Kerry Packer’s former accountant reveals tax secrets

Kerry Packer’s comments on tax — anyone not minimising it needs their head read — are legendary. One of his top accountants has now penned a book sharing his tax secrets.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

It was a salary perk that only Kerry Packer would provide – instead of cash, he awarded one of his most trusted accountants a complete rebuild of an E-Type Jaguar.

“A lot of us who worked for Kerry had a car fetish so this was great,” Allan Mason, a former key accountant at Packer’s Consolidated Press Holdings, recalls.

“This was also back in the days before fringe benefits tax so it was very tax effective for Kerry as well.”

Mason worked for the late media mogul for more than a decade in the 1980s and 1990s, overseeing a number of business divisions within CPH and making sure the company only paid only what it legally owed.

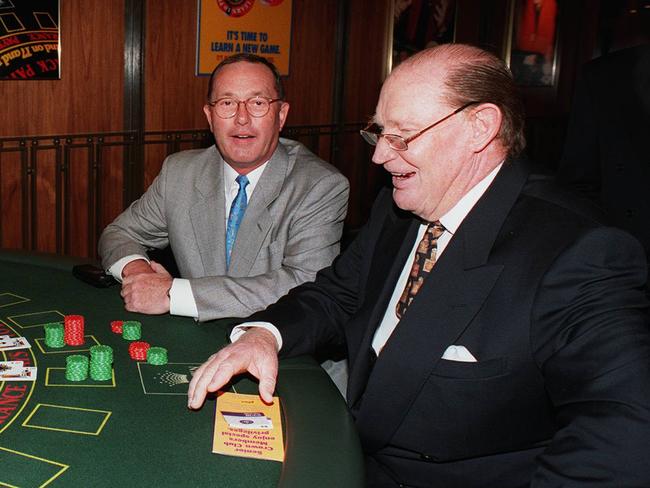

After all, Packer’s view of tax – expressed sharply during his appearance before a 1991 parliamentary committee – has become the stuff of legend.

“If anybody in this country doesn’t minimise their tax they want their head read,” the nation’s then-richest man declared.

“As a government I can tell you you’re not spending it that well that we should be paying extra.”

The comments from Packer – where he stressed he was not evading tax in “any way shape or form” but like everyone else was certainly minimising it – elicited laughter from the public gallery and cheers in living rooms across the nation.

Mason has now written a book, Tax Secrets of the Rich by Kerry Packer’s Former Accountant, which focuses on how to keep your money after you’ve made it.

“He (Kerry) never accepted the status quo,” Mason says.

“An entrepreneur will always want to see what the situation is and see how it can be fixed. Kerry had a very good gut feeling. He made tough decisions but he could take in the bigger picture and back things he believed in.

“We were losing a lot of money with World Series Cricket. We were losing money with 60 minutes – it was losing millions of dollars, George Negus flying all over the world – but Kerry was supportive. As accountants we were telling him this thing is not looking good. But he always said, it is going to work, stick with it, how can we make it better?”

Mason, who these days operates his own practice in Brisbane, like Packer says there is nothing wrong with legally minimising your tax.

That, says Mason, was not only Packer’s view but also that of former Chief Justice of the High Court Sir Garfield Barwick who made it clear that “the citizen is entitled to minimise his liability to pay tax”.

While Packer never wanted to pay a dollar more than he owed, he was flexible on amounts less than this.

Mason recalls once receiving a tax bill for close to $180,000.

“Kerry hit the roof,” he says.

“He said send them (tax office) a cheque for 78c, which was what the tax office claim ended in.”

The dispute ended up in court where CPH ultimately won.

“After we won the case the barrister for the tax office said what do you want to do about the 78c and Kerry piped up – you keep it, you need the money more than I do.”

Mason says two of the biggest myths around tax are the more money you make the more you need to pay and paying a lot of tax means you must be making a lot of money.

“There are many ways you can use the system,” he says.

“Don’t think that you will never pay tax, but it pays to look carefully and it pays to step back and think is there a better way.”

Looking for a better way was drummed into Mason by Packer when he was hired.

“Kerry said, ‘son you need to be worth double than what I’m paying you’,” he recalls.

“I’m standing there thinking but I’m an accountant. But accountants need to be proactive, not reactive. They need to know you and your business, they need to be a member of your team. If you are not getting the right advice, change.

“Working for Kerry, after six months you either didn’t have a job or had a big rise. You were out or you got a big rise. He expected a lot, but he paid well – well above market rates. They were fun times. It was an exciting place to be.”

Packer received weekly reports, faxed in, from each division tracking key revenue, profit and loss measures.

“If something was tracking down that might involve a fairly heavy phone call from Kerry to say what is going on? We need to lift its game? What do we need to do to make it better?” he says.

“Small business don’t always track what they are doing but they should and today they can do that quite easily. Your bank transactions can feed directly into your QuickBooks or Xero and you can look at it in any point in time and know where you are tracking.”

Mason’s other key message is for small business to plan ahead.

This, he says, will become critical as the federal government looks to repay a historic debt pile.

“After the election – I shouldn’t be sceptical – but over the next year or two expect to see some sort of budget repair levy as well as a tightening up in expenses and a more aggressive attitude by tax authorities about what can be claimed,” he predicts.

While Covid has thrown up huge challenges for small business, Mason points out the bulk are doing very well.

He estimates around 80 per cent of his clients are doing as well if not better than pre-Covid.

But for the pockets of real stress – hospitality, tourism, businesses with exposure to international students – he urges them to be realistic and, critically, not to take failure personally.

“Don’t keep your head in the sand during difficult times,” he says.

“If you can’t get your business into a break even position you are going to lose everything. You may be able to restart in a different entity but you need to take hard decisions.

“There is bad luck in business. Business owners should not take it personally. You can be a very good operator and things can go wrong that are totally out of your control. Covid isn’t personal, but you need to take a business decision and my time with Kerry showed me just that. We had to close businesses and sack people. Those things were tough. But it was a business decision, not personal.”