Tough choices: What business wants from Jim Chalmers’ big budget

Tuesday’s budget faces a tough ask in getting the balance right in supporting the economy, but markets are in no mood for big spending plans.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Tuesday’s budget will need to get the balance right to support strong confidence among businesses and households in the face of a slowing global economy, promote skills and productivity, but resist big-ticket spending that adds to inflation through the economy.

That’s the view from a cross-section of leading chief executives as Treasurer Jim Chalmers finetunes his budget, marking the first time Labor has controlled the settings for the nation’s finances in nearly a decade.

The document needs to meet more than the immediate challenge of returning to a sustainable spending path; it needs to send a message that Australia is open for business and the “tough choices” around reform are happening, putting the nation on a path of longer-term growth. It will need to offer certainty for business just as spending is being ramped up in the shift to renewable energy.

National Australia Bank chief executive Ross McEwan said while the economy was doing well, marked by strong business conditions and low unemployment, headwinds were building.

“Higher interest rates and higher cost of living are having an impact on some households and we – and I know the government – are watching this closely,” McEwan says.

“These challenges, coupled with ongoing global uncertainty and continued impacts of some of the decisions needed to get us through the pandemic, mean Treasurer Chalmers and Prime Minister Albanese face some tough choices about how they manage the budget. I’m confident about the Australian economy overall and our ability to manage the challenges and opportunities ahead,” McEwan says.

Jeanne Johns, who heads industrial major Incitec Pivot, argues Tuesday’s budget needs to provide policy settings that offer security to manufacturing.

“Affordable energy is critical to the future competitiveness of our domestic manufacturing sector and it underpins every robust, domestic economy,” Johns says. “This is crucial so we can ensure that jobs stay in Australia and the community can access and benefit from Australia’s natural wealth.”

She says the budget needs to “recognise innovation, boost skilled jobs and ensure ongoing, multimillion-dollar investment in a vibrant manufacturing industry that provides Australia’s economic backbone”.

Stronger than expected growth in the economy, a commodities windfall and multi-decade low in unemployment is translating into higher tax revenue for Canberra. Economists are tipping a deficit for the 2023 financial year at $30bn-$40bn, substantially lower than the $78bn initially forecast by Treasury in March.

A deficit at these levels will represent 1.2-1.5 per cent of GDP, according to economists at Commonwealth Bank. This compares to Morrison government’s first Covid budget in financial 2021, which was marked by heavy spending to reinforce the economy and resulted in a budget deficit of 6.5 per cent of GDP.

CBA chief economist Stephen Halmarick says budget deficits will need to remain inside the 1 per cent to 1.5 per cent of GDP range in the years ahead, in order to not add to inflation. This will be an important part of fiscal policy “working hand-in-hand” with the higher cash rate of monetary policy, Halmarick says. Smaller deficits will also help Australia retain its AAA credit rating, he says.

Tarun Gupta, the chief executive of ASX-listed property developer Stockland, calls for the budget to focus on housing affordability, which he believes is emerging as a national crisis. Gupta says supply is the most important lever in addressing affordability and this will require collaboration through all levels of government.

“Equally, we should be incentivising other housing models, like single and multi-family build-to-rent and build-to-rent-to-buy, which will provide more home and investment choices and other avenues to ownership when done at scale,” he says.

Meanwhile, he wants a long-term focus on restoring migration, which is a cornerstone to economic activity, while more can be done to bring international students back, which will ease the labour crisis business is undergoing.

“Given the current demand for skilled and unskilled labour it’s equally important that we properly resource the assessment and determination of visas to get workers on the ground as quickly as possible,” Gupta says.

Dale Connor, the Australian boss of property, construction and investment major Lendlease, also nominates social housing as an area that can provide long-term relief. This will require a joint initiative between industry and all levels of government.

“We would encourage new market and policy innovations that unlock institutional investment to increase housing supply,” Connor says.

For BHP chief executive Mike Henry, the key aspiration coming out of last month’s jobs and skills summit was making Australia a more productive nation.

