Trump tariff threat puts Aussie aluminium smelters on edge

Australia’s top manufacturing export industry is bracing for the fallout from hefty Trump tariffs on aluminium.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Australia’s aluminium industry – dominated by mining heavyweights Rio Tinto and Alcoa – is fighting to protect already teetering smelters and jobs from the fallout if US President Donald Trump carries out a threat to impose 25 per cent tariffs on all imports.

Any US tariffs on aluminium and steel imports would rock international supply chains with industry experts warning of potentially harmful consequences for smelters in Australia just weeks after the Albanese government moved to offer $2bn in incentives to encourage aluminium producers to switch to renewables as part of its Future Made in Australia policy.

Australian Aluminium Council chief executive Marghanita Johnson said the industry would work with the government to try to minimise any impact on exports and the local workforce.

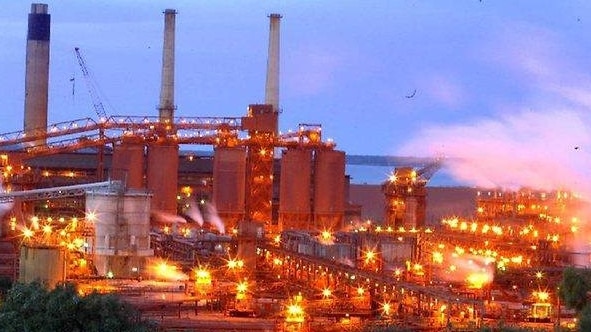

Aluminium is Australia’s top manufacturing export but all four smelters in the country have relied on taxpayer support over the years, with Rio making several attempts to sell its high emissions and loss-making operations.

The US is a small market for local producers behind South Korea and Japan, but any tariffs are expected to have a big knock-on effect on trade flows.

“Bauxite, alumina and aluminium are globally traded and there are interdependencies in these supply chains,” Ms Johnson said.

“It’s early days and we are still working to understand the impact of any potential tariffs on Australia’s aluminium trade. We will continue working with the Australian government and its representatives on this important issue.”

On average, Australia exports about 10 per cent of its 1.5 million tonnes a year of aluminium production to the US.

The aluminium council estimates the industry directly employs more than 21,000 workers and indirectly supports a further 55,000 household incomes, predominantly in regional Australia.

Rio, which operates the Boyne smelter in Queensland and the Bell Bay smelter in Tasmania, declined to comment on Monday.

Rio also owns about 51 per cent of the Tomago smelter in NSW alongside Europe-based Saint-Gobain and others. Tomago and Alcoa also declined to comment.

Pittsburgh-headquartered Alcoa and Rio face major ramifications for their operations in Canada if Mr Trump delivers on his tariff threat and does not agree to exemptions as he has in the past.

Alcoa, a major employer at bauxite mines and alumina refineries in WA and its Portland smelter in Victoria, said last month that Canadian product would be redirected to other markets if tariffs were imposed.

Alcoa chief executive Bill Oplinger also warned of consequences for the US economy and noted Mr Trump had exempted Canada and some other countries from aluminium tariffs during his first stint in the White House.

“Currently, the US imports two-thirds of its primary aluminium from Canada. If there were to be tariffs on Canadian aluminium imports to the US, this would represent a threat to US industrial competitiveness,” he said on January 22.

“A 25 per cent tariff on current Canadian export volume to the US could represent $US1.5bn-$US2bn of additional annual cost for US customers.

“In addition, increasing costs on trade with Canada and Mexico would particularly hurt the US transportation supply chain, the largest end market in North America and specifically the automotive market.”

Australia accounts for about 2.5 per cent of total US aluminium imports.

The integrated mining alumina and aluminium industry contributes about $18bn to Australia’s GDP.

More Coverage

Originally published as Trump tariff threat puts Aussie aluminium smelters on edge