‘We’ll tax you till you’re poor’: How Norway’s Labor-style wealth tax sparked $84 billion disaster

Labor’s controversial super tax has already sparked panic — and experts warn Australia only needs to look at this country to see what happens.

Super

Don't miss out on the headlines from Super. Followed categories will be added to My News.

Labor’s controversial tax on unrealised superannuation gains has already sparked “panic” as investors scramble to sell off assets — and experts say Australia should heed the warning of Norway as a cautionary tale.

Treasurer Jim Chalmers defended his plan to double the tax rate on superannuation earnings above $3 million, from 15 per cent to 30 per cent, despite growing pressure to ditch the policy which would, most controversially, tax unrealised gains on assets including property, farms and shares held by super funds.

He called the policy “modest” and claimed the “changes affect a tiny, tiny sliver of people with superannuation”.

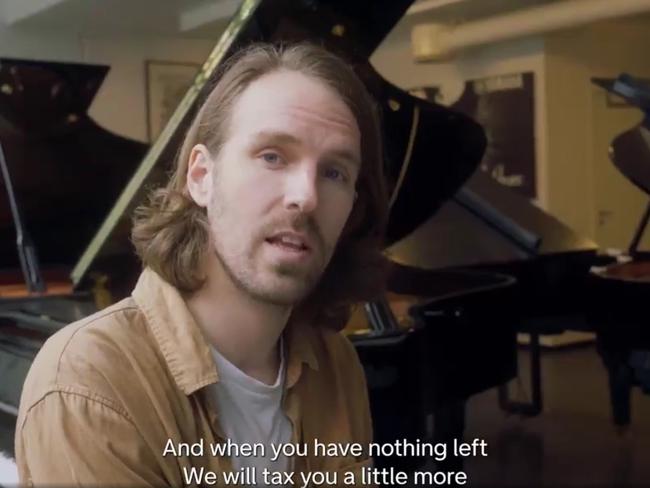

However, a policy with similarities to Labor’s has been pushed by Norway’s government in recent years, and the effects have been stark. They were outlined in a song that went viral on social media.

“Don’t come to Norway, we will tax you till you’re poor — and when you have nothing left, we will tax you a little more,” Christer Dalsbøe, founder of Norwegian tech company Braver sang in a video that caused a stir on social media last year.

“Before you make a grave mistake, you need to be aware. We even tax paper valuations. You’ll have to sell your shares. So if you’re good at technology or business, please stay out. A booming public sector is what this country is about.”

Norway, with a population of 5.5 million, has similarly high income taxes as Australia used to fund its generous social welfare programs, but its wealth taxes are unusual, as they include unrealised gains — taxing the change in the value of an asset even if it is not sold.

In 2023, the country’s centre-left government raised its wealth tax to 1.1 per cent from 0.85 per cent and raised the dividend tax, accelerating an unprecedented exodus of the country’s ultra-wealthy, many of whom have relocated to Switzerland in recent years.

MORE: Can you use superannuation to buy a house?

“The recent wealth tax increase in Norway was expected to bring in an additional $US146 million ($228 million) in yearly tax revenue,” according to research by Alex Recouso, co-founder and chief executive of CitizenX.

“Instead, individuals worth $US54 billion ($84 billion) left the country, leading to a lost $US594 million ($927 million) in yearly wealth tax revenue. That’s a net decrease of $US448 million ($699 million).”

Among those billionaires and multi-millionaires to flee were industrial tycoon Kjell Inge Røkke, who moved to Italian-speaking Swiss city of Lugano.

Mr Røkke was Norway’s fourth-richest person and the country’s highest taxed individual in 2022. His departure was expected to cost Norway about 175 million kroner ($26 million) in lost tax revenue per year, according to The Guardian.

Owners of companies are among those hit hardest, often drawing a modest salary even though their company has a high value.

“If your salary is one million and you have to pay one million in [wealth] tax, it’s clear that it’s untenable,” Tord Ueland Kolstad, a real-estate magnate who “grudgingly” moved to Lucerne, Switzerland in 2022, told AFP last year.

“The system is designed so that it confiscates more than what you can produce.”

To pay a wealth tax, which can exceed their yearly income, entrepreneurs often need to take out dividends, hampering their company’s capacity to invest.

Those dividends are also subject to a tax rate of 37.84 per cent. “So basically you have two options — either leave Norway, or sell your company,” Mr Kolstad said.

Mr Recouso explains that Norway’s approach to wealth taxation “reflects a sophisticated yet burdensome system that interweaves multiple fiscal obligations”.

“Each municipality wields authority to levy its own tax rates, while the national government imposes additional charges on personal income, net worth, and various forms of capital,” he writes.

“The current structure encompasses property tax, value-added tax, and capital gains tax, creating a comprehensive framework that has prompted many of the nation’s wealthiest citizens to reconsider their residency.”

He adds that the valuation of assets for tax purposes, particularly real estate holdings, “frequently generates friction between taxpayers and the tax administration, as disagreements arise over assessment methods and fair market determinations”.

“Norwegian entrepreneurs and billionaires face particularly galling challenges under this tax regime,” he says.

“The wealth tax rate, combined with dividend tax, often forces business owners to withdraw substantial funds from their companies solely to meet tax obligations. This creates a destructive cycle that hampers business growth and reduces incentives for domestic investment.

“The situation becomes even more complex when you consider the exit tax regulations, which insidiously attempt to capture value from departing residents.”

