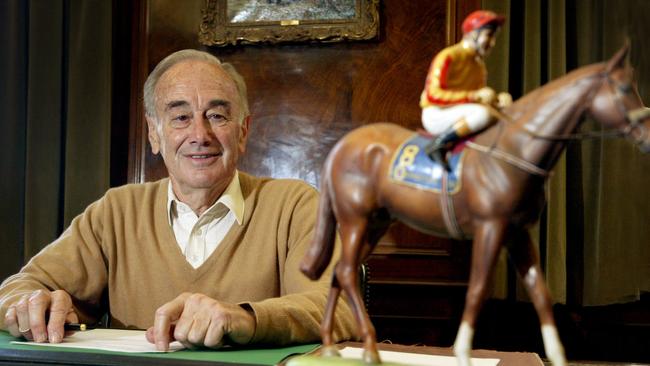

Vale David Hains, a dignified billionaire

David Hains was a billionaire of the old school - eschewing the limelight and fads for a more fundamental view of the world.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

David Hains who has passed away at the age of 92 was truly one of the greats of Australian business and investment for going on half-a-century - although largely unheralded and indeed broadly unknown even in business circles.

Yes, he was one of our billionaires.

But a ‘quiet’ one - perhaps the quietest, and politest, and calmest, and most discrete, of them all; nothing like a Packer, father and or son, continually smack in the public eye, or the newer Cannon-Brookes and Andrew Forrest ‘out there’ variety.

Yes, he was well-known in racing circles – most notably as the owner of the ‘Two Kingstons’: one, Kingston Town, that gave him three Cox Plates; and one, Kingston Rule, his Melbourne Cup.

But even that had faded somewhat in recent years as he concentrated on his two games of golf each week, and his relentless, but increasingly puzzled, interest in the world of money.

Although one could still ruffle his feathers, as I did the last time I spoke to him, suggesting that perhaps the one horse, the one horse, that he might have traded Kingston Town to own was Winx. He would have none of it.

He could never come to terms with the world of Bitcoin and share valuations as (mega) multiples of sales.

And nor, bluntly, did he need to: his, relentlessly successful, focus had always been on targeting undervalued assets and especially so-called ‘distressed debt’.

Racing and golf aside, for nigh on that half-a-century, he would, turn up every business day at his Portland House building – appropriately all-but discretely invisible, just up from the Melbourne Club at the top end of Collins St.

Although looking from the outside as if still part of the ‘Marvellous Melbourne’ of the 1880s – very appropriately not of the ‘decade of greed’ of the 1980s – it was high-tech investor central, and where David could mine his global contacts and caucus with his sons.

That is until Covid and Chairman Dan combined to spike that, consigning him to his Peninsula property.

Vale David Hains, a billionaire of impeccable integrity.

Interestingly, speaking of investment and noted personalities, the Fin Review’s senior Chanticleer columnist is also departing, but, I’m very relieved to say, only into retirement.

In announcing Tony Boyd’s departure over the weekend, The Fin noted that the column was approaching its 50th year.

But it did not mention that the column’s founder and first columnist – and I feel comfortable asserting, still unquestionably the best of the dozen or so who have followed – has, figuratively speaking of course, outlived them all.

Extraordinarily, Robert ‘Bob’ Gottliebsen – 82 in just over a week – is still punching, still holding business and political leaders alike to account (did anyone mention, planes, tanks and submarines?).

But these days not in the Fin. You now find, what I would call, the ‘Real Chanticleer’ in our sister paper The Australian.

Maybe I’m idiosyncratic, but I was struck by the half-century of broad business and investment history and a multitude of events, captured in the juxtaposition of the, somewhat different, departures.

OK, more immediately, this is the week that 2023 really gets underway, with the release Wednesday of the absolutely pivotal CPI numbers for the December quarter.

Most immediately, as I wrote last week, they will decide the Reserve Bank’s interest rate decision next week.

A genuinely low number could see the RBA pause for the first time since last April. An unexpectedly – and decidedly unwelcome – high number could, really should, force the RBA to go back to a 50 point hike.

Most likely will be the middle – 25 point – course.

Beyond this immediate impact, the numbers will give us a very good guide to where inflation is heading in Australia, hopefully sharply south.