earns just over $63,000 in taxable income while surgeons earn the highest paying salary.

Additionally, more than 2 million generous Aussies contributed to their workplace giving programs and those living in Western Australia’s 6011 postcode received the highest average taxable income.

But despite the report highlighting the country’s wealthiest points, what significantly stood out is a well-known, long-term issue.

When comparing men and women across the board, the report indicates that men have the upper hand when it comes to who has the higher paying salary, a trend further affecting superannuation earnings.

The average taxable income for men sits at $74,559, which is just over $21,000 more than their female counterparts who earn an average of $52,798.

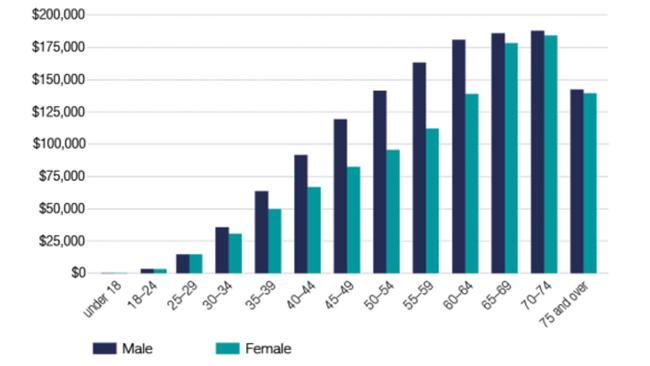

As a result, women’s superannuation account balances were less than men in all age groups but one.

How much less super does a woman earn compared to her male counterpart?

From the moment women step into the workforce, the ATO’s report shows they’re already at a disadvantage when it comes to their super accounts.

Females under the age of 18 began their super journey with a median super account balance of $137, which is more than $100 less than what males their age saved.

The only time where women had more money in their super accounts than men was in the 25 to 29 age bracket, where females had a median of $48 more in their retirement savings.

However beyond this point, the difference in retirement savings between the age groups were largely significant, with men always having more super than women.

The largest gap was evident in the 55 to 59 age group, where male workers had $51,058 more super savings than the median for females.

While the gap grew smaller from 60-years-old onwards, men always had more savings in their retirement account.

Why do men earn more super than women?

Glen McCrea, deputy CEO of the Association of Superannuation Funds of Australia (ASFA), told news.com.au that previous super requirements such as the minimum Superannuation Guarantee threshold, prevented women in lower-paid, part time roles from earning super.

While this rule has since been scrapped, it’s set a lot of women back in their retirement savings.

Additionally, Mr McCrea said family commitments can also largely impact the amount of super a woman earns.

“ASFA analysis indicates that taking a year off for each of two children can lead to 10 per cent less in superannuation at the time of retirement,” Mr McCrea said.

Meanwhile, Mary Wooldridge, the director of Workplace Gender Equality Agency (WGEA), said the gender pay gap also plays a significant part in why men acquire more super than women.

“Women in Australia, on average, retire with significantly less superannuation than men predominantly because they earn less over the course of their working lives, and Superannuation is directly related to remuneration,” Ms Wooldridge told news.com.au.

“WGEA data shows that women, on average, earn 22.8 per cent less than men, in terms of total remuneration. This leads to a consistent shortfall in superannuation contributions, year after year.”

How can employees earn more super?

While women are at a disadvantage in regards to how much super they earn, Mr McCrea said men aren’t as well off as they think.

The deputy CEO said according to the ASFA Retirement Standard, couples need to save up a lump sum of $640,000 and a single person needs $545,000 in super by the age of 67, to live comfortably.

The ATO’s data suggests Australians are well off this number, however Mr McCrea said not all hope should be lost as the superannuation system was still maturing.

“The number of people who are self-funded in retirement is increasing and we estimate that 50 per cent of people will retire at the comfortable level by 2050,” he said.

“Importantly, moving the Superannuation Guarantee to 12 per cent of wages over the next few years, as is legislated, will underpin achievement of this level.”

As for how women can improve their retirement savings, Ms Wooldridge from the WGEA said it’s up to the employer to ensure they’re playing their part in closing the gender pay gap.

“A key action is for employers to undertake pay gap audits and address the issues identified so that women can be fairly compensated while they are working,” she said.

“This will, in turn, improve their economic security in retirement.”

Other options to boost super includes making voluntary contributions to your superannuation account, which comes with tax concessions.

Low to middle-income earners are also eligible for the government’s co-contribution option, where employees can receive up to $500 in their super account from the government after lodging a tax return.

What to do if you don’t think you’re earning enough super?

Australian workers are entitled to super from the age of 18 plus no matter how much they earn or the number of hours they do, while those under 18 must work a minimum of 30 hours per week to qualify for super guarantee contributions.

As of July this year, an employee must pay super equal to 10.5 per cent of an employee’s income under the country’s superannuation guarantee program. This is up 10 per cent from the previous financial year.

The only circumstances where an employee is not entitled to super is if they’re a non-Australian resident paid for work done outside of Australia, an Australian resident paid by a foreign employer for international work, or those covered by a bilateral social security agreement.

Overtime, expense allowances, mileage and other reimbursements aren’t usually included in your weekly super balance, however an employer must indicate what hours are overtime versus regular hours or else they’re required to pay super on all hours.

“The best thing people can do is to regularly check in on their super to make sure contributions are being made, read their statements when they arrive and call their fund if they have any questions,” Mr McCrea recommends.

“If anyone is concerned that their super is not being paid, they should talk to their employer in the first instance and then contact the ATO if necessary.”

Originally published as Latest ATO Statistics Report exposes gender divide in more areas than one