Norwegian Prime Minister Jonas Gahr Store last year criticised the exodus, stressing that taxes are what pay for Norway’s generous welfare system.

“When you’ve made your wealth in Norway, put your kids in school, benefited from the healthcare system, driven on the roads and reaped the rewards of its research, it’s a breach of the social contract,” he said in a speech to parliament.

Geoff Wilson, founder of Wilson Asset Management, said Norway “provides valuable lessons for Australia”.

“Since [2023], over 100 of Norway’s top 400 taxpayers, representing 50 per cent of that group’s wealth, have left the country to protect their businesses,” he wrote in a report last month critiquing Labor’s proposal.

“Norway has since seen a fall in gross domestic product, venture capital investment, and has also experienced higher household indebtedness … the Norwegian brain and wealth drain is a direct result of the tax on unrealised gains.”

Treasurer Jim Chalmers held firm this week on his plan.

“I think most people recognise that these are modest changes [that] affect a tiny, tiny sliver of people with superannuation — still concessional tax treatment just slightly less concessional for people with very large superannuation balances,” he told The Australian Financial Review.

The government has also been criticised for the decision not to index the $3 million cap to inflation, with modelling suggesting the number of taxpayers affected would rise from 80,000 initially to capture the majority of Gen Z workers entering the workforce today by the time they retire.

Financial advisers this week warned retirees with self-managed super funds (SMSFs) had already begun “panic” selling assets and restructuring their investment portfolios to get ahead of the changes, which are slated to start on July 1 if the legislation is passed by the Labor-Greens majority Senate.

Shadow Finance Minister Jane Hume this week called on Dr Chalmers to abandon the “unfair” policy and urged his new economic team to “speak sense” to the Treasurer.

SMSF Association chief executive Peter Burgess on Thursday called on the government to urgently rethink the tax.

“No one disputes Treasury’s desire for a fair and equitable superannuation system, but to claim this tax only affects a minority and serves the national interest is shortsighted,” Mr Burgess said.

“It ignores the broader ripple effects. The government’s narrow focus is blind to the vital connections between superannuants, small business owners, primary producers, and angel investors. This oversight is already destabilising the SMSF sector and threatens to disrupt the delicate balance of our economic ecosystem.”

Warren Hogan, the chief economic advisor to Judo Bank and managing director and founder of EQ Economics, told Sky News the principle of taxing unrealised gains would “not work very well”.

“You’ve got this asset that’s gone up in value, but you don’t want to have to sell that asset in order to pay the tax on it,” he said on Friday. “So where do you get money or liquidity from? “You have to sell something else or have money in the bank to pay that tax. In practice, it doesn’t work very well, particularly for those sorts of assets like farms and houses.”

And a growing number of high-profile investors have warned the policy will devastate Australia’s venture capital and private equity sectors, responsible for funding some of the country’s biggest start-up success stories like $50 billion tech firm Canva.

Industry figures say the proposed tax does not account for the highly illiquid nature of start-up investments.

“I’ve turned down like five good companies that I would have put money into, just because I don’t even know how I’m going to deal with it,” angel investor Dean McEvoy told Capital Brief.

As of January, the total assets under management for all Australia-focused private capital funds reported was just under $150 billion, according to ASIC figures.

That includes $60 billion in unlisted equities, $60 billion from unlisted property, $16 billion in private debt, $12 billion in alternatives, and a growing number of green-focused companies and initiatives.

“This tax will cripple these markets, especially those that predominantly invest in emerging industries such as technology start-ups that address climate change and those driving forward the transition towards a greener economy,” Mr Wilson said.

“These markets are illiquid and mark to market accounting requires six monthly reassessment of valuations, posing great risks.”

Citing the example of Canva, the web-based design platform founded in Perth a decade ago, Mr Wilson noted that to achieve its current valuation it had 18 funding rounds.

“Under taxing of unrealised gains, every funding round would require tax to be paid on a hypothetical valuation,” he said.

“Most start-ups operate with negative cashflow and when capital is raised it is to fund growth, not to provide liquidity to investors. Therefore, there is no liquidity to pay tax on an unrealised gain. If this tax is implemented, the Australian venture capital industry will be permanently and negatively impacted. Start-ups will move offshore and green initiatives with long time horizons will not get off the ground.”

Mr Wilson estimates that changes could have the unintended consequence of triggering a flood of money into the housing market, with up to $155 billion in assets moving into tax exempt structures such as primary residences.

Dr Chalmers again defended the policy on Friday, saying there was “not a unanimous view amongst economists about the worthiness of the change that we’re proposing — I think Chris Richardson wrote something supporting it”.

“So as always when you’re making a change like this there’s always a range of views,” he told reporters.

“Obviously I follow closely the comments made by the peak groups and others. We’re still providing concessional tax treatment for big balances in superannuation, it’s just slightly less concessional. But it’s concessional compared to the marginal rate that people would be paying.”

The Treasurer insisted “we need a little bit of perspective here”.

“I know this is seen in some quarters as contentious,” he said.

“We announced this policy almost two-and-a-half years ago, it’s been in the parliament for a big chunk of that, we’ve been consulting on it. It’s a modest change. It still leaves concessional tax arrangements in there for people who have more than $3 million in super. It is a modest change, it does impact only a very small amount of people and it still provides concessional tax treatment.”

— with AFP

More Coverage

Originally published as ‘We’ll tax you till you’re poor’: How Norway’s Labor-style wealth tax sparked $84 billion disaster