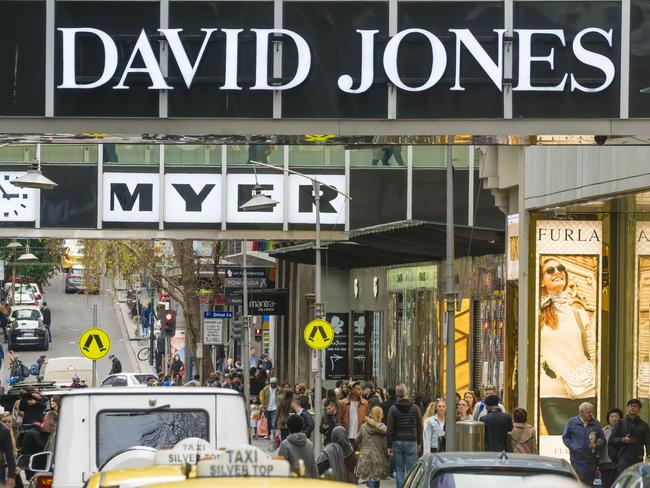

Terry McCrann: Myer and David Jones merger a sensible union

OF course, a merger between Myer and David Jones makes great sense but it’s not going to happen any time soon. Or at least, not in the immediate future, writes Terry McCrann.

Terry McCrann

Don't miss out on the headlines from Terry McCrann. Followed categories will be added to My News.

OF course, a merger between Myer and David Jones makes great sense.

But it’s not going to happen any time soon. Or at least, not in the immediate future, not this side of Myer — putting it politely — going into “administration”.

SHARES SURGE IN MYER TAKEOVER RUMOUR

SOUTH AFRICAN WOOLWORTHS HOLDINGS SAYS THERE IS NO INTEREST IN DJS MERGING WITH MYER

As I’ve been writing for some time, if you did put the two premier department store chains together and promptly closed — I dunno, half? — of their combined stores, you would have the basis for a viable and even attractively profitable, at least medium-term, future.

In these rapidly changing times — and it’s not just the rolling roiling impact of online digital disruption — it’s impossible to sensibly predict anything much beyond five years.

But judging on the state of retail right now and the very substantial sales that both Myer and DJs still command, a combined, slimmed and energised group — and a deal which would give Myer the sort of retail drive and focus it certainly does not have now under the leadership of a retired accountant — could be effective.

MYER CHAIRMAN VOWS TO FIX DEPARTMENT STORE CHAIN

VALUE TO TUMBLE FROM DAVID JONES AS TOUGH MARKET UPSETS REVITALISATION

Indeed, this is precisely the time a merger, finally, actually makes sense.

Until the last five or so years, it would not have made sense: Myer and DJs had carved out very effective overlapping but still critically separate retail franchises.

Myer had command of the “great middle”; DJs had built a unique semi-mass market branded control of the retail top end.

Now, both of those have shrunk under the combined impact of online retail and the top brands going solo. The Myer and DJs of 2018 now exist in a much tighter parallel retail space. They also no longer have the vast numbers of “rusted-on” customers they used to have.

So why no merger?

There are two big negative drivers. The biggest is their retail leases. It would cost huge sums to walk away from them. But that’s the only basis on which a merger makes sense. There’s also a double negative. In the good (actually, fabulously rich) old days, the big retailers owned their stores.

So, closing stores would actually pour cash into the company rather than drain it, as it sold off to developers or other wannabe retailers. No longer.

The second negative is Myer’s former saviour turned bete noire (and who presents himself as its saviour redux) Solomon Lew.

DJs certainly does not want to “inherit him” from Myer — either by having to persuade him to sell into a merger or by continuing his role as a minority shareholder.

The owner of DJs, the South African Woolworths group (no relation to the local Woolies), spent 17 years with exactly the same situation that confronts the current Myer — with Lew as a minority shareholder in its previously listed Country Road, continually proffering “advice”.

As I say it took that long to resolve that and the resolution cost the South Africans plenty.

They are not going to rush to a replay.

Lew would exploit any merger proposal to maximum advantage. What he could lose in Myer as a supplier vastly exceeds what he’s losing as a shareholder. What he could gain from a merged Myer-DJs would be huge.

But Myer going into administration would instantly de-fang both negatives.

A board of directors is powerless to break leases; an administrator can turn the landlords into just another bunch of creditors hanging out for cents in the dollar.

Ironically, Myer’s current chairman Garry Hounsell is exactly suited to a job he cannot have.

Equally effectively, Myer going into administration would also instantly vaporise Lew’s shareholding. His “advice” would instantly become entirely gratuitous.

Exactly that happened at the Ten Network, enabling the US CBS network to come in over the top of the previously controlling Murdoch family and associated major shareholders.

This means that everyone is on “Myer watch” over the all-important next few months.

Even in the “good times”, this is the worst trading period for Myer as customer numbers go into deep freeze. After the dreadful trading period through Christmas-New Year, the second-half Myer numbers promise to be “interesting”.

It could also, though, force Lew to try something while his shareholding — and indeed all shareholdings — still have some power.

The other interesting watch is Wesfarmers. Under new CEO Rob Scott, it has embarked on “undoing” its gigantic 2007 purchase of Coles. It’s also “decision time” for what it does about the $1 billion-plus Bunnings push into the UK. Does it stick or quit?

These are largely incidental to the Myer (and DJs) situations. Except Wesfarmers also has the even worse (than Myer) performing Target chain. Interestingly and importantly, Target sits below Myer in the target-market spectrum.

When they were together in the same group, they were very effective complementary brands. The Myer Target (and the early Wesfarmers one) was almost a licence to print money.

Target can be “resolved” separately. It also plays into the Myer and DJs future.