The very worrying sign hidden in Aussie bank accounts

A graph has revealed an ominous job market trend that has hit Australia, and its having a major impact on the bank accounts of thousands of Aussies.

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

ANALYSIS

We have some bad news: Women have less money than men.

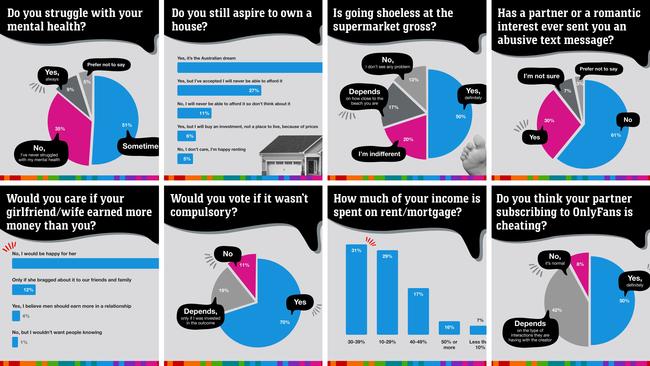

Earlier this year, news.com.au launched The Great Aussie Debate, a wide-ranging, 50 question survey that has uncovered what Australians really think about all the hot topics of 2025.

Over two weeks, more than 54,000 Australians took part in the survey, revealing their thoughts on everything from the cost of living and homeownership, to electric vehicles and going shoeless in supermarkets.

As a result, we have discovered that women have got less in their savings accounts than Australian men, and, as a double whammy, they have more debt too.

MORE: Australia’s fastest growing salaries

Women were most likely to tell the Great Aussie Debate Survey they had $20,000 to $50,000 in savings.

About 15 per cent of women fell into that bracket. But males were more likely to say they had saved more than that.

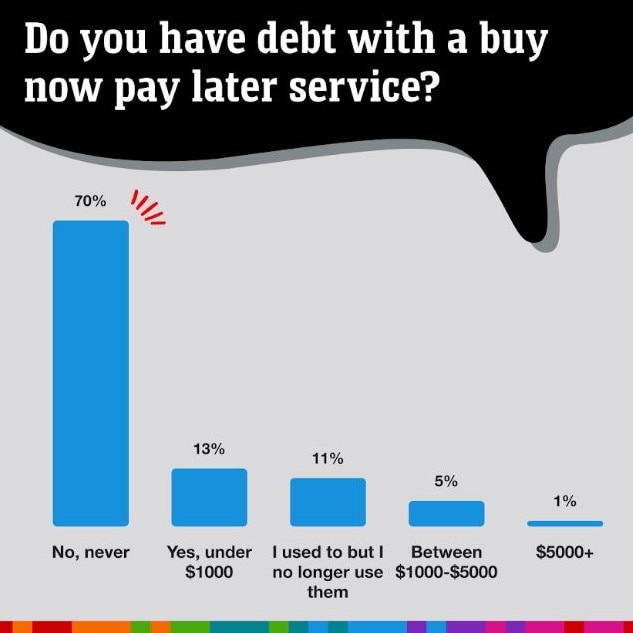

Net worth is not just about assets, it’s about liabilities, and women are on the hook for some

bigger debts, including Buy Now Pay Later (BNPL) schemes, like Afterpay.

The share of women saying they had up to $1000 in BNPL debt was 17 per cent, compared to 10 per cent of fellas.

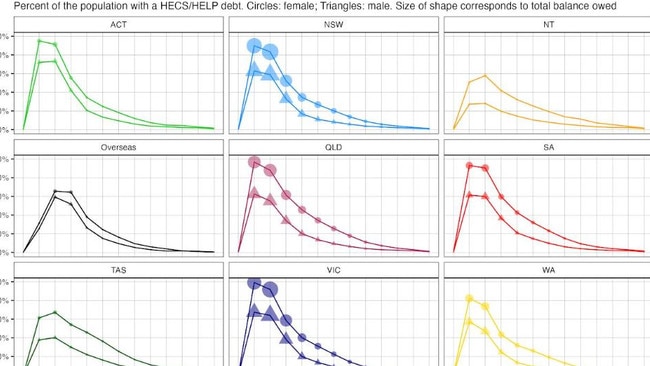

BNPL debt is not the only kind of debt women have more of. They also have more HECS/HELP debt.

The current generation of women is more likely to be taking on HECS/HELP debt, the older generations are paying it off more slowly and the combo means women of all ages are more likely to have student debt.

We can also see this in the ATO data, as the next chart shows.

BNPL debt is not a great idea, HECS usually is though.

So the news that women are more likely to have HECS debts is a bit of a mixed bag.

If more women are getting HECS debts, that could be good, but if fewer are paying it off, well that’s a different story.

The three big ‘whys’

So why are women worse off? Savings come from income, mostly. And men make more income.

Why is that?

Partly because men take less leave around the birth of their kids, which gives them more career continuity and more experience and more chance to get promoted.

Women can find themselves in a situation where going back to work doesn’t make financial sense. (One of the big benefits of cheap and abundant child care is that it helps women get back to the workforce a bit sooner.)

