QBCC whistleblower reveals dire state of Queensland’s building regulator

The employee quit after claiming this government department “doesn’t care about people”, including customers, or her.

EXCLUSIVE

One of Australia’s biggest building regulators has been accused of failing customers and working its own staff so hard that some are on the brink of mental breakdowns and even suicide.

The Queensland Building and Construction Commission (QBCC) regulates the Sunshine State’s building sector, which includes providing struggling homeowners with payouts if their homes are defective or if their builder goes bust.

But a former staff member has called the government organisation “a joke” and accused it of forcing unqualified staff into making decisions which end up costing homeowners thousands of dollars.

“They (the QBCC) do not care about people,” Amber, a single mother in her 30s, told news.com.au.

Amber, whose name has been changed to protect her privacy, worked at the QBCC for 18 months but quit earlier this year.

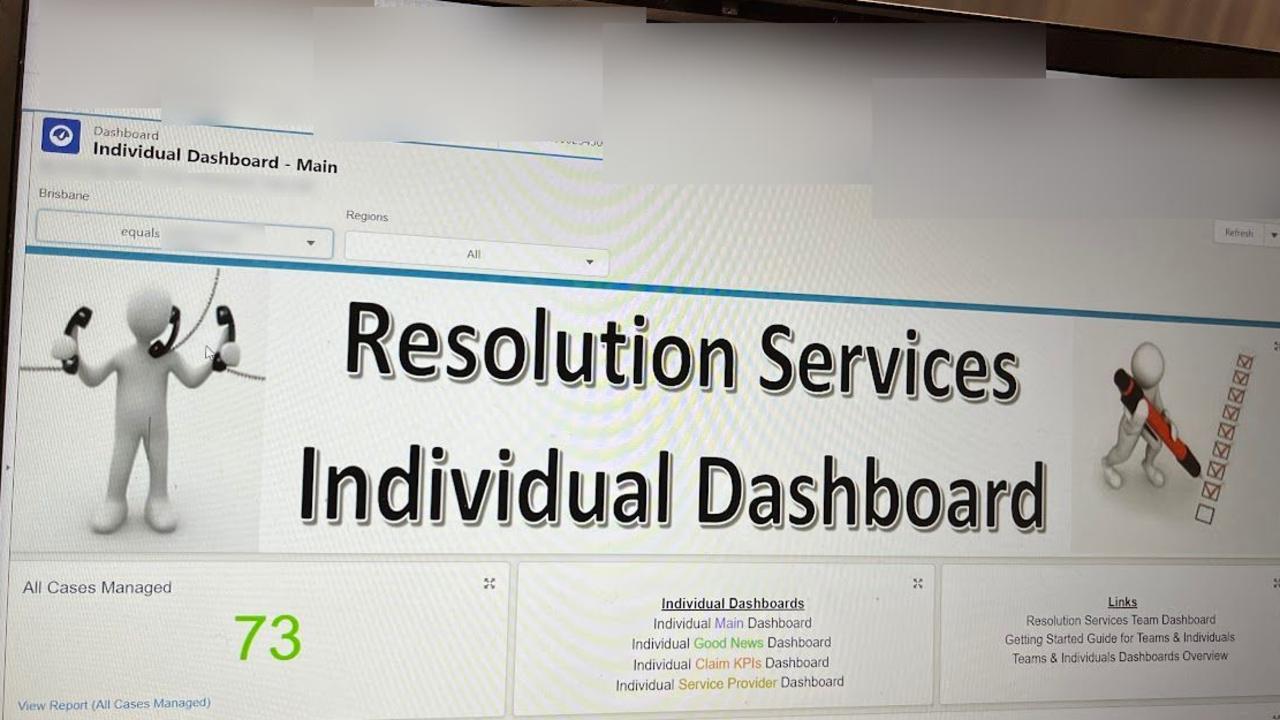

She said her workload was insane, with “no time to double check” anything, in turn forcing her to make rushed decisions which financially devastated customers.

Only three months into the job, Amber said she was responsible for more than 100 cases, while admitting “I had no idea what I was doing”.

“Unexperienced temporary staff are making a decision on a claim when we’re not lawyers,” she said. “We’re making serious decisions on someone else’s major asset. And we’re not qualified.

“There’s concern that we’re not making the right decision,” she said. “There’s no pressure not to approve claims. It’s just get to the decision as fast as you can.”

She said she has cost one customer $10,000 and another customer six months because she made a mistake in their insurance claim.

Have a story? Get in touch | alex.turner-cohen@news.com.au

And the problem is, once a decision is made, it’s virtually impossible to get it reversed. News.com.au has previously reported that if a customer appeals a decision, the QBCC has a 28-day window to review their case.

But if the government body can’t look at the case in that period of time, which is common, then the appeal just reverts back to the initial decision.

“I used to say to my customers, ‘if you’re not happy, then go to the media’,” Amber said.

QBCC case officers like Amber have been slammed with work in the past two years after several major builders collapsed in the state, including Oracle Homes, which went bust owing $14m with 300 homes left incomplete, PDH Homes with more than 1700 projects across Victoria and Queensland, and PBS Building also went under with $25 million of debt and 80 Queensland projects in jeopardy.

A QBCC spokesperson said they had hired 157 new staff since June last year amid growing demand and to “prioritise...the wellbeing of our people”.

But even with the extra hands, things haven’t got easier, with Amber claiming “the only way you can keep on top of the work is to do overtime,” something which the QBCC has denied.

Amber claimed some cases were being assigned to staff even if they are on sick leave or annual leave.

One time she worked when she had both Covid-19 and an eye infection and on another occasion, Amber said she worked until 3am because she was about to go on leave and if she didn’t do that to catch up on her work she would be told off.

Exhausted, the next day she had a car crash and had to write off the car, and also suffered from whiplash.

“I hate that customers think it’s us. We’re genuinely worried about them. We’re just snowed under, it’s impossible to keep on top of things,” she said.

Serious issues in the QBCC’s process dealing with customers’ claims

It usually takes three months for a claim to be accepted, Amber said, and after that a further 12 months for the payout to be finalised.

“The process is a joke, I’ve said that so many times. The process is a failure,” she said.

In the wake of multiple building companies going bust, the QBCC introduced a cash settlement offer, which is meant to be a fast, streamlined offer for customers.

However, Amber said she found a mistake in the claim from a building surveyor which had severely reduced the amount the customer would have received, and the settlement ended up taking more than a year for them to rectify it.

“The cash offer was meant to be quicker. But I say to everyone, you have to pick between time and money,” Amber said.

Amber said she fears “Nothing will happen until someone takes their life”.

It comes after the Victorian equivalent of Queensland’s regulator, the Victorian Building Authority (VBA), was charged over the suicide of one of its staff, where the man was overwhelmed with pressure to meet ambitious targets.

The QBCC comes under Queensland Housing Minister Meaghan Scanlon’s portfolio.

In a statement, Ms Scanlon said “The QBCC is an independent authority, but it’s my expectation that any allegations be looked at and dealt with appropriately”.

alex.turner-cohen@news.com.au

*Name withheld over privacy concerns

Originally published as QBCC whistleblower reveals dire state of Queensland’s building regulator