Terry McCrann: Recognising uncertainty key to surviving what lies ahead

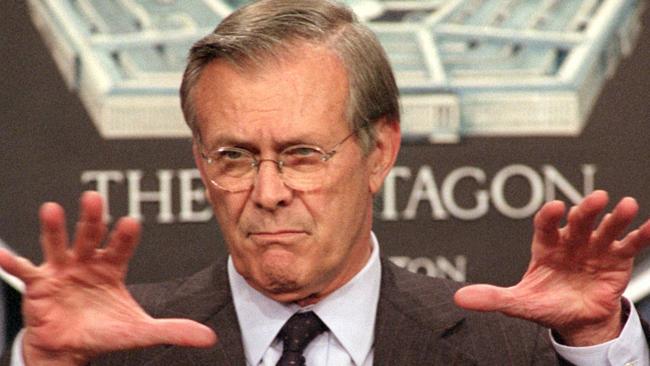

As former US Defence Secretary Donald Rumsfeld once commented, “there are known knowns” and “unknown unknowns”. We don’t really know what will happen with the economy opens but at least the unknowns are clear, writes Terry McCrann.

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

One of Winston Churchill’s great quotes captures exactly where we are on the three key issues of the share market, the broader economy and indeed the virus that has been driving everything.

It needs to be blended with a more recent observation from the second president George Bush’s defence secretary Donald Rumsfeld to best help in coping with the challenge and monumental uncertainty of where we might be headed.

In my judgment, they combine to define these couple or so weeks in June as a sort of limbo period, or more actively as a critical pivot between the global lockdowns of the past three months and the reality of the openings–up that are now underway.

Churchill said at a critical point of the Second World War that “This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

Clearly we are not at “the end” — most obviously of the virus, but also of the enforced economic recession, either in Australia or anywhere else.

The market’s more complicated and uncertain. We had the sickening plunge; we had the spectacular bounce-back; and in the last week we’ve had the volatility.

I would argue that we are also not yet at the “beginning of the end” on any of the fronts. But that at best, we might find out over the next few weeks that we are at the “beginning of the end”.

That at best, we don’t get a full-on “second wave”, or if we do, it’s manageable and containable. Just as obviously what happens with the economy, what is allowed to happen with the economy, turns crucially on the answer.

Again the market’s different: there we are hostage to what happens on Wall St and so in a very real sense what happens with the virus in the US quite separately to what happens with it here.

This brings me to Rumsfeld. He famously remarked (and got idiotically ridiculed for it): “There are known knowns” — those are the things we know we know.

But there are also “known unknowns” — the things we know we do not know — and, critically, there are also “unknown unknowns” — the ones we don’t even know we don’t know.

He went on to say that through history that last category tended to be the “difficult ones”. Now that was something between a statement of the bleeding obvious and the mother of all understatements.

If you don’t know that a cruise missile has been fired at your house — and Rumsfeld in effect fired a few in his time — and you don’t even know you don’t know, you are going to be “surprised” and it is going to be “difficult” when it arrives.

You can see how the three categories apply to the current state of play — especially when contrasted with the serious lack of knowledge back in March when we started on it all: virus, market, economy.

There are clear “known knowns”: we know about the virus now, we know about the economy in recession, and we know about where the market’s been, where it is and what had been driving it.

The known unknowns are similarly fairly clear.

We don’t know how the virus will go with the openings — especially openings that are taking place into a virus-friendly winter.

We don’t really know what will happen with the economy. Yes, it will be “better”, but can businesses come back to life, can all — some? most of? — the jobs come back and how quickly?

Plus, of course, what will happen in the broader global economy and in particular China and the US.

But at least we know we don’t know; we should be able to manage into that uncertainty. By definition we can’t be certain about anything — they would be “known knowns”.

In a counterintuitive way, precisely because the share market is more uncertain, it offers greater potential for effective or at least sensible management.

It is, of course, that third category — the unknown unknowns — that will be “difficult”, but also why these next few weeks will prove so critical as they should work to reduce them.

Of course, by definition, they can never be eliminated: we can never “know”.

The virus will be what it will be. But if it doesn’t flare up, the economy will pick up in the September quarter. That will make for much easier management, as both government and Reserve Bank will be managing renewed growth.

That will be the “easy bit”. Again, abstracting for whatever might happen with the virus into 2021, I don’t see the economy getting all the way back to where it was in the March quarter.

We are also going to have to think very deeply about the drivers that we relied on in that “old economy” — massive population growth, foreign students, housing construction and infrastructure.