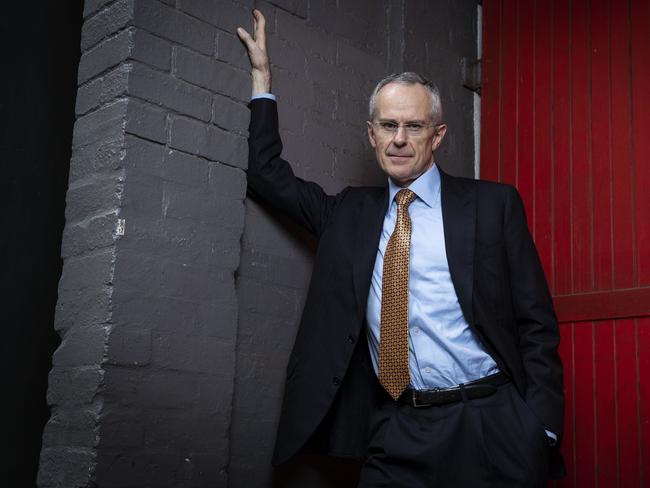

Trigger-happy: Why ACCC boss Rod Sims likes to take big companies to court

The boss of Australia’s consumer watchdog has built a reputation for a trigger-happy, no-holds-barred approach to ensuring big companies play fair. Now he’s silencing the critics. Here’s why.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

He’s built a reputation for throwing the book at the big end of town, and now Australia’s top competition cop is silencing the critics, writes Jeff Whalley.

As he strides into another year at the helm of the nation’s competition watchdog, Rod Sims can look back on the past one with satisfaction.

The Australian Competition and Consumer Commission, chaired by Mr Sims, had been criticised by businesses in recent years for being too quick to take them to court.

TPG-VODAFONE DEAL BOTHERS ACCC

But 2018 will surely go down as a watershed: the year the rules of engagement in policing big companies changed — and the year Mr Sims’ no-nonsense approach was vindicated.

Since he joined the ACCC more than seven years ago, Mr Sims has readily resorted to what he calls the “demonstration impact” of taking corporate heavyweights to court.

Other regulators, however, have been more hesitant, trying to instead uphold their responsibilities through negotiation.

As a result of the financial services royal commission, the ground is shifting.

At the inquiry’s public hearings, the corporate regulator, the Australian Securities and Investments Commission, and the prudential watchdog, the Australian Prudential Regulation Authority, copped serves for lacking bite.

In his interim report in September, commissioner Kenneth Hayne noted ASIC “rarely went to court to seek public denunciation of and punishment for misconduct”.

“The prudential regulator, APRA, never went to court,” Mr Hayne said.

Ahead of his final report, due next month, those regulators are surely on notice.

Speaking with Business Daily, Mr Sims says the legal route is a highly effective one.

“The bottom line is we are not the compliance department of companies,” he says.

“If we catch you out breaking the law and there has been a sufficient level of detriment and (it) has hurt consumers, we are going to take you to court.

“That is the best way of stopping this happening in the future.”

Ms Sims says that behind closed doors, companies often push for the ACCC to simply go away.

“I have had numerous meetings with companies we’ve caught out. They say ‘court costs are costly for everyone — we promise not to do it again if you let this go’.

“We say, ‘no way, that makes us your compliance department. That means you can breach the law and if we find out, you can just stop. That is not deterrence’.”

The best deterrent for misconduct, he says, is a big penalty.

“We will focus on big companies as they have the biggest demonstration impact. And we will tell everyone about it.”

Mr Sims, a passionate Hawthorn fan, draws an analogy with football.

“It is (like) the umpire in the game catching out someone for a trip and saying, ‘by the way don’t do that again’,” he says.

“When both Luke Hodge and Jordan Lewis were rubbed out two years ago, that was one of a hell of a demonstration effect … it mucked up our season.”

THE COST OF JUSTICE

A former director of a corporate consultancy, Mr Sims took the reins of the competition regulator in August 2011, succeeding Graeme Samuel.

He was reappointed for a three-year term in 2016, and reappointed again last September, for another three-year term that will stretch his tenure to July 2022.

That will mean he is in the role for almost 11 years, making him the longest serving chair of the watchdog.

Mr Sims says 20 years in the private sector gave him an insiders’ perspective — that unless companies are taken to court, they are “not going to take it seriously”.

He acknowledges the praise now being heaped on ACCC for tough policing “does help” in motivating his troops.

“The fact that the work they do is appreciated is good, but you’ve got to make sure you don’t get ahead of yourself.

“We are not going to use the royal commission to ramp up what we do — we will just keep doing what we are doing.”

Mr Sims rejects the notion that legal costs have become a barrier to readily suing major corporations.

But he adds that the ACCC is limited in what it can pay its lawyers.

“When we take on big end of town, they are able to pay $15,000 to $20,000 a day,” he says.

The ACCC spends $25 million a year on court cases, he says, while corporations it clashes with frequently spend far more.

“My guess is that the companies are paying five to ten times that. It might not be right, but won’t be far out,” Mr Sims says.

The bigger problem for the ACCC, he says, is that it only has 140 investigators to get matters to court.

“Our constraint is not in any way our legal costs … (but) investigators.”

The ACCC would like to investigate every sector, everywhere, he says, from “shonky people selling indigenous people crappy goods in one part of the country … (to) Ford misleading consumers over the power transmission in another.”

That comment is a reference to the watchdog’s case against Ford over the way it dealt with customers who complained about the dual-clutch transmission system in some car models.

The Federal Court in April ordered the carmaker to pay $10 million in penalties.

Mr Sims says “at least three to four” staff are needed to put together each case that ultimately goes to court.

“We could do a lot more for the Australian community if we had more than 140 investigators.”

MAKING A SPLASH

There have been many more cases with “demonstration impact” this year.

Mr Sims says the three criminal cartel cases the ACCC launched were particularly important.

Following an investigation by the watchdog, criminal charges were laid against Mildura-based Country Care in February, relating to alleged cartel conduct involving products — including beds, mattresses, wheelchairs and walking frames — used in rehabilitation and aged care.

In June, bankers from ANZ, Deutsche Bank and Citigroup were served with charges of alleged criminal cartel conduct in relation to a $2.5 billion capital raising program carried out for ANZ in 2015.

And in August, criminal charges were laid against the Construction, Forestry, Maritime, Mining and Energy Union for alleged cartel conduct relating to the supply of steelfixing and scaffolding services.

Mr Sims says civil cases — such as the Ford ruling, and the Federal Court’s order in April that Telstra pay $10 million after charging customers for digital content they had unknowingly purchased, such as games and ringtones — were also crucial.

In another landmark event, last month he released a 374-page report on the ACCC’s probe into possible misuses of market power by technology titans such as Facebook and Google.

The watchdog is proposing new laws, including rules that would affect how technology companies collect personal data and display advertisements to consumers.

There is little prospect that the regulator’s demonstration impact will fade this year, with

plenty of work for Mr Sims to turn his attention to after a summer break.

He says the watchdog will announce details of its first case over the abuse of market power since new laws were introduced after the review of competition policy carried out for the federal government in recent years by Professor Ian Harper.

The ACCC will also “have an eye on the finance sector” and continue its investigations as part of its inquiry into digital platforms.

Other key focus areas will include cars, consumer safety, energy, health and communications and franchising, he says, and there are sure to more agenda-setting cases too.

“I think we will have three more criminal cartel matters … it will show people and boards that the (ACCC) criminal cartel regime is here to stay,” Mr Sims says.

“It is important to follow up this year’s work with more.”