But that’s only part of it. There’s another interesting wrinkle.

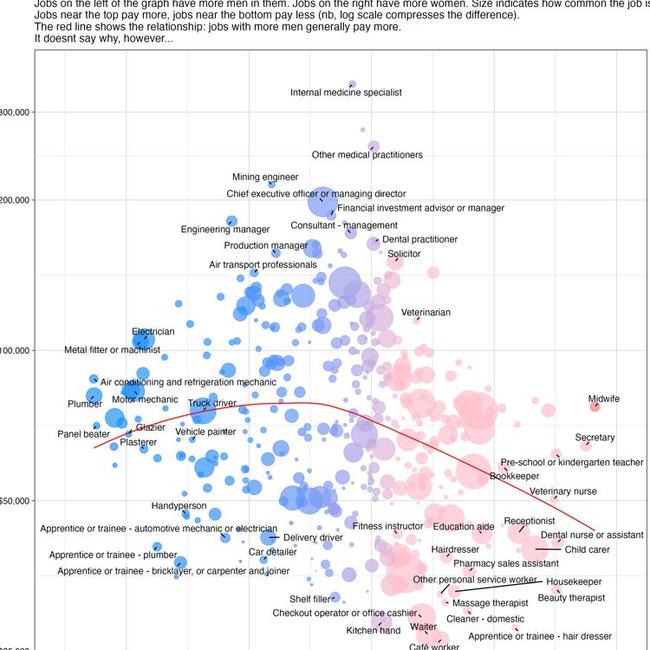

The higher pay of men is partly because men do the jobs with higher pay.

As the next chart shows, many jobs are as gender segregated as a Sydney Private School.

If you’re a plumber or a plasterer, you probably don’t have any female colleagues!

And a lot of those blokey jobs have higher incomes than the most female-dominated jobs.

Why is that?

This is pretty interesting, because we don’t really know. It’s cultural, probably.

For example, look at electricians. There’s not an obvious reason a woman can’t be an electrician, but there is almost 100 male electricians for every female one.

It’s just not a job women seem to go into. A bit like men and nursing.

Men can measure out drugs and apply bandages and manage patients, but many don’t choose that career.

There’s a weird cultural expectation about what blokes do and what ladies do and we see very little deviation from it.

That would be a totally neutral thing, a mere curiosity, if the jobs got the same pay.

Big shifts

One thing that’s interesting to me is when a job goes from being female-dominated to male-dominated and becomes better paid.

The classic example is computer coding, which was once seen as a clerical skill and is now seen as a job for geniuses.

There could be a whole domain heading the other way now, with office jobs becoming more female dominated and tradies making more money.

When I was a kid everyone said it was smart to go to school and uni and get an office job. But now most people in uni are women and the more middling office jobs don’t pay especially well, while people with trades are doing very nicely.

The implication is that the gender earnings divide might get even wider.

What should you do with your savings?

So if you are a woman who has managed to scrimp your income and generate some savings, what should you do with them?

As the Barefoot Investor would tell you, you need to invest.

You can’t just leave savings sitting in your transaction account where they earn no interest.

If you do that the rate of inflation will eat away at the earning power.

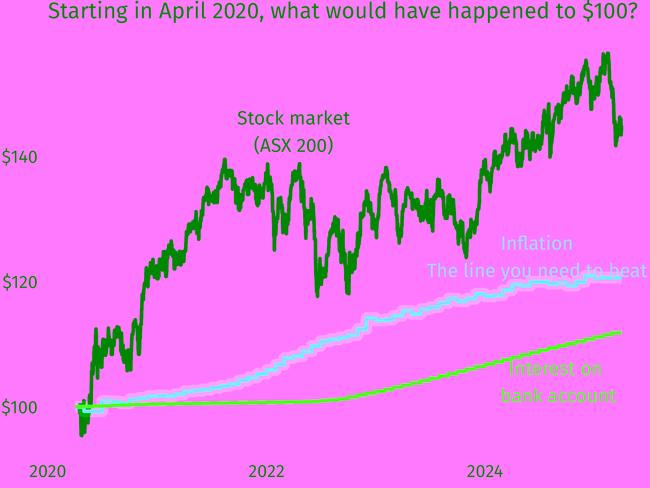

Imagine you invested in 2020. What should you have done?

The chart below shows that buying the stock index would have meant your savings beat inflation.

The bank account option (rolling over a one-year term deposit) would have got you a bit of interest, but not enough to preserve you buying power.

The stock market has outpaced inflation for a long time. So it’s notable that women are less likely to own stocks.

Just 42 per cent of people with money invested in the stock market are women and 58 per cent are men.

This is just counting people with money outside superannuation and the men with money in the stock market have much more.

Men hold $667,000 on average, compared with $413,000 for women.

Whether you’re talking income, savings or investment, it all adds up to a country where women have less economic heft than men.

Jason Murphy is an economist | @jasemurphy.bsky.social. He is the author of the book Incentivology

Originally published as The very worrying sign hidden in Aussie bank accounts