The BHP chief says the miner has been heavily investing in apprenticeships and traineeships on both sides of the country, and continues to work towards a target of having substantially more women in its workforce, particularly in senior roles.

“At the end of the day. We’re a heavily export-dependent economy. We’re competing with many other nations around the world for the same opportunities and it’s so important that we’ve got the settings in place here in Australia that allow us to compete well on a global scale. And that’s going to require a different approach in some areas than what we’ve had there in the past,” Henry told a recent shareholder briefing.

Insurance Australia Group chief executive Nick Hawkins says work needs to continue with industry and government on building disaster resilience across the nation as storms and flooding become more frequent.

“We know that mitigation, land-use planning and building-code reform are key to keeping communities safe in natural disasters,” Hawkins says.

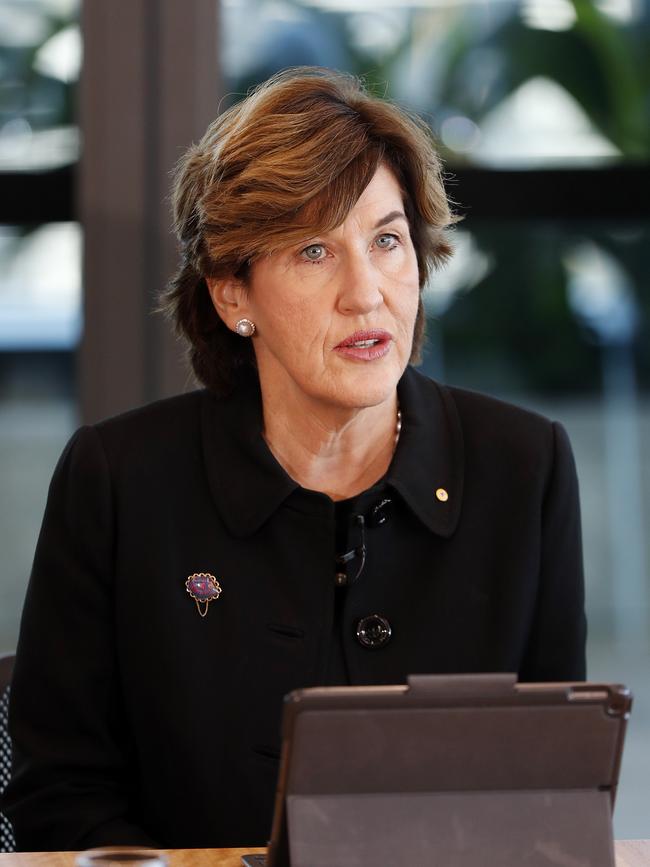

Likewise, Suncorp chair Christine McLoughlin has called for greater spending on disaster resilience. She says this year’s repeated flooding has compounded pressure on Australian households and consumers from higher food and transport prices. McLoughlin says the Commonwealth government has spent $24bn on disaster recovery since 2005, and only $510m on resilience. “That balance needs to change,” she says.

NAB’s McEwan says it is pleasing to see the Albanese government already commit to improve paid parental leave and provide additional funds to make childcare more affordable.

“Both are fundamental to ensuring equal opportunity for parents, in particular women,” McEwan says.

A focus on helping small businesses get on with business as well as building out productivity measures through the economy would be welcomed, he adds.

Chalmers has so far been given a strong warning from markets about the need to exercise restraint and ensure government spending doesn’t add more fuel to inflation. British markets were thrown into turmoil in recent weeks following the release of the Truss government’s highly expansionary mini-budget.

For Australia this will include resisting new cost-of-living spending measures.

On Sunday, Chalmers said the budget would see “substantial” restraint on spending, even with the additional expected commodity-linked windfall flowing to Canberra. But he also cautioned there were existing spending pressures including on defence, aged care and NDIS, while inflation added to spending demands on the budget.

johnstone@theaustralian.com.au

Originally published as Tough choices: What business wants from Jim Chalmers’ big budget