The merger of Fairfax and the Nine Network comes years too late, writes Terry McCrann

BEFORE Apple, Google, Amazon, Facebook and Netflix, Nine sat at the top of the lucrative free-to-air TV pile and Fairfax were still running strong. Their merger comes at the very least 10 years and arguably more like 20 years too late, writes Terry McCrann.

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

WE’RE finally getting the merger that’s been continually predicted every year for over 20 years — back into the 20th century and before the Apple iPhone even existed.

That’s to say, it’s at the very least at least 10 years and arguably more like 20 years too late.

Back then — before Apple, Google, Amazon, Facebook and Netflix — Nine sat at the top of the very lucrative free-to-air TV pile and the Fairfax “rivers of classified advertising gold” were still running strong.

NINE AND FAIRFAX: ‘NOT A MERGER, A TAKEOVER’

Back then, free-to-air TV still had a lock on viewer eyeballs. The only challenger was Foxtel pay-TV (part of Rupert Murdoch’s NewsCorp which owns this newspaper) — but only a partial challenger as it got into only one-in-three homes.

Back then, the actual print versions of newspapers still commanded big readerships and shared with TV almost all the advertising dollars.

Putting a FTA-TV network — especially the dominant one — together with one of the major print media groups, it could be argued, would have built a very powerful company.

Which of course is precisely why the (then) media laws prohibited it. Although, it should be added, those laws were aimed more directly at stopping doing such a deal.

Anyway, all that’s been swept into the digital dustbin of history.

The three FTA-TV networks no longer have a lock on viewer eyeballs — the advertising dollars they share are now lower in total than ten years ago.

It’s been worse and faster for print. Print circulations have plummeted, and along with that ad revenues. All print groups — Fairfax over there and NewsCorp here — have struggled to build digital audiences and ad revenues.

And if the present is challenging enough, the future looks even more volatile and uncertain for media, as more and more content comes pumping down the digital pipe and your smart phones get bigger and better.

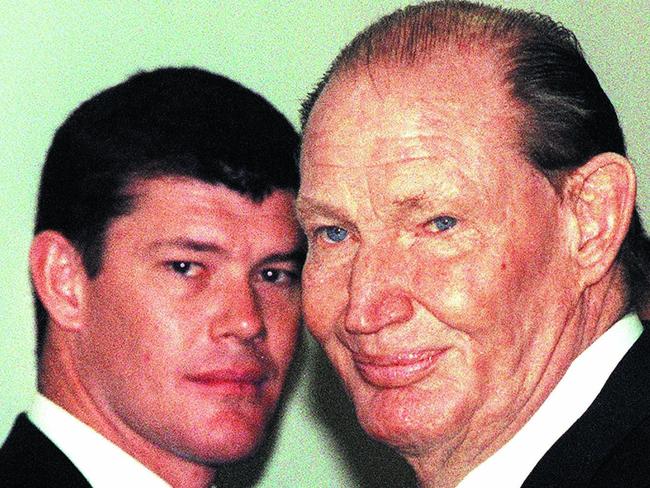

A simple metric of how the changes flow through to company values is this. In 2006, less than a year after his father Kerry died, James Packer sold the Nine Network to investors at a value of $5.5 billion.

The deal announced today values the combination of Nine and Fairfax at $4.2 billion. The two companies together are worth substantially less than Nine was on its own ten years ago — and no-one could seriously argue that putting them together is going to dramatically build value.

Indeed we have exactly such an example. Kerry Stokes’s Seven Network merged with WA Newspapers. This put the dominant FTA-TV channel in Perth together with the dominant Perth newspaper. And the combined value just headed south.

There’s virtually no DYNAMIC synergies between print and FTA-TV — especially when both are losing audiences. It’s really all on the cost side. The only way to “make money” out of Today’s joint announcement all-but announced that. It trumpeted cost savings of $50 million a year.

Yes, it also talked about “enhancing the position” with advertising agencies and advertisers and ”enabling optimisation’’ of content.

But all that really adds up to is desperately trying to build a higher wall against the digital tsunami.