Terry McCrann: Treasurer Frydenberg needs to be bold and borrow a huge amount

Josh Frydenberg could elevate himself to the pantheon of great federal treasurers if he borrowed $1 trillion, paid off the national debt and put the rest in the Future Fund, writes Terry McCrann.

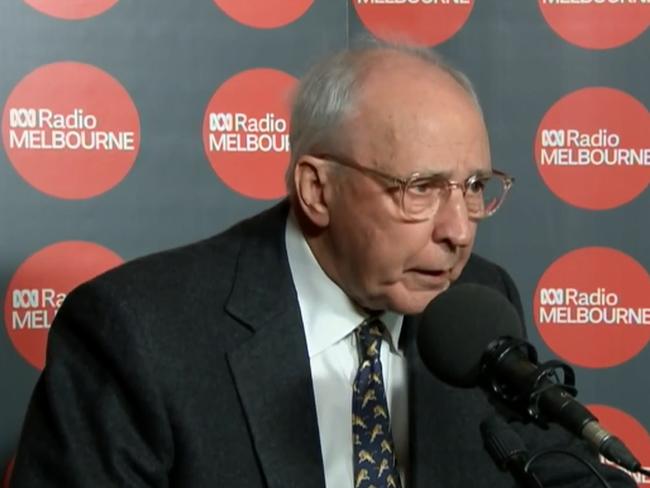

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

OK. Treasurer Josh Frydenberg has got his tax cuts through the Senate and the first lot are already on their way to taxpayers and he is on track to deliver our first Budget surplus since Peter Costello.

What does he do next? Here’s a really revolutionary idea: Set about issuing around $600 billion of 30-year Commonwealth bonds.

They would sell like the proverbial hot cakes.

Don’t mess around with trying to force-feed borderline infrastructure projects. And even worse, promote dodgy so-called “public-private partnerships” to finance them.

They’re just a recipe for smart investment bankers to rip off both taxpayers and users of the infrastructure to enrich both themselves and the lucky, greedy, investors.

There’s plenty of infrastructure being built by state governments and especially in NSW and Victoria.

And it is fundamentally the responsibility of state governments to both select and to prioritise such projects. And then stand responsibility for them.

I would make one big exception: It is up to Canberra to embark on building the infrastructure to deliver water from the north to feed into the Murray-Darling system and instantly solve all the issues about both the overall supply of, and the allocations of, that water.

What was a literal pipedream 30 and even more 50 years ago is now realistic, necessary and fundamentally appropriate. And one of the — very, very — rare things that could actually sensibly run on a mix of renewables and (real) gas power generation.

That’s a whole-of-government issue: What could elevate Frydenberg to the — currently, two-member — pantheon of great treasurers, alongside Costello and Paul Keating, is the conversion of the entire corpus of federal debt to 30-year terms.

If it supposedly makes sense to borrow tens of billions of dollars at this time of not just record low — but irrationally hyper-low — interest rates to pour into infrastructure, it makes even greater sense to borrow hundreds of billions of dollars to lock in those super-low rates for 30 years.

And to do so for every dollar of federal debt. And indeed, for that matter, all state debt as well.

The government could do it for 10 years, paying an interest rate of just 1.35 per cent or so.

It would be far better to do it for 30 years, even though the government would then have to pay the “much higher” rate of around 2-2.1 per cent.

But even at that higher rate it would instantly save money.

Last year public debt interest added up to $17 billion. Paying even 2.1 per cent on outstanding debt would cost just $12 billion a year.

Yes there would be an “upfront” capital cost if you bought all the existing bonds back at one hit, as most of them are trading at well above their issue price thanks to the dramatic drop in yields.

But then you wouldn’t even have to do that, if you just let them run off to maturity over the next few years. Although that would mean you would then be “over-funding” the government’s borrowing needs.

That though, leads to an even more revolutionary thought, that could elevate Frydenberg even above his pantheon peer group.

Forget about borrowing $600 billion and paying off the existing debt; borrow, say, $1 trillion, pay off the $600 billion of existing debt — and give the other $400 billion to the Future Fund to invest.

That would almost certainly more than pay for itself.

Over the past 10 years the FF has consistently earned 10 per cent-plus every year; over the past three years it earned 9.6 per cent each and over the past year 9.7 per cent.

Yes, these figures are crude and broadbrush, but say the FF could maintain earnings of 8-10 per cent a year.

The $1 trillion would cost the government $20 billion a year in interest, while just the $400 billion would generate $32 billion to $40 billion of income for the FF — which is the government!

Surely you can’t do this? Well in fact the government is already doing it. The FF has $150 billion invested. It’s as if some $150 billion of the $600 billion of government debt was borrowed and given to the FF to invest.

It makes a lot more sense than borrowing billions for dodgy infrastructure. It makes a lot, lot more sense than borrowings billions for dodgy infrastructure and enriching clever investment bankers and greedy investors.

MORE: TERRY McCRANN’S COLUMNS

FRYDENBERG LASHES RECESSION COMMENT

Two final points. This would actually be a process of putting a Budget in surplus to very effective work; instead of simply and slowly using the surpluses to pay off the existing debt, borrow at 2 per cent to earn 10 per cent.

Secondly, this is in effect exactly what all the big countries are doing with their combinations of big budget deficits, near-zero interest rates — and indeed, negative in some cases like Germany and Japan, and central bank money printing QE exercises.

We are — trillion dollar — mugs not to join the game.