Mark Bouris issues grim retirement warning for Aussies

Young workers have been told they will have no choice but to work into their later years “because you won’t have enough money”.

At Work

Don't miss out on the headlines from At Work. Followed categories will be added to My News.

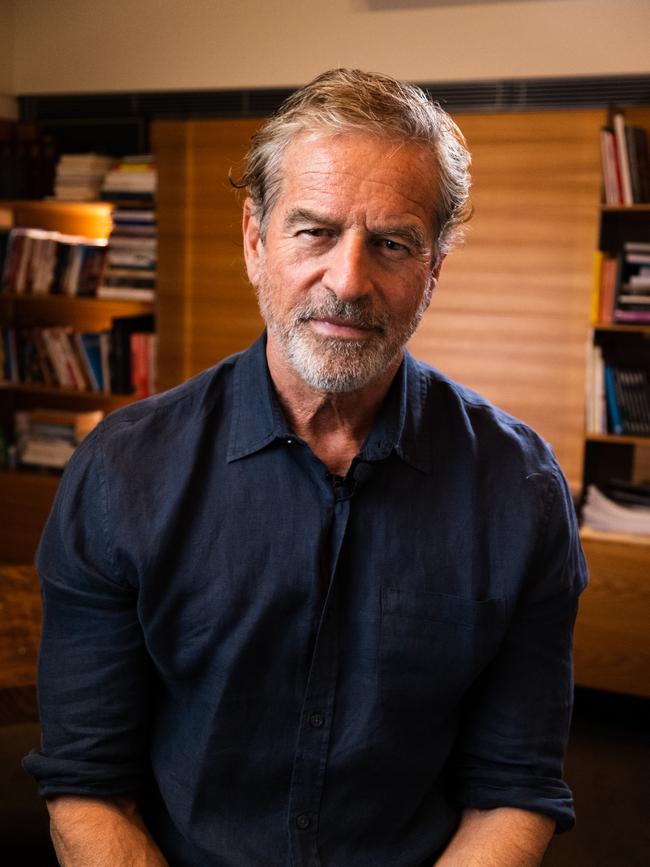

Businessman Mark Bouris has issued a grim warning for young Australians – they should be prepared to work into their 80s.

Speaking on his Mentored podcast, Mr Bouris said Gen Z and Millennials “won’t be retiring at 65 … because you won’t have enough money”.

“If you’re 20 now you won’t be retiring until you’re 80, maybe 90,” he said.

“You might be putting super away, but the super you’re putting away today will never be enough by the time you’re 65 years of age in the current environment.

“Everything’s gonna be so expensive, it’s just gonna keep going up, and up, and up. We’ve seen house prices and what they’ve done.

“If you think that you’re gonna retire at 65 or you’re gonna have enough money to retire at 65, you’ve got another thing coming.”

There is no official retirement age in Australia, but a person must be 67 before they are eligible to receive the age pension.

A report by Vanguard last year found that almost half of retirees did so earlier than they would have thought.

The average retirement age reported was 61, while those still working had an average ideal retirement age of 62.6 but an average realistic age of 67.9.

“A key factor feeding into the fear of running out of money in retirement is the ongoing increases in average life expectancy rates,” wrote senior finance writer Tony Kaye in October.

“One in two of the more than 1,800 Australians aged 18 years and over who participated in Vanguard’s retirement research said they did not know whether their money will last in retirement.”

Analysis by KPMG in 2024 found the average retirement age post-Covid had risen to the highest levels since the early 1970s.

The expected retirement age for men was 66.2 years, and for women was 64.8 years, the highest since 1972 and 1971 respectively.

“The adoption of working from home has made many older Australians in professional jobs realise that they could ‘semi-retire’ and continue to dabble in the workforce from home or even from a coastal location,” KPMG urban economist, Terry Rawnsley said.

Meanwhile the Association of Superannuation Funds of Australia declared in December couples need to have $73,000 to spend each year to enjoy a “comfortable” retirement.

That figure was on the basis people owned their own home outright, a reality that has become less common for Australians due to ballooning property costs.

Mr Bouris said young workers would need to “accept” the changing goalposts and “enjoy working” for longer.

The Yellow Brick Road chief said the traditional retirement age of 65 also assumed people would die by 80 – and people were now living longer.

“If you’re going to die when you’re 100, and you retire at 65, but the assumption has been made that you’re going to die at 80, you’re going to have 20 years where you’ve got no money,’ he said.

“So I can tell you now, you will be working till you’re 80.

“So you might as well accept it now. I’m going to enjoy working, with all my mates. And hang around with people who have the same sort of view.”

More Coverage

Originally published as Mark Bouris issues grim retirement warning for Aussies