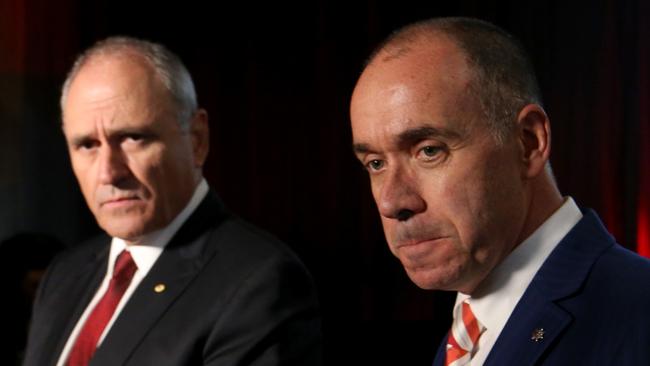

Terry McCrann: NAB shareholders have declared no confidence in chair Ken Henry

National Australia Bank chairman Ken Henry should have resigned his position on Wednesday. That would have been the most appropriate time and place to have done so, writes Terry McCrann.

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

Sorry Ken, but you have to go.

Arguably you should have announced your resignation on Wednesday.

That would have been the most appropriate time to have done so — and it would have been in the even more appropriate place: directly to shareholders, at, to stress, their AGM.

The 88.4 per cent vote against the NAB remuneration report is effectively a vote of “no confidence” in the board and very specifically the chairman.

NAB INVESTORS REVOLT AGAINST BANKING PAY DEAL

NAB CHIEF SAYS REPAYING CLIENTS TAKING TOO LONG

NAB CHIEF SAYS BANK HAD NO PURPOSE

It went well beyond the ritualistic and ultimately pointless “virtue signalling” that most of these votes really are.

It ranks as easily the greatest vote of “no confidence” in a board and in a chairman that I have seen in more than 40 years of business commentating.

In the place where Ken Henry spent most of his working life, a vote of “no confidence” in the “chairman of the nation’s board”, the prime minister, forces an immediate resignation.

The same should have been the case in Melbourne.

The buck stops at Henry’s desk both literally and even more specifically than is usually the case.

Shareholders weren’t just voting against “a” RemReport. They were voting against very specifically Henry’s RemReport; and only slightly less obviously against, again, his leadership this year on specific levels of executive pay.

As he explained, the board had this year changed the way executive pay was calculated and it also very deliberately decided to make the change ahead of and so irrespective of what the RC came up with.

He really did own this RemReport.

Even though, right through his speech, it was repeatedly: “we, we, we”. As a board, “we” have been making changes; “we” could have waited; “we” were not alone; and on and on.

Sorry Ken, again, that’s not how it works. The chairman takes the rap. You are the chairman.

It would be mindful for Ken — and indeed his fellow directors — to look at some NAB history, particularly around “the troubles” in the early 2000s over what was a comparatively minor forex scandal. Minor against the RC revelations, but minor even back then.

Two successive NAB chairmen fell on their swords — Charles Allen and Graham Kraehe — with nothing remotely like either the responsibility or shareholder angst which was revealed on Wednesday.

The big, big thing different on Wednesday was the way — most — shareholders followed through on the 88 per cent broad RemReport “no confidence” with a 64 per cent rejection of a shares award to CEO Andrew Thorburn.

This was exactly different to what happened at Westpac last week, when 64 per cent voted against the RemReport, but then 72 per cent (idiotically, pathetically and inconsistently) voted FOR a similar shares award to that bank’s CEO, Brian Hartzer.

This second NAB “no” vote, unlike the RemReport vote, had a real consequence: Thorburn won’t get his shares.

Even though it is of limited impact; NAB will now have to pay him the equivalent in cash.

This, though, seals Henry’s fate. Not only did holders follow through, but the messy outcome should have been avoided by Thorburn not getting the bonus in the first place; that’s, Henry’s bonus.

There’s a further sealer — from Henry himself. He effectively announced that Thorburn would remain CEO for another three years at least. After he gets back from his RC-stress leave.

You don’t want chairman and CEO to leave at the same time. Henry has to go now.

APRA DOES A SEINFELD

Well, this has been a year in which we’ve seen pretty much everything in and around the banks and with their various regulators — ASIC, APRA, AUSTRAC, and of course the venerable “steady as she goes” (seemingly forever) RBA. To say nothing of a certain little off-the-shelf RC.

But on Wednesday APRA still managed to give us something new to round off the most extraordinary year ever, or to kick off the (hopefully, less extraordinary) new one — our first “Seinfeldian” regulatory move; a move that was “all about nothing”.

APRA has freed the banks from its “30 per cent interest-only mortgage loan cap”. It’s a sensible exercise of deregulation.

It is also completely irrelevant.

As TD Securities’ Annette Beacher graphically showed — and I presume we all knew — investor loans have been on a collapsing flight path for pretty much two years.

Interest-only loans have been heading south all year; they are already down to just 27 per cent of all home loans and will likely be approaching 20 per cent by the middle of next year.

It’s a combination of two things: There are far fewer aggressive investors around wanting to borrow; and the RC-whipped big four banks are reluctant to lend to them anyway, even P&C (principal and interest) but even more so IO (interest only).

Throw in two other factors: the banks are pruning the size of IO loans they are prepared to make, and the conversion of previous IO loans to P&C ones (in a falling property market) that are further squeezing both demand for and supply of IO loans.

APRA could have left the 30 per cent cap in place and it would have had exactly the same consequences as its removal: zero.

Removal does, though, show an APRA which likes regulatory consistency and a certain fussy neatness.